Market Update: Stock Groups Under Pressure, With a Few Surprising Reversals

The recent market downturn has put significant pressure on various stock groups, including the securities sector. Despite some stocks reaching their ceiling prices just the previous session, many witnessed sharp declines or even “floor” prices during today’s trading, such as BSI, VND, EVS, VIG, SBS, BVS, CTS, VCI, and FTS.

However, a few stocks swam against the market’s downward tide, notably VUA and VDS, which ended the session on August 22 with impressive gains, even hitting historical peaks.

Specifically, VUA of Stanley Brothers Securities Joint Stock Company soared by nearly 15%, climbing to 19,600 VND per share. This marked the second consecutive session of ceiling prices, with a trading volume of 10,200 units—a surprising surge considering the typically minuscule trading volume of a few hundred shares per session, and some days with no trading at all.

VUA’s impressive surge

Similarly, VDS of Dragon Capital Vietnam Joint Stock Company (VDSC) witnessed a vibrant session, with its share price soaring to a historical peak of 25,000 VND per share and an unprecedented trading volume of 12.4 million shares. VDS’s market capitalization surpassed 6,682 billion VND for the first time.

VDS’s remarkable performance

Stanley Brothers Securities Undergoes a Change in Ownership

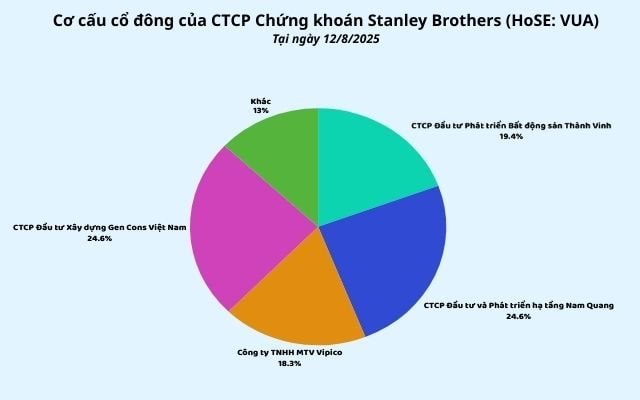

VUA’s positive performance followed a series of changes in the company’s upper management. On August 12, Stanley Brothers Securities welcomed four new major shareholders: Real Estate Development Investment Joint Stock Company Thanh Vinh, Infrastructure Development Investment Joint Stock Company Nam Quang, Vipico One Member Limited Company, and Construction Investment Joint Stock Company Gen Cons Vietnam. This group holds a combined total of 29.4 million VUA shares, equivalent to 86.97% of the charter capital.

Stanley Brothers Securities welcomes new major shareholders

This development occurred just before an upcoming extraordinary general meeting of shareholders, which will primarily focus on dismissing all three members of the Board of Directors and the Supervisory Board and electing their replacements. The Chairman of the Board of Directors, Mr. Luyen Quang Thang, has also sold his entire holding of 300,000 shares.

Among the new major shareholders, Real Estate Development Investment Joint Stock Company Thanh Vinh is the investor in the TNR Stars Thai Hoa project (29 hectares in Nghe An). This company previously held 5.19% of MSB Bank’s capital before divesting in 2023.

Infrastructure Development Investment Joint Stock Company Nam Quang, dubbed the “KCN Hai Duong mogul,” owns three significant projects: Nam Sach Industrial Park (62.4 hectares), Phuc Dien Industrial Park (82.9 hectares), and Tan Truong Industrial Park (198 hectares). These projects are currently managed by TN Property Management, a subsidiary of ROX Key Holdings (TN1). Vipico One Member Limited Company (holding 18.34% of Stanley Brothers’ capital) is the investor in the TNR The LegendSea Da Nang project, located on the prime Vo Van Kiet land plot (11,487 sq. m).

Construction Investment Joint Stock Company Gen Cons Vietnam (holding 24.64% of Stanley Brothers’ capital) is a construction company within the ROX Group ecosystem, previously operating under the names TNCons and ROX Cons.

At the helm of ROX Group are the entrepreneurial couple, Mr. Tran Anh Tuan and Mrs. Nguyen Thi Nguyet Huong.

VDSC Reports Modest Profit for the First Half of the Year

Turning to Dragon Capital Vietnam (VDSC), the company has announced plans to issue 4.7 million shares under its 2025 Employee Stock Ownership Plan (ESOP).

213 employees will be able to purchase VDS shares at a preferential price of only 10,000 VND per share, which is approximately 60% lower than the closing price of VDS shares on August 22. All ESOP shares will be subject to a transfer restriction for 1-2 years.

Among the allocated list, Chairman of the Board of Directors, Nguyen Mien Tuan, will be able to purchase the most shares at 277,800, followed by General Director Nguyen Thi Thu Huyen, who is allocated 259,700 shares. If the issuance is successful, VDS’s charter capital will increase to 2,720 billion VND.

The ESOP plan comes at a time when VDSC’s business performance is less than impressive. In the second quarter of 2025, VDSC’s operating revenue reached approximately 170 billion VND, a decrease of nearly 45% compared to the same period last year.

Most business segments experienced declines, with proprietary trading bringing in just over 16 billion VND, a 90% drop. Additionally, losses from FVTPL assets soared, resulting in a loss for the proprietary trading segment.

While revenue decreased, operating expenses increased by 11 billion VND to 138 billion VND. Consequently, VDSC reported a pre-tax loss of 13 billion VND, compared to a profit of 147 billion VND in the same period last year. After-tax loss amounted to over 6 billion VND, compared to a profit of 26 billion VND in the previous year.

For the first six months of the year, VDSC generated 332 billion VND in operating revenue, with after-tax profit reaching nearly 11 billion VND, a decrease of 95% compared to the same period last year.

“Buy on a Market Peak: A Safer Bet Than Buying on a Dip, Say VPBankS Experts”

The experts suggest that, at present, with a P/E of just 15, the market would need to surge by a further 20% to reach its peak, assuming profits remain static.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).

The Market Maverick: Can We Expect a Resilient Reversal?

The VN-Index experienced significant volatility but managed to recover towards the end of the trading session, with above-average volume. The uptrend remains intact as the MACD indicator continues to hover above the signal line, indicating no signs of weakness. However, the risk of volatility persists as the index hovers at historical highs. In the event of increased selling pressure, the middle band of the Bollinger Bands will serve as a crucial support level.

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.