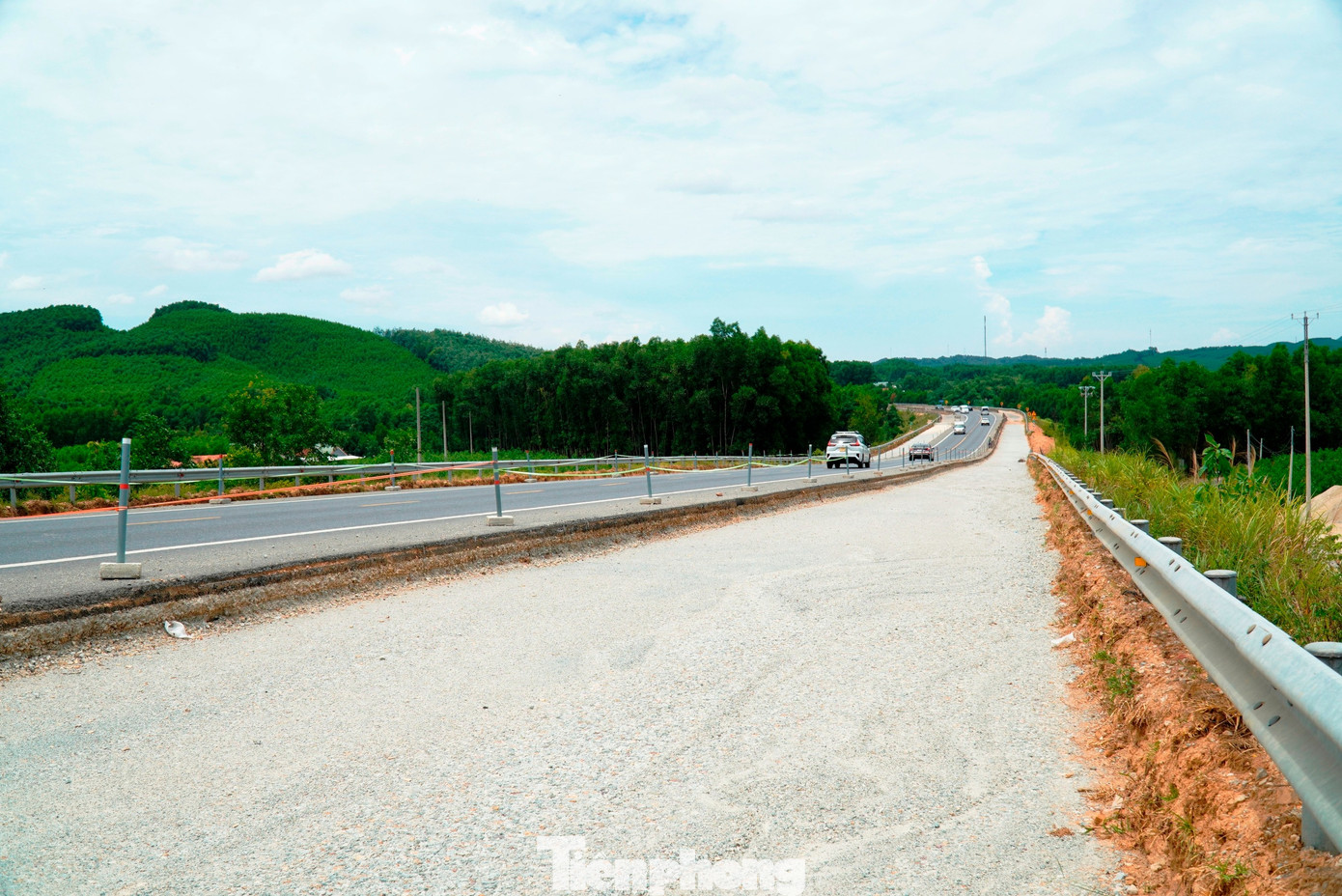

The La Son – Hoa Lien Highway Expansion Project is a key component of the North-South Highway in the east, aiming to gradually improve the central region’s transportation infrastructure, meet transportation demands, and reduce congestion on National Highway 1.

The Ho Chi Minh Road Project Management Unit is in charge of this project, which is about 65 kilometers long, has four lanes, a 22-meter-wide road, and a design speed of 60 to 80 kilometers per hour, adhering to highway standards. With a total investment of over VND 3,010 billion from the state budget, the majority of which is allocated for construction and the handling of related technical infrastructure, the project traverses two localities: Hue City and Da Nang.

The project was inaugurated in Hue on May 29th, with a construction period of 240 days.

The main package, XL01 – La Son – Hoa Lien construction, is worth over VND 2,700 billion.

According to the plan, the project must be finished by early 2026. The Ho Chi Minh Road Project Management Board representative stated that land clearance work along the route has basically secured the four-lane scale from the previous La Son – Tuy Loan project. Currently, additional land clearance is only required for some locations of communal roads and canal extensions.

Construction work is currently focused on road foundations, bridges, drainage systems, and traffic safety facilities. Construction sites are arranged in a continuous 3-shift pattern to ensure timely progress and beat the rainy season.

On the construction site, contractors have mobilized 54 construction teams with over 570 workers, 76 engineers, and hundreds of machinery and equipment to work simultaneously.

Notably, the project includes the construction of 50 bridges, with the addition of new units integrated with the old ones.

For many bridges with added units, the construction units have completed 100% of the pile-driving work, a complex task, such as the Ta Lang – Gian Bi Bridge at Km51+741.79, with 21/21 piles completed; the Km41+950 Bridge with 10/10 piles completed; and the Km60+986 Bridge with 14/14 piles completed…

According to the Ho Chi Minh Road Project Management Board, taking advantage of the dry weather, contractors are expediting the progress of the project. The Board will continue to direct and closely monitor the progress and quality of the project, ensuring absolute safety during the upcoming rainy season, and striving to complete the La Son – Hoa Lien Highway Expansion Project on schedule by early next year.

The Road Less Travelled: Unveiling Hanoi’s Vision with a $700 Billion Makeover

The Hanoi People’s Council has approved the utilization of 700 billion VND from the surplus salary reform budget to initiate land clearance for the upcoming expansion project of Linh Nam Street. This significant allocation of funds underscores the city’s commitment to expediting the project, which is slated for completion by 2027.

The Premier’s Charge to Phu Tho Province

“In a bid to fast-track the crucial Laos Cai – Hanoi – Hai Phong railway project, the Prime Minister has directed Phu Tho province to devise a standalone land clearance and resettlement proposal. This directive underscores the government’s commitment to expediting this vital transportation corridor. With a targeted land clearance commencement date of August 19, the province is now tasked with formulating a comprehensive plan to swiftly and efficiently manage the land acquisition and resettlement process, ensuring a smooth path forward for this ambitious railway endeavor.”

The Mighty Connector: A $300 Million Bridge, Months Ahead of Schedule, Set to Unite Two Provinces

The Rach Mieu 2 Bridge is nearing completion with the final touches being put in place. The construction team is gearing up for the inspection on August 12, followed by the anticipated handover to Dong Thap and Vinh Long provinces on August 19. This marks a significant step towards the official inauguration and operation of the bridge.