Novaland Group Joint Stock Company (Novaland, Stock Code: NVL) has just announced the resolution of its Board of Directors on approving the transfer of the entire owned capital contribution at Nova Property Management Limited Company (Nova Property).

As known, Nova Property is a subsidiary in which Novaland holds 99.99% of the charter capital (as of June 30, 2025). After the transfer, this enterprise will no longer be a subsidiary of Novaland.

Novaland authorized the company’s legal representative or General Director to decide on the timing of the transfer, the transferee, the transfer price not lower than the investment cost, and to sign relevant agreements, contracts, and documents in accordance with the company’s regulations and current laws, ensuring the best interests of the company, and carry out the necessary procedures to complete the above content.

Illustrative image

According to our information, Nova Property Management Limited Company, formerly known as Nova Asset Management Limited Company, was established on September 8, 2017, with a charter capital of VND 20 billion. Of this, Novaland contributed VND 19.99 billion (99.99% ownership), and Ms. Huynh Phuong Thao contributed VND 20 million (0.01% ownership).

On January 8, 2018, the company increased its charter capital to VND 139 billion. Novaland contributed nearly VND 138.99 billion, and Ms. Huynh Phuong Thao contributed VND 139 million.

It is known that Ms. Huynh Phuong Thao is the sister-in-law of Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors. At this time, Mr. Bui Dat Chuong, Mr. Nhon’s brother, held the position of Chairman of the Members’ Council and Legal Representative of Nova Property.

In the latest update on December 7, 2023, Mr. Nguyen Ngoc Tuan is the General Director and Legal Representative of Nova Property, holding 0.01% of its charter capital.

In another development, Novaland recently announced the appointment of Mr. Vo Quoc Duc as the company’s Chief Financial Officer, effective August 21, 2025.

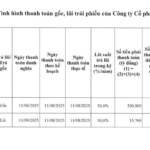

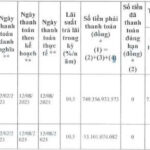

According to the Hanoi Stock Exchange (HNX), Novaland has recently published documents disclosing information about the company’s bond principal and interest payments.

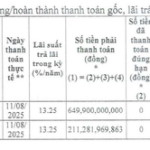

Specifically, according to the plan, on August 15, 2025, Novaland had to pay nearly VND 489.7 billion for the NVLH2224005 bond lot, including nearly VND 468.3 billion in principal and nearly VND 21.4 billion in interest.

However, due to a lack of funds, the company has only paid nearly VND 4.5 billion, with the remaining VND 485.2 billion unpaid.

It is known that the NVLH2224005 bond lot includes 5 million bonds with a face value of VND 100,000/bond, a total issuance value of VND 500 billion, issued on February 16, 2022. With a term of 24 months, the bonds are expected to mature on February 16, 2025.

On the other hand, on August 11, 2025, Novaland paid nearly VND 861.2 billion for delayed principal and interest payments for the bond lot with the code NOVALAND.BOND.2019.

This bond lot has a total issuance value of VND 1,300 billion, issued by Novaland on June 28, 2019, with a term of 6 years and expected maturity on June 28, 2025.

“Novaland Issues Statement on Ho Chi Minh City Court Ruling in Dispute with Taekwang Vina Over Nearly VND 10,000 Billion Project”

The Vietnam International Arbitration Centre (VIAC) recently issued an arbitral award in a dispute between two companies, ordering the South Korean partner to continue performing its contractual obligations pertaining to a real estate project in Ho Chi Minh City.