Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam’s (SBV) Branch No. 2, assessed the results of Scheme 06 on “Developing the Application of Population Data, e-Identification, and e-Authentication to Serve National Digital Transformation for the period of 2022-2025, with a vision towards 2030” (Scheme 06) in the banking sector after nearly four years of implementation (2022-2025). He highlighted the impressive outcomes and their significance in technological innovation and application for the sector’s continued development, from the perspective of bringing socio-economic benefits and supporting businesses.

First, the expansion and development of cashless payments and improved capital efficiency in the economy. Connecting to, utilizing, and exploiting the national population database to develop account-related services (including opening payment accounts, payment authentication, customer information verification, and account cleansing) has yielded significant benefits for the expansion and development of cashless payments.

Over 86% of individuals aged 15 and above now hold bank accounts, enabling credit institutions to offer various payment services, especially e-banking services (cards, internet banking, mobile banking, e-wallets, QR codes, etc.). This forms the foundation for the expansion of cashless payments and the success of government and SBV initiatives such as salary payments through accounts, cashless social welfare payments, and electronic payments for utilities like electricity, water, and telecommunications, as well as in the fields of healthcare and education. As a result, the scale of cashless transactions has grown significantly, with a value of VND 295.2 million billion in 2024 alone, 25 times the GDP. This achievement significantly contributes to the realization of the 2020-2025 plan for expanding and developing cashless payments and serves as a driving force for economic growth, maximizing the benefits of cashless transactions in the economy.

Second, the development of diverse, convenient, fast, secure, and efficient electronic payment services has not only helped businesses and individuals reduce transaction costs associated with cashless payments but also accelerated capital turnover through timely payments, thereby improving capital efficiency for enterprises, customers, and the entire economy.

Third, it has promoted the growth of economic activities aligned with the requirements of a digital economy, including e-commerce, tech-based transportation, tourism, and consumer credit services, fostering modern trends, technological applications, and the creation of convenient products that serve socio-economic development and improve people’s lives.

Fourth, Scheme 06, with its extensive population database, serves as a foundation for technology development and application in various fields of management and governance at the industry, local, and national levels. In the banking sector, the population database is directly related to legal and personal account services. Thus, it is a valuable source of data and information for developing account services and e-banking products, ensuring service quality, security, and information confidentiality, promoting cashless transactions, and effectively combating technology-related crimes.

Through the exploitation of population data and the implementation of technological solutions, the number of individual customers falling victim to fraud and losing money has decreased by 59%, and the number of personal accounts receiving fraudulent money has dropped by 52% (compared to the situation before implementation – July 1, 2024). Furthermore, credit institutions have completed the cleansing of all individual and corporate customer files with transaction activities on digital channels. These are quantifiable, effective, and impressive results from the exploitation of population data under Scheme 06 by the banking industry.

Fifth, the exploitation of population data and the implementation of Scheme 06 in the banking sector will facilitate administrative reforms, the development of online public services, and the creation of new products in line with the requirements of digital banking and the digital economy. Especially, the effective implementation and coordination of Scheme 06 will enable the banking sector to better meet the capital and banking service needs of businesses and the economy, enhance management efficiency, and promote administrative reforms and innovations in line with the current regional banking model.

– 08:49 19/08/2025

The Future of Innovation: InnoEx 2025 Unites the Global Creativity and Innovation Community

The International Forum and Exhibition on Innovation – InnoEx 2025, themed “Shaping the Future Economy: From Data to Digital Assets,” serves as a testament to Vietnam’s growing prominence in the global innovation landscape. This prestigious event convenes a diverse array of domestic and international businesses, investors, experts, and startups, fostering a dynamic environment that ignites groundbreaking ideas and propels Vietnam’s innovative spirit on the world stage.

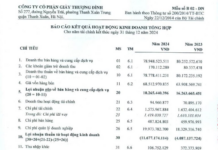

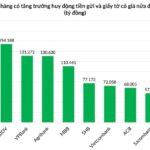

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”

“A Challenging Road Ahead: Tackling Bad Debt”

The latest bad debt situation in the banking industry paints a more optimistic picture, with a significant slowdown in growth, reflecting the banks’ efforts to manage their asset quality. While the industry-wide non-performing loan ratio remains higher than pre-pandemic levels, the trend is heading in the right direction. This indicates that although challenges persist, the banks’ strategies to tackle bad debt are showing signs of success.

The Digital Transformation Bill: Proposing 9 Prohibited Actions in the Digital Transformation Era

The Ministry of Science and Technology is drafting the Digital Transformation Act to enhance the legal framework for the country’s digitalization and create an interdisciplinary legal foundation for digital transformation in sectors embracing digitalization. Notably, the act includes provisions on prohibited actions during digital transformation.