|

Sowatco’s Annual General Meeting for 2025 was held on the morning of May 15th. Photo: Tu Kinh

|

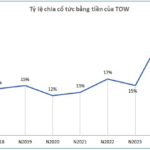

This will be the first payout since 2019 for Sowatco. Previously, the company planned not to distribute dividends for 2024 to prioritize investment capital. However, the positive financial results in the past year have led the board to change this decision.

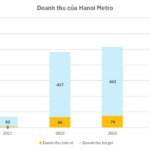

Specifically, in 2024, revenue reached VND 1,150 billion, a 40% increase compared to 2023. Net profit was VND 274 billion, a 20% increase, and undistributed profit accumulated on the consolidated financial statements audited at the end of the year exceeded VND 1,200 billion. Based on these results, the board proposed distributing dividends to shareholders while still ensuring sufficient capital for investment plans.

However, for 2025, the management wants to ensure capital for the company to focus on infrastructure investment and the long-term development of port projects, so no dividends are expected to be distributed.

Responding to shareholders’ questions about not distributing a 5-10% dividend each year, CEO Dang Vu Thanh said: “If we calculate the average, receiving 35% at once is equivalent to receiving 5% for 6-7 years. And when receiving a large sum of money at once, shareholders can do more.”

Sowatco is expected to pay out approximately VND 235 billion. The parent company, Southern Cargo Services (HOSE: STG), will receive nearly VND 219 billion through direct and indirect ownership through its subsidiary, Infrastructure Investment and Development Corporation. The payment is planned for 2025.

| Sowatco shareholders have not received dividends for a long time |

|

|

The worst-case scenario regarding tariffs could reduce the business plan by 30%

For 2025, Sowatco sets a revenue target of VND 1,220 billion, a 6% increase compared to the previous year, but does not increase the profit-after-tax target, maintaining it at around VND 273 billion. However, this plan does not take into account the adverse impact of the application of countervailing duties by the US.

CEO Dang Vu Thanh stated that, in the worst-case scenario, tariff measures could cause the company’s revenue and profit to decrease by 25-30% compared to the set plan. This is mainly due to the dependence of the cargo structure at Sowatco-operated ports on the US market. Specifically, at Long Binh port, 75-80% of the cargo volume is for export to the US. At Sotrans ICD, this figure fluctuates between 47-48%.

“In fact, right after President Trump applied countervailing duties and before the 90-day suspension, there was a decrease in cargo volume,” said Mr. Thanh. Therefore, if tariff measures continue to be implemented in 2025, negative impacts on business operations are inevitable.

Nevertheless, the first half of 2025 looks positive. In the first quarter, Sowatco’s extraction output exceeded the plan by more than 30%, with revenue of VND 260 billion, a 14% increase, and after-tax profit of VND 63.2 billion, an 18% increase, achieving 21% and 23% of the full-year revenue and profit targets, respectively.

For the second quarter, CEO Sowatco forecasts “at least not lower than the first quarter.” The basis for this prediction is that enterprises are accelerating exports to “get ahead” of potential policy changes. The leadership expects the second quarter to continue this growth trend, thereby creating a buffer to proactively cope with unfavorable scenarios in the last months of the year.

| Sowatco’s profit remains stable and is expected to continue growing in the second quarter of 2025 |

|

|

“Gold Mine” logistics in the Mekong Delta region

Another important item on the agenda of the meeting was the approval of the strategy to expand operations in the Mekong Delta region through the acquisition of existing ports or the transfer of shares of companies owning ports in this region.

According to Tran Tuan Anh, a member of Sowatco’s board of directors, the Mekong Delta is an economically rich region but lacks a synchronized logistics infrastructure. With a population of about 32 million and being the country’s largest agricultural and aquatic product production center, the demand for cargo transportation from this region is very high. However, the inland port system is still fragmented and outdated, not meeting modern standards. Sowatco sees this as a great opportunity to help solve the infrastructure “bottleneck” and thereby enhance competitiveness.

“Currently, two large units, Tan Cang and VIMC, have been present here for a long time and are also looking for solutions,” said Mr. Tuan Anh. With experience in operating large ports such as Long Binh, Sotrans ICD, and VICT, and as a shareholder of Dong Nai port, along with the support of international strategic partners, Sowatco believes it has sufficient financial, technical, and human resources to implement appropriate large-scale projects in the Mekong Delta.

“I believe that the Mekong Delta will be a ‘gold mine’ for those who can exploit it well and find the right key,” he affirmed.

In addition, 2025 also marks the launch of several key projects within Sowatco’s ecosystem. CEO Dang Vu Thanh revealed that the company is implementing a project to expand container handling capacity, expecting a 60% increase in operating capacity. Although these projects may not bring immediate profits in the first 1-2 years, they will lay a solid foundation for sustainable long-term growth.

“I think we can accept not making a profit in the first 1-2 years. You can wait one more year until the 2026 Annual General Meeting to see this story clearly,” said the leader confidently.

|

CEO Dang Vu Thanh answers shareholders’ questions. Photo: Tu Kinh

|

– 15:29 15/05/2025

Unveiling the Ultimate Guide to Captivating Copy: “TOW Unveils Record-Breaking Dividends: A Historic Payout after Landmark Profits”

“In a move that will surely delight investors, the Tra Noc – O Mon Water Supply Joint Stock Company (TOW) has announced an extraordinarily generous cash dividend for 2024. Shareholders have every reason to rejoice as the company has declared a record-high dividend ratio. Mark your calendars, as May 29, 2025, is the crucial date for trading without entitlement to this dividend.”

“Sotrans CEO on the 54% Profit Growth Plan: What’s the Strategy?”

Despite aiming for over a 50% growth in after-tax profits in 2025, the leadership of Southern Logistics Joint Stock Company (Sotrans, HOSE: STG) believes that this is not an unrealistic expectation. This confidence is based on positive business signals since the beginning of the year and significant improvements in previously challenging operational areas.