Real Estate Development Corporation Phat Dat (HoSE: PDR) reported consolidated business results for Q2 2025 with after-tax profit reaching VND 65 billion, a 30% increase compared to the same period last year. This profit figure even surpasses the company’s revenue from sales and service provision, which stood at VND 19.9 billion.

Such revenue is insufficient to cover operational expenses, with business management costs alone amounting to VND 40 billion. Phat Dat’s profitability stems from its financial activities, generating VND 226 billion in revenue, notably including a VND 139.2 billion gain from the liquidation of an investment.

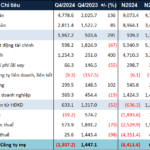

Figure 1: Phat Dat’s Financial Report for Q2 2025 (in VND billion)

A Swift Transaction Yields VND 435 Billion

During this quarter, Phat Dat concluded a notable transaction: the transfer of all its shares in Ngo May Real Estate Investment Joint Stock Company.

As per the financial notes, on June 25, 2025, Phat Dat divested its entire stake in Ngo May, the owner of the Ngo May project in Gia Lai, to Quy Nhon 68 Investment Company Ltd. for VND 435 billion.

As of the beginning of the year, the inventory value of the Ngo May project was VND 292 billion, comprising mainly compensated land value, land use fees paid to the state, land leveling costs, construction expenses, and other investment costs. Thus, the estimated profit from this sale exceeds VND 140 billion, contributing to Phat Dat’s financial revenue.

However, Phat Dat has only collected VND 160 billion from this deal and is yet to receive the remaining VND 275 billion, meaning 63% of the transaction value is still recognized as accounts receivable.

Notably, Quy Nhon 68 Investment Company Ltd. was established on the very same day as the transaction, June 25, 2025.

The company is headquartered at the Golden King office building, 15 Nguyen Luong Bang, Tan Phu ward, District 7, Ho Chi Minh City. Its charter capital amounts to VND 500 billion, contributed by two shareholders: Phan Sy Nguyen, the CEO, holding 70%, and Nguyen Thanh Hien, holding the remaining 30%.

Figure 2: Rendering of the Ngo May Project’s Tourist Apartment Block – Source: phatdat.com.vn

The sequence of events leading up to this transaction unfolded swiftly and seamlessly. On June 20, 2025, Phat Dat’s Board of Directors passed a resolution to sell the Ngo May real estate project. Just five days later, on June 25, Quy Nhon 68 Investment Company Ltd. was established, and the transaction took place. Subsequently, on June 27, Phat Dat’s General Meeting of Shareholders approved the exclusion of the Ngo May project from the company’s capital usage plan.

Recurring Profits from Asset Sales

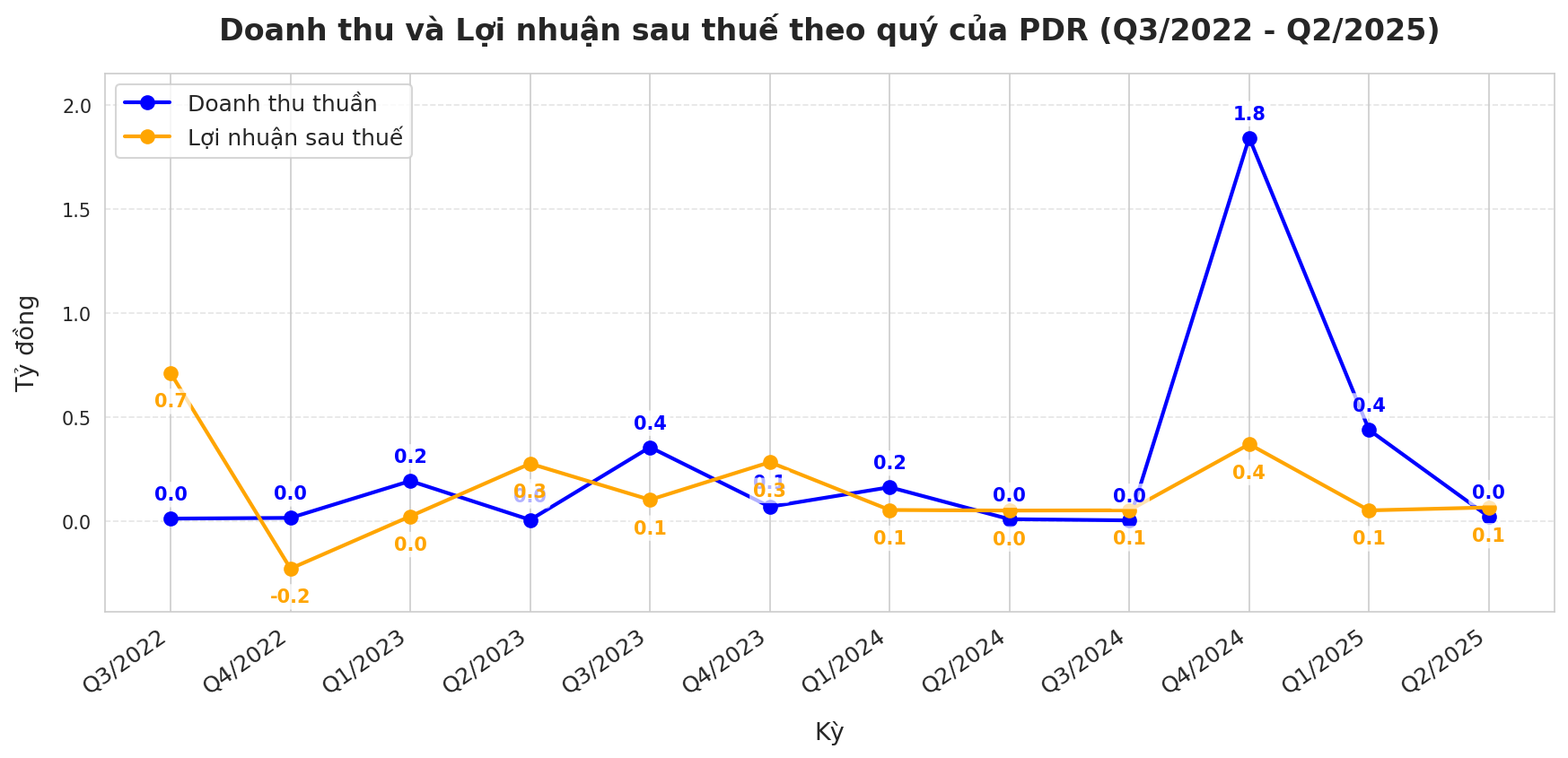

Engaging in “wholesale” transactions, such as transferring shares in subsidiaries and associated companies, to recognize profits is not a new strategy for Phat Dat.

Historically, in Q3 2022 and Q2 and Q3 2024, as well as in Q2 and Q4 2023, the company employed this approach to generate substantial profits.

Revenue from sales activities has consistently been modest, sometimes as low as VND 2-3 billion, while financial revenue has reached hundreds of billions, even trillions.

For instance, in 2021, Phat Dat’s profits were largely attributed to the transfer of subdivisions within the Nhon Hoi New City project to another company. The remarkable profit of VND 710 billion in Q3 2022 resulted mainly from the transfer of the Astral City project in Binh Duong.

Similarly, in Q2 2024, Phat Dat recorded revenue of just VND 8.3 billion but booked financial revenue of over VND 200 billion from transferring a 25% stake in BIDICI Real Estate to Mr. Nguyen Tra Giang on June 24, 2024, just before the financial statement closing date.

Figure 3: Phat Dat’s Financial Statements for Q2 2025 (in VND billion)

A closer look at Phat Dat’s cash flow statement reveals significant challenges. In the first six months of the year, the company’s operating cash flow was negative VND 1,330 billion.

To address this shortfall, Phat Dat resorted to increased borrowing, with cash inflows from borrowing amounting to VND 1,196 billion, a 95% increase compared to the previous year. Cash on hand decreased from VND 343.6 billion at the beginning of the year to VND 25.2 billion by the end of Q2.

Faced with financial pressures, PDR undertook capital restructuring initiatives. Following the successful completion of a $30 million debt-to-equity swap in Q2, the company issued over 72.5 million bonus shares as dividends in early August 2025, raising its charter capital to nearly VND 9,800 billion. Additionally, there was a notable shift in the debt structure, with short-term borrowings decreasing by 34.6% while long-term borrowings increased by 20.6%, indicating PDR’s proactive approach to “refinancing” to alleviate short-term debt repayment pressures.

Phat Dat has demonstrated financial strategy agility by selling assets to ensure positive profits and successfully restructuring its capital. However, the reliance on “wholesale” project sales for profit and the negative operating cash flow also raise questions about the sustainable development of a renowned project developer like Phat Dat.

Moreover, the effectiveness of the “wholesale” project sales strategy will be measured not only by reported profits but also by the company’s ability to collect accounts receivable and convert them into actual cash, thereby addressing its current financial challenges.

Raising $73 Million for the DatXanhHomes Parkview Project: An Ambitious Venture by Dat Xanh

“With a strategic move, Dat Xanh Group plans to offer 93.5 million private shares to raise an impressive VND 1,739.1 billion. This bold initiative aims to fuel the development of their flagship project, DatXanhHomes Parkview. This move underscores the company’s confidence and ambition in the Vietnamese market, as they seek to revolutionize the real estate landscape with this groundbreaking endeavor.”

The Green Tea Bud Bridge: Unveiling the 500 Billion VND Marvel in Thai Nguyen

The Huong Thuong Bridge is an iconic, record-breaking structure in Thai Nguyen Province. With its impressive design, the bridge boasts three main concrete spans, utilizing prestressed concrete and a cable-stayed system to achieve an incredible 100-year lifespan.