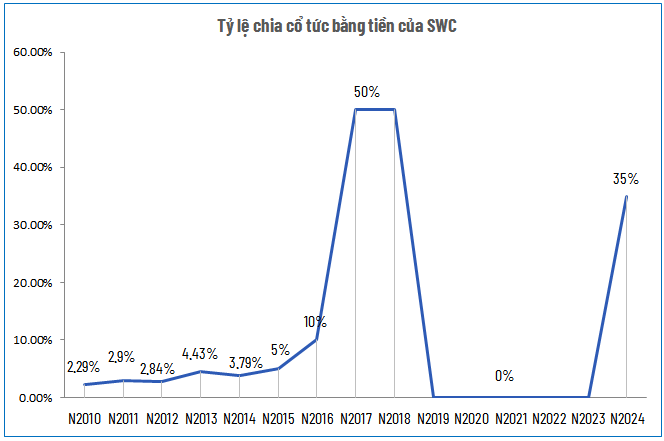

With 67.1 million shares outstanding, Long Binh Port Enterprise in the former Thu Duc City plans to spend approximately VND 235 billion on this dividend payment.

Source: VietstockFinance

|

This is the first time in 5 years that SWC has returned to cash dividends, with no dividends distributed in any form from 2019 to 2023. Previously, the company had consecutively paid out cash dividends at a record rate of 50% in 2017 and 2018. The year 2017 also marked the highest net profit in SWC‘s history, reaching VND 504 billion. During the 5-year hiatus on dividends, SWC‘s profits continued to grow. It was only in 2024, when net profit reached VND 274 billion – the second-highest in its history, that the company decided to resume dividend payments.

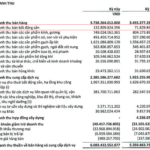

| SWC’s financial performance over the years |

Source: VietstockFinance

|

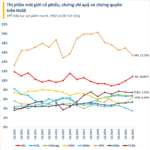

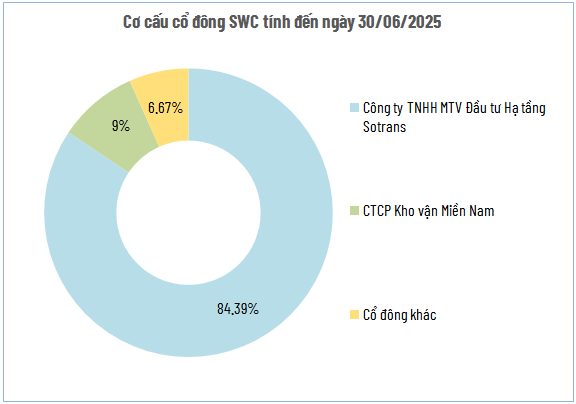

Currently, SWC is a subsidiary controlled by TNHH MTV Infrastructure Investment Sotrans, which holds an 84.39% stake and is estimated to receive more than VND 198 billion in dividends. Sotrans, in turn, is a wholly-owned subsidiary of Southern Cargo Joint Stock Company (HOSE: STG). Additionally, STG directly holds a 9% stake in SWC, entitling it to receive over VND 21 billion in dividends.

| SWC’s financial performance for the first 6 months over the years |

In 2025, SWC (Sowatco) targets a revenue of VND 1,220 billion, a 6% increase from the previous year, while maintaining its after-tax profit target at VND 273 billion. In the second quarter of 2025, Long Binh Port Enterprise recorded a net profit of nearly VND 80 billion, a 28% increase compared to the same period, despite a slight decrease in revenue. Cumulatively, in the first half of the year, net profit reached nearly VND 143 billion, a 23% increase, completing 50% of the yearly plan.

– 11:28 20/08/2025

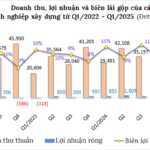

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

The Ultimate Stock Market Rally: VPS Securities Convenes Extraordinary Shareholder Meeting

VPS plans to hold an extraordinary General Meeting of Shareholders in October, with the record date for meeting participation set for September 8th.