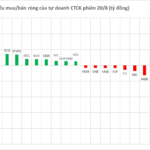

Last week, the VN-Index rose by 15.47 points to 1,645.47. Trading liquidity broke records, with the total trading value of the entire market reaching VND 281,420 billion, up nearly 9% from the previous week, equivalent to an average of nearly VND 56,300 billion per session. In contrast, the HNX-Index ended the week at 272.48 points, down 9.86 points from the previous week.

On the HoSE, foreign investors net sold for five consecutive sessions, with more than 189.4 million units, worth over VND 7,687 billion. On the HNX, foreign investors net bought 6.6 million units, worth over VND 75 billion.

In the Upcom market, foreign investors net sold for five sessions, with 13.1 million units, worth over VND 274 billion. Thus, during the trading week from August 18-22, foreign investors net sold nearly 196 million units on the entire market, with a total net selling value of over VND 7,886 billion.

Paying Dividends Despite Losses

On September 12, Vietnam Maritime Transport Joint Stock Company (Vosco – stock code: VOS) will finalize its list of shareholders to pay 2024 dividends. Accordingly, VOS will pay dividends in cash at an 11% rate, meaning shareholders will receive VND 1,100 per share. The payment will be made on October 10.

Vietnam Maritime Transport Joint Stock Company will spend VND 154 billion on dividends for shareholders.

With 140 million shares currently in circulation, Vosco will distribute VND 154 billion in dividends to its shareholders. Of this amount, the Vietnam National Shipping Lines (VIMC) – Vosco’s parent company, which holds 51% of its charter capital, will receive over VND 78 billion.

Notably, this is the first time that VOS shareholders have received dividends since 2011. That year, the company paid dividends for 2010 at an 8% rate.

Vosco has decided to pay dividends despite its business performance in the first half of 2025 showing losses. Specifically, in the first six months, VOS recorded a revenue of VND 1,298 billion, a decrease of over 56% compared to the same period last year. Due to operating below cost, VOS reported a loss of nearly VND 44 billion, compared to a profit of VND 358 billion in the previous year, the lowest since 2020.

Buying Spree

Mr. Doan Huu Ha Vinh, a member of the Board of Directors and son of Mr. Doan Huu Thuan, Chairman of the Board of Directors of Thua Thien Hue Construction Joint Stock Company (stock code: HUB), purchased 100,000 HUB shares to increase his ownership to 0.33% of the charter capital.

Thus, after this transaction, the group of shareholders related to Mr. Vinh and Ba Ria-Vung Tau Housing Development Joint Stock Company (Hodeco – stock code: HDC) now owns 41.73% of HUB’s charter capital.

Mr. Bui Minh Luc has just purchased an additional 1,296,700 VRC shares of VRC Real Estate and Investment Joint Stock Company (stock code: VRC) to increase his ownership to 7.39% of the charter capital. With this transaction, Mr. Luc has become a major shareholder of VRC.

Hodeco now owns up to 41.73% of the charter capital of Thua Thien Hue Construction Joint Stock Company.

According to the 2024 annual report, as of the end of 2024, VRC had only one major shareholder, Ms. Tran Thi Van, who owned 24.17% of the charter capital.

Mr. Phan Ngoc Hieu, Vice Chairman of the Board of Directors of PC1 Corporation Joint Stock Company (stock code: PC1), has registered to buy 8 million PC1 shares to increase his ownership. The transaction will be conducted from August 22 to September 21 by order matching or negotiation.

Currently, Mr. Hieu does not own any PC1 shares. If the transaction is successful, he will increase his ownership in PC1 to 2.24% of the charter capital. It is estimated that Mr. Hieu will spend more than VND 243 billion to purchase the above shares.

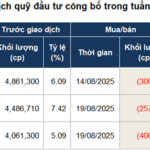

Two members of the KIM Vietnam fund, KITMC Worldwide Vietnam RSP Balanced Fund and TMAM Vietnam Equity Mother Fund, sold 300,000 and 100,000 VTO shares of Vitaco Petroleum Transport Joint Stock Company (stock code: VTO), respectively, to reduce the ownership ratio of the group to 4.58%. Thus, the KIM Vietnam fund is no longer a major shareholder of VTO.

Expert Opinion: A 5% or More Rate Hike Isn’t a Negative Signal

The experts at LCTV predict that the market is undergoing a short-term technical correction rather than a trend reversal.

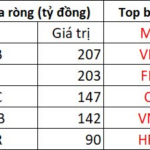

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.