The VN-Index ended the week of August 18-22 with a gain of 15.47 points (+0.95%) compared to the previous week. The market recorded impressive gains in the first four sessions, driven by strong inflows into banking stocks, briefly pushing the index above the 1,690 mark. Weekly trading liquidity remained high, averaging 45,424 billion VND per session. Notably, while domestic investors were net buyers, foreign investors sold a net 7,305 billion VND across all three exchanges during the first four sessions.

In the final session of the week, profit-taking in banking, real estate, and several large-cap stocks caused the VN-Index to plunge, losing over 42 points to close at 1,645.47 points (-2.52%). Foreign investors continued to sell, netting 1,347 billion VND in this session.

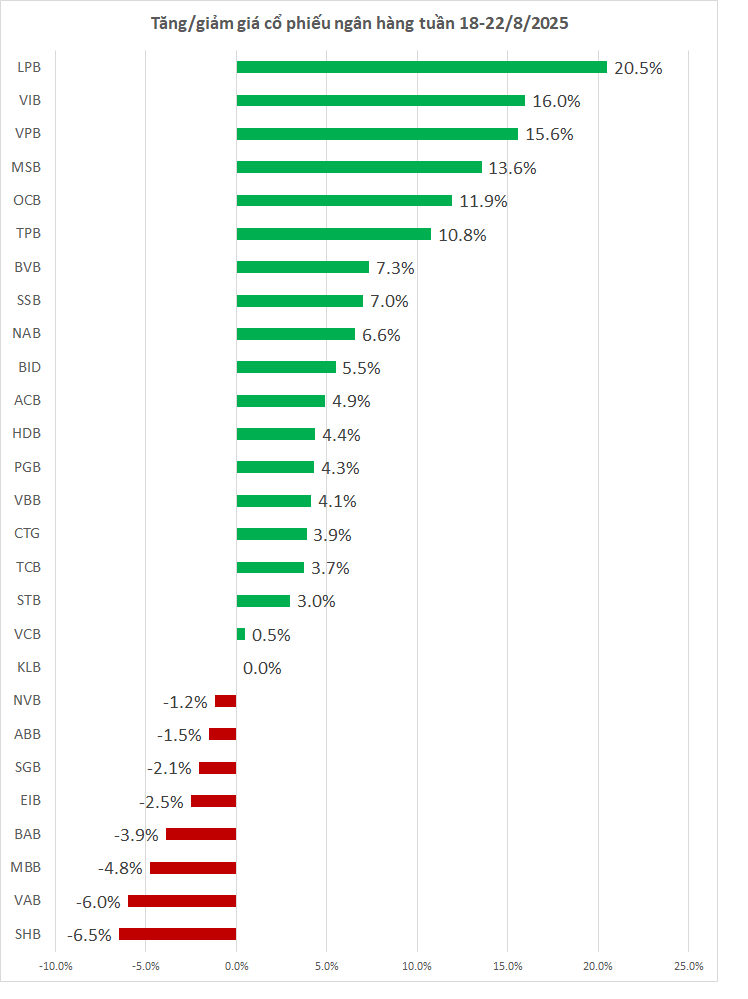

Banking stocks rose across the board in the last four trading sessions of the week and the morning of August 22. However, the afternoon session of the same day saw sharp declines, resulting in weekly losses for many banking stocks. Declining bank stocks for the week included SHB (-6.5%), MBB (-4.8%), and EIB (-2.5%), among others.

Meanwhile, most bank stocks posted weekly gains, such as LPB (+20.5%), VPB (+15.6%), VIB (+16%), and OCB (+11.9%).

VPB, the ticker for VPBank, was the focal point of the banking sector, with a series of “hot” news breaking during the week. VPBank’s subsidiary, VPBank Securities Joint Stock Company, unexpectedly revealed plans for an initial public offering (IPO) in the fourth quarter of this year.

The IPO of VPBank Securities is expected to bring significant revenue to the parent bank and create additional long-term growth momentum for VPBank.

In a related development, family members of VPBank’s leadership showed their confidence in the bank by registering to purchase a substantial amount of VPB shares. Mr. Bui Hai Quan’s daughters, Ms. Bui Cam Thi, and Ms. Bui Hai Ngan, registered to buy a total of 40 million VPB shares. The transactions are expected to take place between August 25 and September 23, through matching or negotiated deals. Prior to this, neither Ms. Thi nor Ms. Ngan held any VPB shares.

Additionally, Ms. Pham Thi Nhung, a member of VPBank’s Board of Directors, registered to purchase 10 million shares from August 26 to September 24, using the same methods.

VPB shares surged in the first four sessions of the week, including two consecutive ceiling-hitting sessions on August 19 and 20, before reversing course and plunging to the floor price (-6.99%) on August 22.

As VPB attracted attention, foreign investors sold a net amount of over 1,700 billion VND worth of the stock during the week, making it the most heavily sold bank stock by foreign investors.

In terms of other bank stocks, foreign investor activity for the week was unremarkable. For instance, they sold a net 350 billion VND of CTG (VietinBank) and 260 billion VND of STB (Sacombank) while buying a net 142 billion VND of EIB (Eximbank) and 124 billion VND of BID (BIDV), among others.

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.