Gilimex’s Q2 Financial Statement Delayed Due to Accounting System Glitch

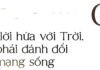

According to Gilimex’s consolidated financial statements for Q2 2025, the company reported a loss of nearly VND 71 billion, compared to a profit of VND 5 billion in the same period last year. Revenue decreased by 11% to just under VND 129 billion, and the gross profit margin narrowed from 14.5% to 8.5%.

The main reason for this was the industrial real estate business. In Q2, this segment brought in less than VND 410 million, a decrease of more than 90% compared to the VND 4.2 billion in the same period last year, as the company focused on infrastructure development to meet land delivery deadlines for investors by the end of the year.

Financial expenses surged by 71% to over VND 24 billion, with interest expenses increasing sevenfold and foreign exchange losses nearly tripling from the previous year. Additionally, the company did not record other income of over VND 22 billion as in the previous year but instead recorded other losses of over VND 13 billion.

|

Prior to this, the Ho Chi Minh City Stock Exchange (HOSE) had issued a second reminder regarding Gilimex’s delay in publishing its Q2 2025 financial statements. The company explained that the delay was due to a critical glitch in their accounting software system, which affected data and required the accounting department to reprocess everything.

Six-month loss of nearly VND 68 billion, far from the annual profit target

In the first six months of 2025, Gilimex incurred a net loss of nearly VND 68 billion, compared to a profit of VND 9 billion in the same period last year. Semi-annual revenue decreased by 30% to VND 255 billion. With these results, the target of VND 150 billion in profit for 2025 seems challenging to achieve. The plan to generate VND 1,200 billion in revenue has only been realized at 21% so far.

From Q4 2022 to the present, Gilimex’s quarterly revenue has ranged between VND 100-300 billion, significantly lower than the previous period when it surpassed VND 1,000 billion. Net profit has remained very low, with consecutive quarters of losses.

| Gilimex’s Quarterly Financial Results for 2021-2025 |

|

|

Gilimex’s challenges stem from a contract dispute with Amazon. Previously, Amazon accounted for up to 80% of Gilimex’s revenue, leading the company to expand its factories and workforce significantly. However, when Amazon unexpectedly reduced its orders, Gilimex suffered losses of approximately $280 million.

Gilimex filed a lawsuit in the US courts in 2022, and a verdict is expected in Q3 2025. If the company wins the case, it hopes to receive compensation for its losses. However, if it loses, Gilimex could face a potential loss of up to one-third of its equity.

On September 11, Gilimex will hold an extraordinary general meeting of shareholders in 2025, expecting to allocate 20% for legal consulting and 20% as bonuses for leaders and personnel if they win the case, after deducting costs and damages.

Share price surges to the ceiling, nearing the year’s peak

News of the lawsuit immediately impacted the share price. On August 22, GIL shares surged to the ceiling price and continued to rise to VND 20,300 per share on August 25, nearing the year’s peak. The share price has recovered by 25% in the past three months, although it is still 2% lower than it was a year ago. Trading volume on the morning of August 25 reached over 716,000 shares, with a buying volume of over 4.3 million shares at the ceiling price.

| GIL Share Price Movement since the Beginning of 2025 |

|

|

As of the end of June, Gilimex had 1,235 employees, an increase of 193 from the beginning of the year. On the balance sheet, the company recorded over VND 838 billion in bank deposits, a 14% increase, and over VND 64 billion in trading securities, mainly in GMC shares (with a provision for expected credit losses of over VND 51 billion).

Garmex Saigon (GMC), a former garment manufacturer for Gilimex, had to discontinue its garment business in mid-2023 due to lost orders, with inventories still exceeding VND 109 billion related to Gilimex.

Te Manh

– 14:13 25/08/2025