The trend of high-interest-bearing savings accounts has taken the banking industry by storm, with Techcombank leading the charge. VPBank’s Super Profit, TPBank’s Double Profit, VIB’s Super Yield, and LPBank’s Profit Prosperity are all following suit.

This trend has also attracted the attention of financial technology companies (fintech) such as Infina. Based in Singapore, Infina launched its Profitable Account for both individuals and businesses at the end of last year.

How does Infina work?

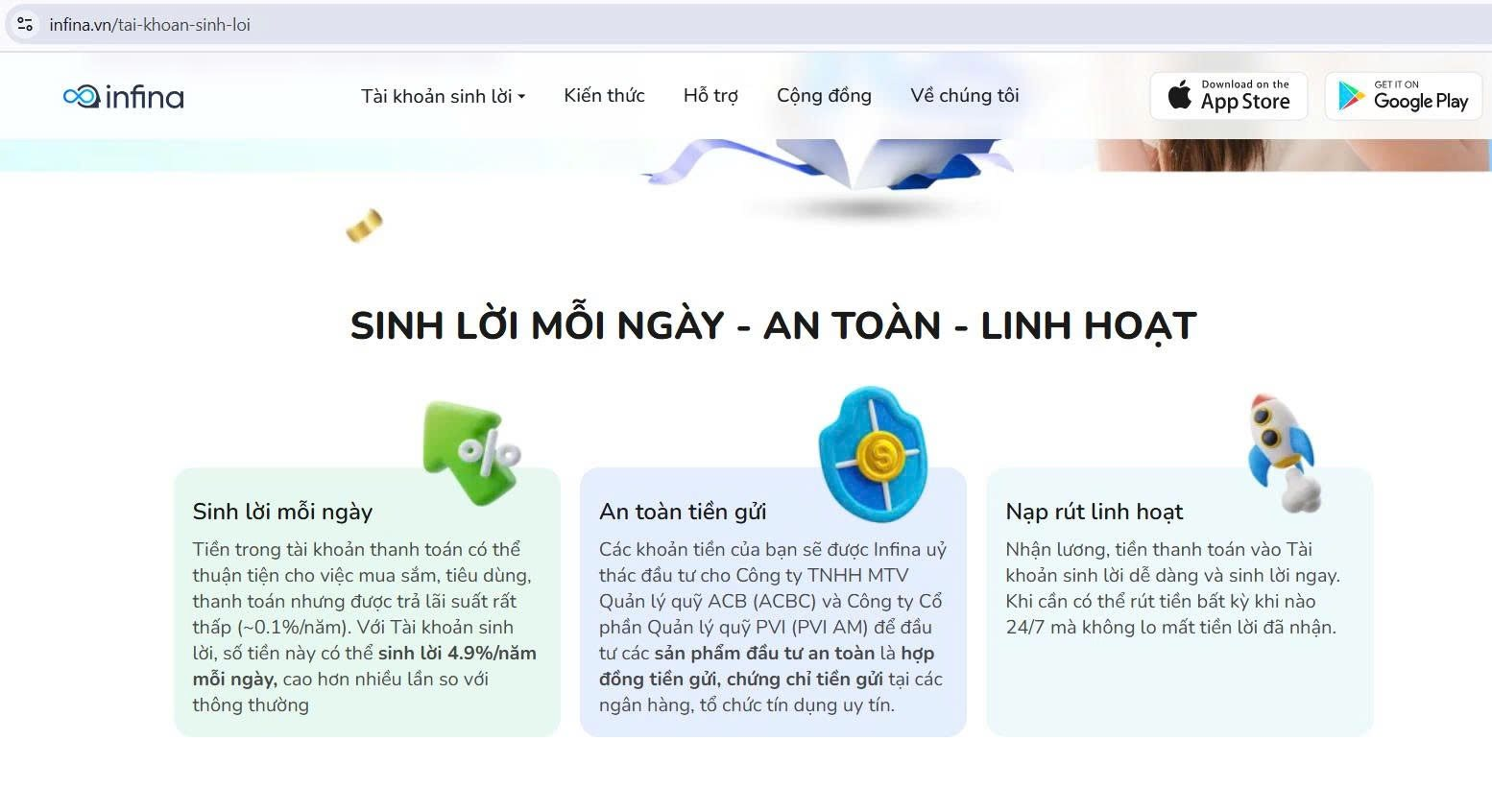

Infina offers attractive interest rates of up to 4.9%/year for individuals and 3.4%/year for businesses. Customers can withdraw their money at any time, similar to a checking account, without losing their accumulated interest.

Infina has partnered with Woori Vietnam Bank to operate this product. Customers can open an identified account on the Infina app to deposit their money, which cannot be accessed through Woori Bank’s app.

Infina then entrusts this money to investment management companies, such as ACB’s ACBC and PVI AM. These companies invest in products such as deposit contracts and certificates of deposit at banks and credit institutions.

In the past year, Real Stake Fintech JSC (owner of Infina) entrusted nearly VND 200 billion to PVI AM. At ACB Capital, they received over VND 1,500 billion in entrusted investments last year and over VND 1,100 billion in the first half of this year. Infina was the only investor with both opening and closing balances during this period.

To enhance its competitiveness in the market, Infina has collaborated with ZaloPay and AppotaPay to create similar profitable balance products.

The company has approximately 2 million users, with a quarter of them actively using their platforms each month, taking advantage of the convenient profit solutions that Infina offers.

However, Infina faces an uphill battle when competing with similar products offered by established banks like Techcombank and VPBank, which have a seamless service experience and stronger brand recognition. To counter this, Infina offers an introductory interest rate of up to 10%/year for the first 30 days from the time of deposit.

Another strategy for Infina is to partner with banks in operating these products, such as TPBank’s Double Profit, by entrusting them with investments.

TPBank, for instance, achieves a profit rate of up to 4.5%/year by collaborating with Infina to invest in products like certificates of deposit and term deposits at TPBank itself. This model could lead to a new era of competitive capital mobilization in the banking industry.

Nevertheless, it’s important to recognize that there are inherent risks in entrusting money to companies like Infina or WealthCraft, VPBanks, which customers may not fully grasp.

Infina made waves with its real estate co-buying product.

Infina entered the Vietnamese market in 2018 and has since raised multiple successful funding rounds from prominent venture capital firms like Y Combinator, Sequoia Capital, and Saison Capital. Last year, they secured additional funding from the JB Financial Group in South Korea.

Before gaining prominence with its profitable account product, Infina initially made a name for itself with its real estate co-buying product launched in 2022. However, this offering quietly came to an end, and the company shifted its focus to products that allowed users to invest in stocks, fund certificates, and certificates of deposit.

In late 2022, Infina was listed among applications showing signs of operating securities business without a license from the SSC. The SSC cautioned investors about the potential risks and the lack of legal protection for their rights and interests in case of disputes.

The regulatory body advised investors to exercise caution when trading securities on these applications, emphasizing that investors would be solely responsible for any risks arising from such transactions.