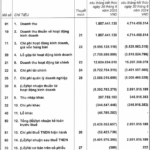

Flashback to 09/07/2025, HOSE decided to place ORS on alert status from 16/07/2025, as the auditor of the 2024 financial statements, Ernst & Young Vietnam Co., Ltd., expressed an exception regarding service fees receivable with a balance as of 31/12/2024 of over VND 28 billion.

According to ORS, by the end of 30/06/2025, this service fee receivable had been completed and the Company no longer had a balance of service fee receivables as mentioned in the exception of the auditing organization.

On 14/08/2025, the Company announced the 2025 semi-annual financial statements audited by International Audit and Valuation Co., Ltd., with the conclusion of the auditing organization being full acceptance.

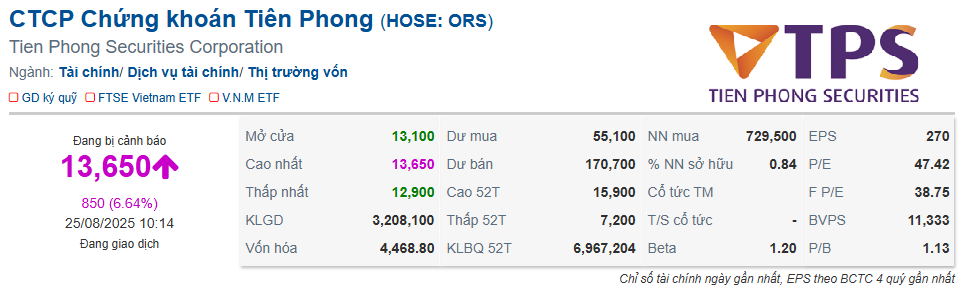

After announcing that it had overcome the reasons for being put on alert, ORS stock immediately received a boost and soon hit the ceiling price in the 25/08 session, but then faced some pressure.

As of 10:40 am, ORS was up 5.08% to VND 13,450/share. Compared to the early April lows due to a series of unfavorable news from internal to the shock of tariffs on the entire market, ORS stock price has increased by nearly 90%.

ORS hit the ceiling price in the 25/08 session

|

In another development, ORS has just announced a change in the person in charge of administration. Accordingly, Ms. Nguyen Thi Ngoc Thao will take on the role of Chief of the Board of Directors Office, Head of Administration of the Company from 22/08/2025. Previously, Ms. Thao did not hold any positions at ORS. According to the information provided, Ms. Thao currently does not hold any positions in other organizations and does not own any ORS shares.

The case of exemption is Ms. Nguyen Thi Le Tung – currently holding the position of Director of ORS Finance Block. Recently, Ms. Tung was also dismissed by the 2025 Annual General Meeting of Shareholders from the position of Member of the Board of Directors, along with 5 other members of the Board of Directors, including Mr. Do Anh Tu, Ms. Bui Thi Thanh Tra, Mr. Ta Quang Luong, and Mr. Le Quoc Hung.

The meeting elected three new members to the Board of Directors, including Mr. Nguyen Hong Quan, Ms. Dang Thi Bich Thuy, and Mr. Tran Quang Huy. Thus, in terms of personnel, ORS has reduced the number of members of the Board of Directors from 7 to 5.

At the same time, the meeting dismissed Mr. Nguyen Trat Minh Phuong from the position of Member of the Supervisory Board and elected Ms. Nguyen Thi Phuong Thuy to this position.

– 11:28 25/08/2025

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

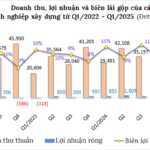

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

Dabaco Takes Over Another Livestock Company in Thanh Hoa

“Dabaco is set to acquire a 98% stake in Lam Son Nhu Xuan CNC Agriculture Joint Stock Company, a Thanh Hoa-based enterprise. This acquisition involves the transfer of 9.8 million shares, representing a significant step for Dabaco as it expands its presence in the dynamic and thriving agricultural sector of Vietnam.”

“Expanding Horizons: VCAM Fund Management Targets 2 Trillion VND Capital Increase”

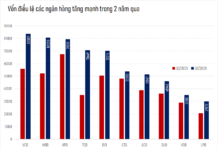

The Board of Directors of VCAM, a leading securities investment fund management company, approved the issuance of nearly 5 million new shares to increase its charter capital to VND 200 billion on August 14th. This move underscores VCAM’s strong position and ambitious growth strategy, leveraging its robust owner’s equity to bolster its market presence and expand its investment opportunities.

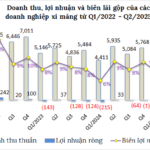

A Sunny Outlook for the Cement Industry: Profits Soar to 12-Quarter High

The cement industry has seen a remarkable turnaround in the second quarter of 2025, with a stunning recovery in profits. The sector reported a whopping 216 billion dong in earnings, a nearly three-year high and a massive 6.4 times increase compared to the same period last year. This impressive performance marks a significant shift for the industry, with many businesses turning their fortunes around and moving from losses to impressive gains.