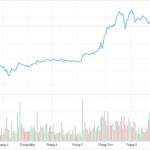

Vietnamese pepper prices continue their upward trend, capturing the attention of producers and exporters alike. In key provinces such as Gia Lai, Dak Lak, Dak Nong, Binh Phuoc, and Ba Ria-Vung Tau, pepper prices fluctuate between 145,500 and 148,000 VND per kg. The average market price hovers around 146,000-146,700 VND/kg, a slight increase of 2,000 VND from the previous trading session. This marks the highest price range since the beginning of August, with total increases ranging from 6,000 to 8,000 VND/kg.

This positive development bodes well for farmers and businesses, especially considering the stagnant state of the pepper market in the first half of the year. The sustained high domestic prices reflect stable demand from exporting purchasing enterprises and the resilient domestic consumption market. Experts attribute the price increase to a short-term local supply shortage, particularly as a significant portion of the crop has already been contracted for export since the beginning of the year.

In the global market, Vietnamese pepper remains competitively priced. According to the International Pepper Community (IPC), Vietnam’s export price for black pepper with 500 g/l density stands at 6,240 USD/ton, while the 550 g/l variety fetches 6,370 USD/ton. White pepper ASTA is quoted at 8,950 USD/ton. Compared to other producing countries, Vietnamese pepper is priced lower than Indonesia and Malaysia but remains competitive against Brazil.

Despite not commanding the highest prices in the region, Vietnamese pepper maintains its competitive edge due to its large volume, improved quality, and consistent supply to major markets. Pepper exports have performed well, weathering challenges posed by international trade policies. Notably, even with the US imposing a 20% import tariff on certain agricultural products, Vietnamese pepper continues to exhibit revenue growth.

Experts predict that domestic pepper prices may sustain their upward trajectory if supply remains limited and importing countries increase orders in anticipation of year-end festivities. However, to capitalize on this momentum, businesses must focus on enhancing quality to meet the stringent quarantine and traceability requirements of premium markets.

In summary, Vietnamese pepper enjoys a dual advantage of rising domestic prices and robust export performance, underpinned by stable international demand. This positive signal comes after years of volatility in the pepper market. To solidify this position, the industry needs a long-term strategy focusing on deep processing, brand building, and market diversification, moving away from a sole reliance on raw exports. In the short term, the current price increase is expected to provide much-needed support to pepper farmers and boost Vietnam’s agricultural exports in the latter half of 2025.