Vietnamese Stock Market Surges to New Heights: Bank Stocks Lead the Charge

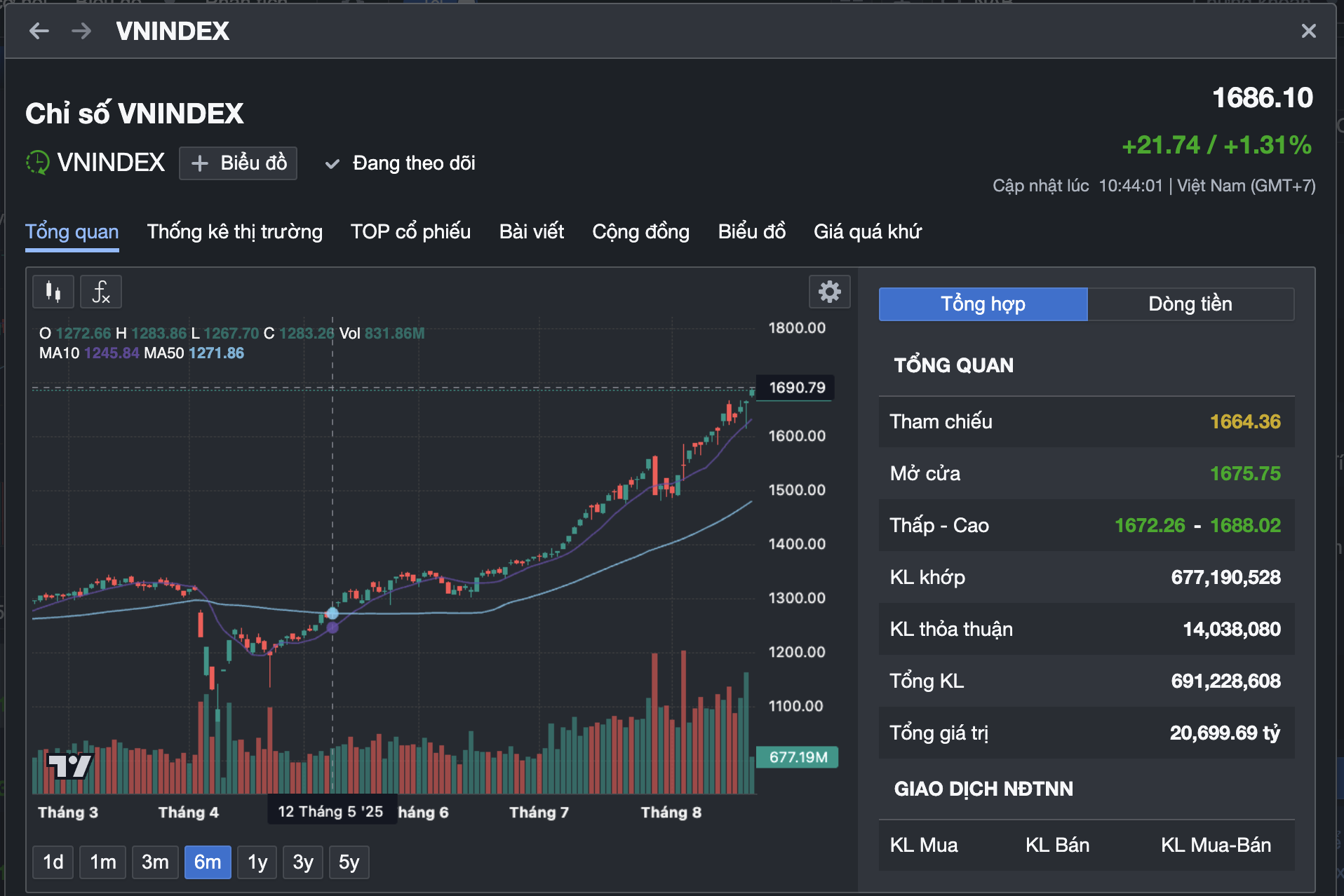

On August 21st, the Vietnamese stock market soared to new heights as the VN-Index surged over 21 points to reach 1,685 points, the highest level in its history. The VN30 also broke through the 1,850-point mark, gaining more than 30 points. The HNX-Index on the Hanoi Stock Exchange climbed 2 points to 285.79.

The market’s strong performance in recent months has been largely driven by bank stocks. During the morning session, several stocks continued their upward momentum, with OCB, VIB, STB, and BVB reaching the maximum daily price limit, while KLB, NVB, VBB, PGB, and LPB also traded close to their ceiling prices.

VN-Index has been consistently breaking records, with bank stocks leading the surge.

Bank Stocks Double in Value

VPB (VPBank) has been the center of attention, with its share price nearly doubling in just under two months, surging from the 19,000 VND range to over 37,500 VND. Despite the rapid rise, insiders related to the bank’s leadership have registered to purchase a significant number of shares.

According to HoSE disclosures, Mr. Bui Hai Quan, Vice Chairman of VPBank’s Board of Directors, has registered to buy a total of 40 million VPB shares through his two daughters, Ms. Bui Cam Thi and Ms. Bui Hai Ngan. The transactions are expected to take place between August 25th and September 23rd through matching or negotiated deals. If successful, each daughter will hold 0.25% of VPBank’s capital. At the current market price, Ms. Thi and Ngan would need to spend 1.5 trillion VND to acquire all the registered shares.

As of August 21st, VPBank’s market capitalization stood at over 289 trillion VND, equivalent to 10.9 billion USD, placing it among the highest-capitalized banks in Vietnam. The bank attributed the recent surge in its share price to positive half-year financial results and expectations surrounding the planned IPO of VPBank Securities.

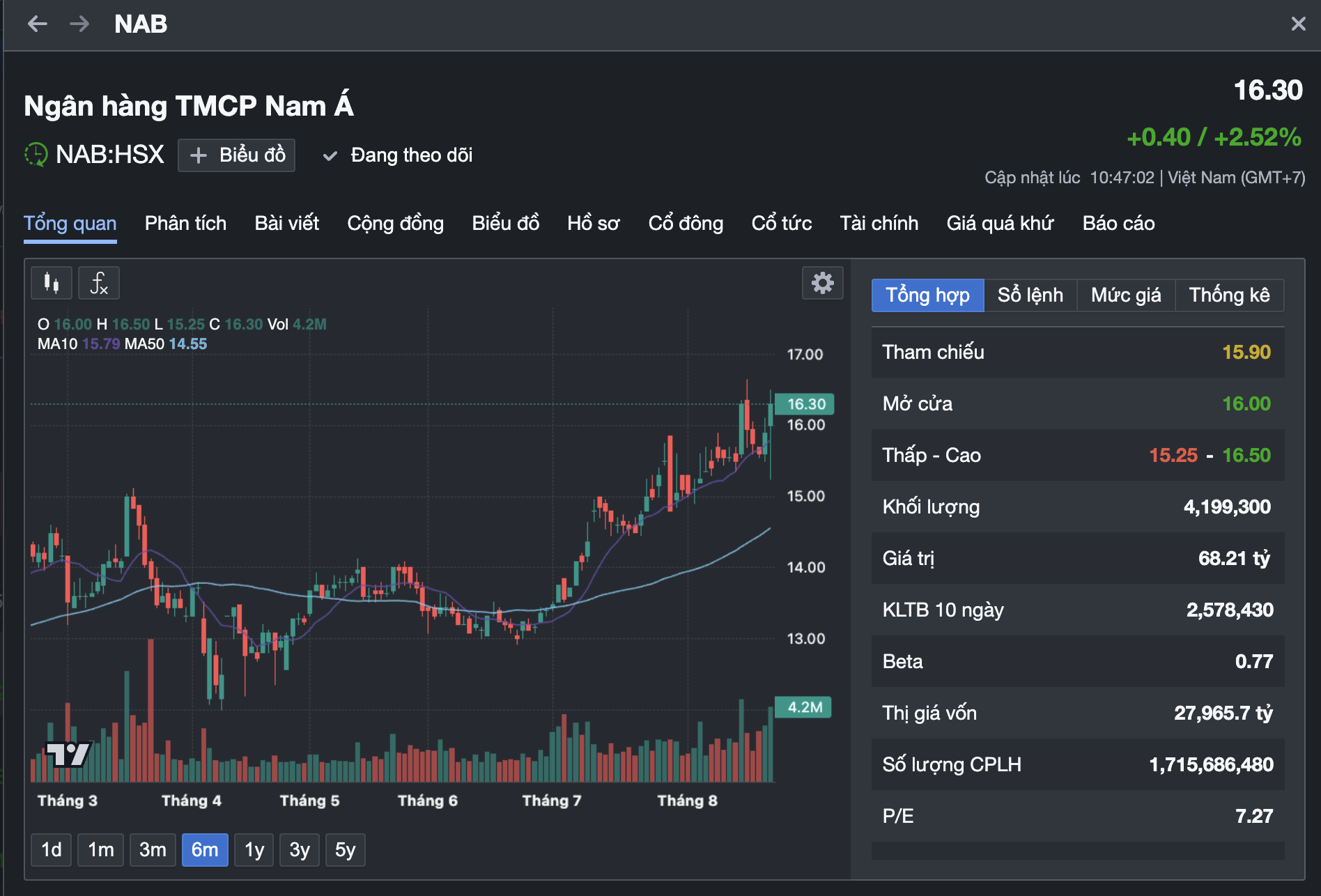

In addition to VPBank, Nam A Bank also witnessed notable transactions from individuals related to its senior leadership. Ms. Tran Kieu Thuong, the sister of Mr. Tran Ngoc Tam, Permanent Vice Chairman of the Board of Directors, purchased over 1 million NAB shares during the period of August 8th to 14th, at an average price of 15,700 VND per share, totaling approximately 15.7 billion VND.

Following this transaction, Ms. Thuong’s holdings in Nam A Bank increased to over 1.046 million shares, representing 0.061% of the bank’s charter capital. Currently, NAB is trading around the 16,200 VND mark, reflecting a nearly 20% gain over the past month.

VPB, the stock symbol for VPBank, has doubled in value in a short period.

NAB, the stock symbol for Nam A Bank, has experienced significant price movements over time.

Market Pulse, August 25: VN-Index Plunges Over 31 Points, VIC and VHM Stage a Comeback

The trading session ended on a gloomy note, with the VN-Index shedding 31.44 points (-1.91%), settling at 1,614.03. Likewise, the HNX-Index witnessed a decline of 5.9 points (-2.17%), closing at 266.58. The market breadth tilted towards decliners, as 488 stocks closed in the red compared to 265 advancers. The VN30 basket echoed a similar sentiment, with 23 stocks losing ground, 5 gaining, and 2 remaining unchanged.

Market Beat: Indecision Creeps In, Market Polarizes

The investor sentiment remains cautious, resulting in lackluster trading volumes and a tug-of-war between the major indices around the reference levels. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index exhibited a similar back-and-forth pattern, managing to maintain a slight gain and trading at around 273 points.

The Stock Market’s Best-Kept Secret: Banking on Big Gains

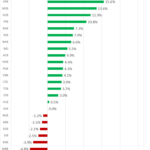

Last week, from August 18 to 22, 2025, a slew of bank stocks witnessed an impressive surge, with gains exceeding 10%. This significant upward trend underscores the robust performance and resilience of the banking sector, highlighting its potential for investors seeking lucrative opportunities in the financial realm.