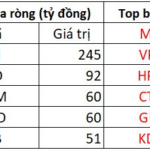

The stock market witnessed increased profit-taking pressure in banking and real estate stocks during the trading week ending August 22nd, following a sharp rally. The VN-Index closed at 1,645.47 points, down 42.53 points or 2.52%, with red dominating the afternoon session. Foreign selling remained a headwind, with net outflows of VND 1,521 billion across the market.

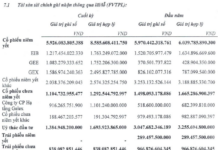

In contrast, proprietary trading by securities companies surged, with a remarkable net buy value of VND 1,201 billion on the HoSE. Specifically, VCB led with a net buy value of VND 241 billion, followed by HPG at VND 159 billion, and HDB at VND 135 billion. Other notable net buys included MWG, ACB, E1VFVN30, SSI, MBB, STB, and TCB.

On the other side, securities companies offloaded VIB the most, with a net sell value of VND 60 billion. This was followed by EIB at VND 21 billion, DBC at VND 15 billion, NLG at VND 7 billion, and DGW at VND 7 billion. Several other stocks experienced notable net selling, including FUESSVFL, GMD, PVD, PNJ, and HHS.

The Bank’s Shares Double in Value, and the Vice-Chairman’s Daughter Still Spends Billions to Buy In

VPBank’s stock has soared to unprecedented heights, witnessing a remarkable 100% surge in just three months. This extraordinary rally has propelled the stock to reach new record highs, showcasing an impressive performance that stands out in the market.

Market Pulse, August 25: VN-Index Plunges Over 31 Points, VIC and VHM Stage a Comeback

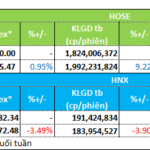

The trading session ended on a gloomy note, with the VN-Index shedding 31.44 points (-1.91%), settling at 1,614.03. Likewise, the HNX-Index witnessed a decline of 5.9 points (-2.17%), closing at 266.58. The market breadth tilted towards decliners, as 488 stocks closed in the red compared to 265 advancers. The VN30 basket echoed a similar sentiment, with 23 stocks losing ground, 5 gaining, and 2 remaining unchanged.

The Cash Flow Chooses Stocks and Shares, Banking.

Volatility in liquidity contrasted at the HOSE and HNX exchanges this week (August 18-22). A clear trend emerged, with financial stocks attracting the most capital inflows.