According to YSVN’s forecast, during this review period, FTSE Vietnam ETF (FTSE ETF) may add FPT shares with a weight of 10.6% and HCM shares with a weight of 1.14%.

On the other hand, VTP is likely to be removed from the portfolio. YSVN also notes that FTS faces a similar fate if it fails to meet the capitalization requirements.

Regarding the VNM ETF, YSVN believes that FPT is also likely to be added, accounting for 2.44% in weight, and no stocks are expected to be removed. Several stocks are predicted to increase in weight, including MSN, VNM, VJC, and BVH. Meanwhile, VIX, SSI, VND, and NVL are expected to witness significant reductions in their weights.

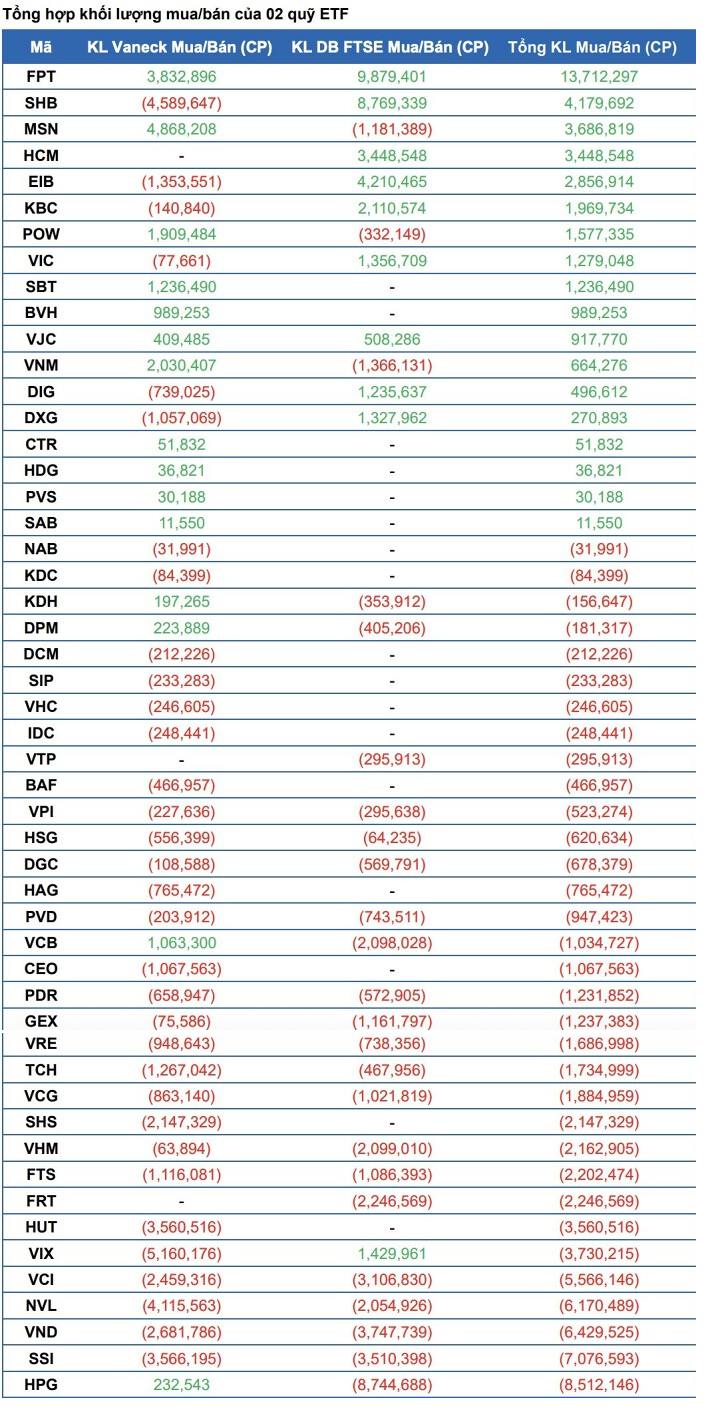

Combining the predicted transactions from both funds, FPT, SHB, MSN, HCM, and EIB top the list of buys with corresponding volumes of 13.7 million shares, 4.2 million shares, 3.7 million shares, 3.4 million shares, and 2.9 million shares.

Conversely, HPG, SSI, VND, NVL, and VCI are the group facing the most substantial selling pressure, with respective volumes of 8.5 million shares, 7 million shares, 6.4 million shares, 6.2 million shares, and 5.6 million shares.

Yuanta Vietnam Securities’ Forecast

As per the schedule, the cut-off date for the reconstitution is August 29. FTSE Vietnam ETF will announce the official portfolio on September 5, while VNM ETF is expected to disclose its portfolio on September 12. Both funds will complete the reconstitution trades by September 19.

– 16:26 26/08/2025

FPT’s Triumph: Prime Minister’s Trust in Truong Gia Binh Propels Stock to Impressive Heights

FPT’s stock has declined by over 34% since the beginning of the year. This significant drop has investors concerned about the future performance of the company. With a poor outlook for the upcoming quarters, it’s essential to understand the factors contributing to this decline and whether there are any potential upsides to this downward trend.