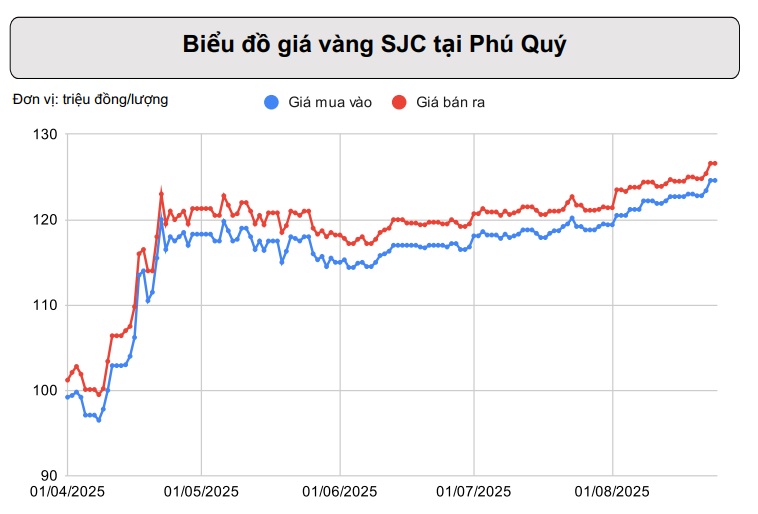

Gold prices surged last week, reaching a new peak with transactions hovering around 124 million VND per tael for buyers and 126 million VND per tael for sellers.

International gold prices also witnessed a significant surge towards the end of the week following the Fed Chairman’s speech. The market interpreted the Fed’s stance as more dovish, causing the US dollar to weaken and boosting precious metals. Escalating tensions in Venezuela also positively influenced the safe-haven demand for both gold and silver.

SJC gold prices since April 1st.

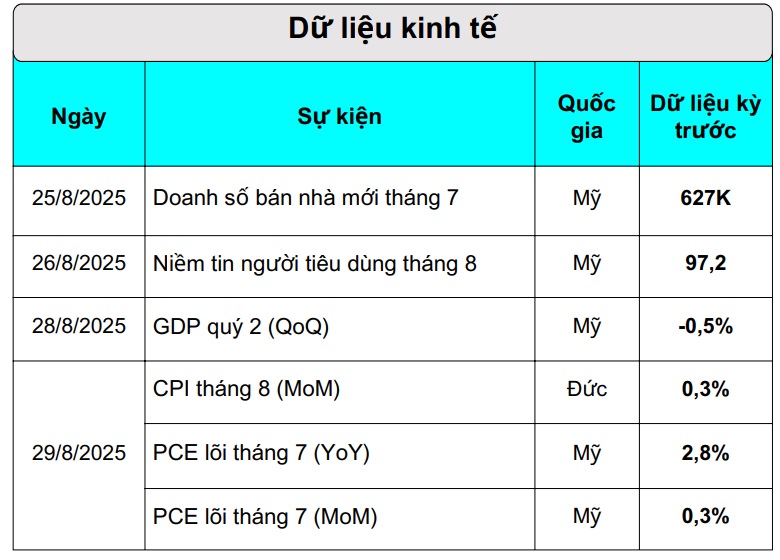

According to experts from Phu Quy Group, a leading precious metals company, investors this week will focus on the US economic performance in the second quarter and the inflation rate in July. The Personal Consumption Expenditures (PCE) index, favored by the Fed to gauge inflation, will be crucial.

Hence, the more dovish signal sent out last week, combined with a lower PCE figure than the previous period, would enhance the likelihood of an interest rate cut, weakening the dollar and propelling the upward trajectory of precious metals.

Economic data that could influence gold prices this week.

Additionally, new home sales and consumer confidence remain vital leading indicators. Weaker data would further encourage monetary easing to stimulate the US economy.

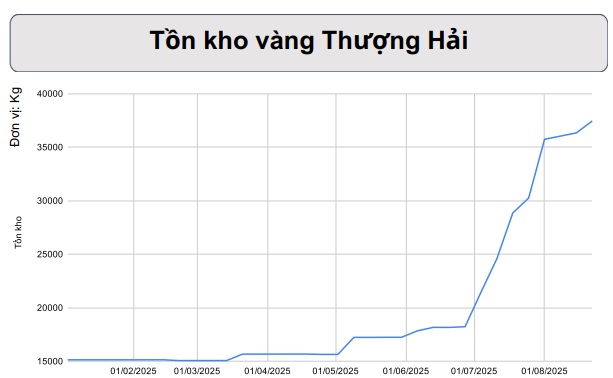

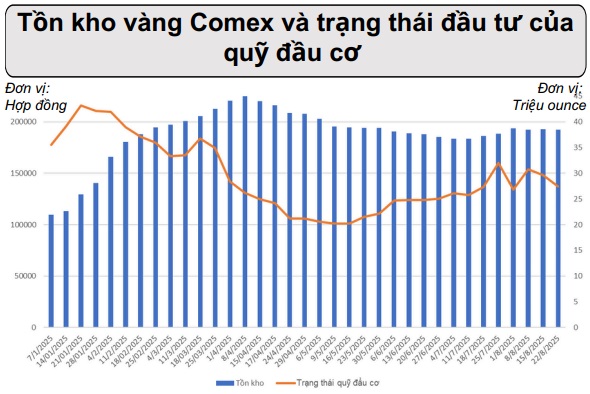

Regarding inventory, gold stocks in Shanghai continued to rise last week. Meanwhile, a slight decrease in speculative buying indicates that profit-taking is still occurring in the COMEX gold market. With prices moving sideways within a broad range, the market awaits the establishment of a new equilibrium and further clues on the Fed’s monetary policy to determine gold’s future direction.

Phu Quy Group predicts that if the US dollar remains weak due to expectations of a Fed rate cut in September, gold prices may find further support this week. The targeted price range is around 3,450 USD per ounce, with the potential to breach the resistance level of 3,500 USD per ounce.

“Riding the Wave of Precious Metal Profits: Silver Buyers Reap 35% Gains Since the Start of the Year”

“Since the start of the year, domestic silver prices have surged over 35%, outpacing the gains of the VN-Index (approximately 30%) but still lagging behind the impressive surge in gold prices (nearly 49%).”

The Greenback Hits a New High: Official Exchange Rate Surpasses 26,500 VND

The US dollar is on a roll, with the exchange rate reaching new heights on August 20, 2025. The official exchange rate hit a record high, with the selling price reaching a staggering VND 26,500 per USD at banks across the country. This unprecedented surge has the market buzzing, as the Vietnamese currency feels the heat from the mighty dollar.