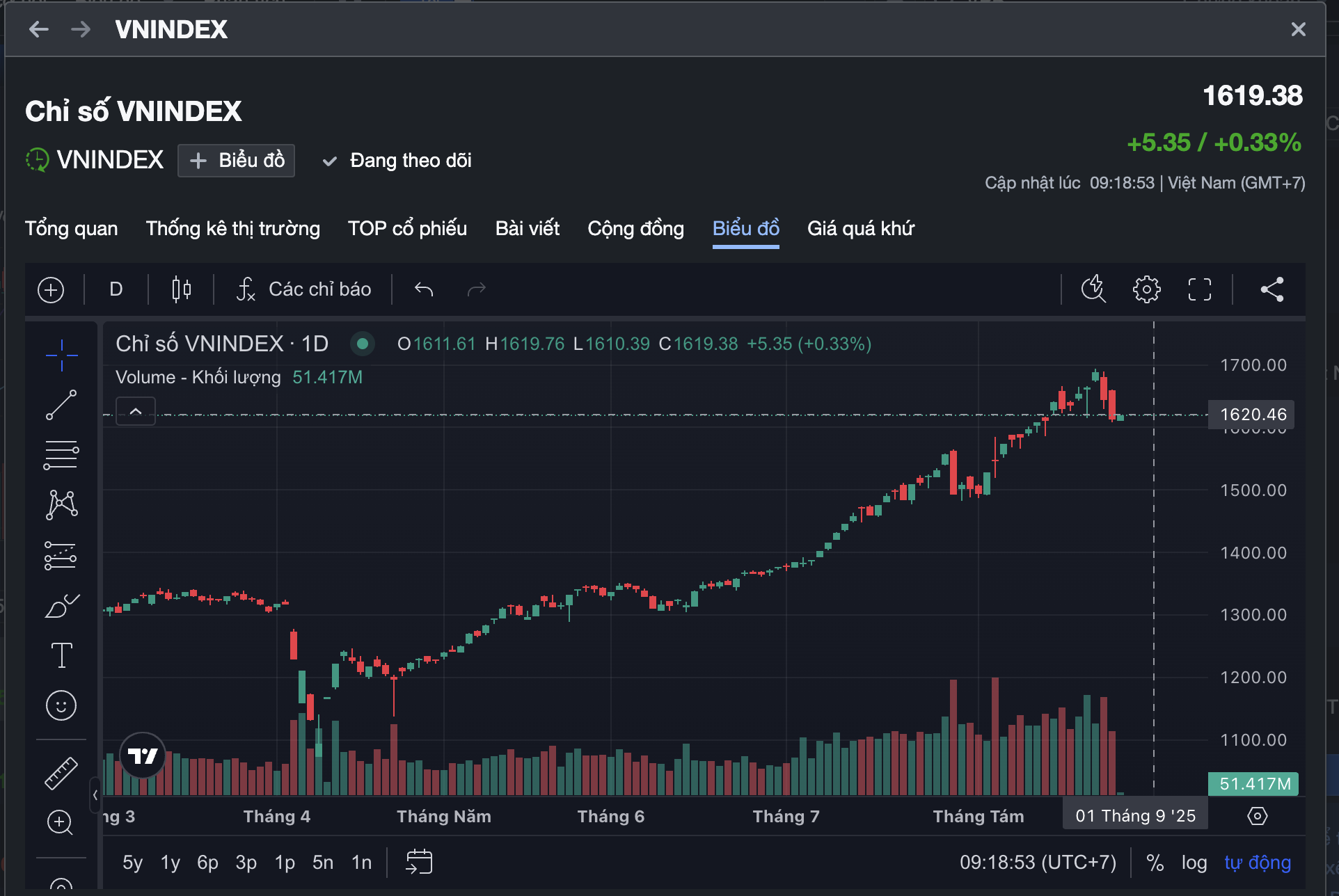

The Vietnamese stock market opened on August 26 amidst a sea of red, with the VN-Index hovering just above the 1,600-point mark. This marked the third consecutive session of declines, following a loss of around 75 points in the previous two sessions, equivalent to a 4.47% drop from its historic peak.

Has the Bank Stock Rally Run Out of Steam?

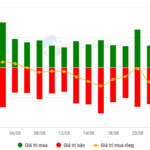

The focus of this correction has been on bank stocks, as a slew of codes were dumped, with some even hitting the daily limit down for two straight sessions, leaving many new investors with losses before they could even receive their shares.

During the August 25 session, bank stocks such as VPB, TPB, MSB, OCB, VIB, and NAB all plunged to the floor price. Notably, VPB suffered a two-day losing streak, causing investors who bought at the end of the previous week to lose up to 14% in just a few days, and this figure could be higher for those using margin trading.

This development has prompted many investors to question whether the rally in bank stocks has run its course or if it is merely undergoing a temporary correction after a sharp surge.

According to the Vietnam Construction Securities Company (CSI), the overwhelming selling pressure on August 25, with the banking sector plunging by 3.96%, was the primary reason for the market’s steep decline. The sharp drop in liquidity indicated weak demand at the 1,610-point level, as most investors were reluctant to “bottom fish.” As a result, the VN-Index is likely to remain in a short-term corrective phase.

The stock market continues to be awash with red as soon as the trading session opens this morning.

Bank Stocks: Growth Potential Remains

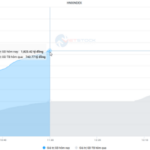

However, several experts believe that this correction is necessary and could present opportunities for the subsequent phase. Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Company, stated that in the past four weeks, bank stocks have been the market leaders, attracting strong capital inflows with an average matching value of up to VND 18,800 billion per session, accounting for 34% of the total floor turnover. The increase in trading value from VND 13,700 billion to VND 18,800 billion per session within a month indicates that this group is showing signs of accumulation and preparing for a breakthrough rather than entering a distribution cycle.

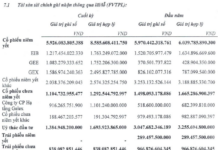

In Mr. Duong’s opinion, the valuation of bank stocks is not yet excessive. Most banks have a price-to-book (P/B) ratio below 2.4 times, while credit growth this year is expected to reach 16%, and many banks are likely to surpass a 20% profit margin. This suggests that there is still room for growth in the banking sector.

Sharing this viewpoint, Mr. Dinh Minh Tri, Director of Individual Customer Analysis at Mirae Asset Securities Vietnam, emphasized that market liquidity remains abundant. The cash balance of investors at securities companies in the second quarter of 2025 was at a very high level, indicating that there is still ample capital ready to be deployed.

According to Mr. Tri, the current corrective phase could be an opportune time for medium and long-term investors to enter the market, provided they focus on stocks with solid fundamentals.

Mr. Tri predicted that five sectors are worth noting: banking, securities, public investment, import-export and port services, and retail. Among these, the banking sector, despite its recent sharp surge, remains attractive due to positive profit expectations.

In summary, the VN-Index is undergoing a short-term correction after a prolonged upward trend. While short-term investors still face risks, this could be an opportunity for long-term investors to accumulate stocks, particularly in pivotal sectors such as banking.

VN-Index is undergoing a short-term downward trend after a prolonged hot streak.

The Ultimate Guide to Reaching New Heights: Vietstock Daily 27/08/2025

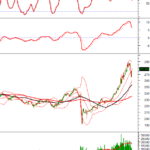

The VN-Index demonstrated resilience by maintaining its position above the middle of the Bollinger Bands, and its impressive recovery was highlighted by a surge of nearly 54 points. To ensure a more sustainable upward trajectory, an improvement in trading volume is necessary. If the index surpasses the previous peak of 1,680-1,693 points in upcoming sessions, it will pave the way for reaching new heights.

Technical Analysis for the Session on August 27: Climbing Higher

The VN-Index and HNX-Index soared in unison, reaching new heights. The ADX indicator confirmed the market’s robust momentum, signaling a bullish trend for investors.

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.

Vietstock Daily: Summit Showdown

The VN-Index pared its gains towards the end of the trading session on August 27th, forming a Long Upper Shadow candle. This indicates that profit-taking pressures remain robust at the previous peak of 1,680-1,693 points. Additionally, with the Stochastic Oscillator indicator continuing to weaken after issuing a sell signal, it suggests that the index is likely to encounter further volatility in the upcoming sessions.

The New Wave of Banking: Leading Expectations and Managing Margins

The post-COVID-19 era has witnessed a record-breaking rally for bank stocks, but this impressive performance belies a more nuanced story. This surge is underpinned by a combination of factors, including heightened expectations and the influx of margin financing into the financial sector. While this has provided a much-needed boost to the market, it also presents challenges, as the margin contraction highlights a delicate balance that could impact the market’s trajectory.