Doan Hoang Nam, son of Bau Duc, has registered to purchase an additional 25 million HAG shares of Hoang Anh Gia Lai. This comes just after his recent purchase of 27 million HAG shares last Friday, on August 22nd.

If this transaction is successful, Nam’s holdings will increase to 52 million shares, amounting to a 4.92% stake in the company. The expected execution period for this purchase is from August 28th to September 12th. Based on HAG’s current share price, the value of the shares Nam intends to buy is estimated to be over VND 400 billion.

On the other hand, Bau Duc, Chairman of Hoang Anh Gia Lai, sold 25 million shares on August 22nd, reducing his holdings to 305 million shares, valued at approximately VND 4,900 billion. Bau Duc has three children, including a daughter, Doan Hoang Anh, and two sons, Doan Hoang Nam and Doan Hoang Nam Anh. The eldest child, Doan Hoang Anh, currently holds 13 million HAG shares, representing a 1.23% stake.

All three of Bau Duc’s children were sent by him to study and live in Singapore from a young age and have remained out of the public eye, never appearing in the media.

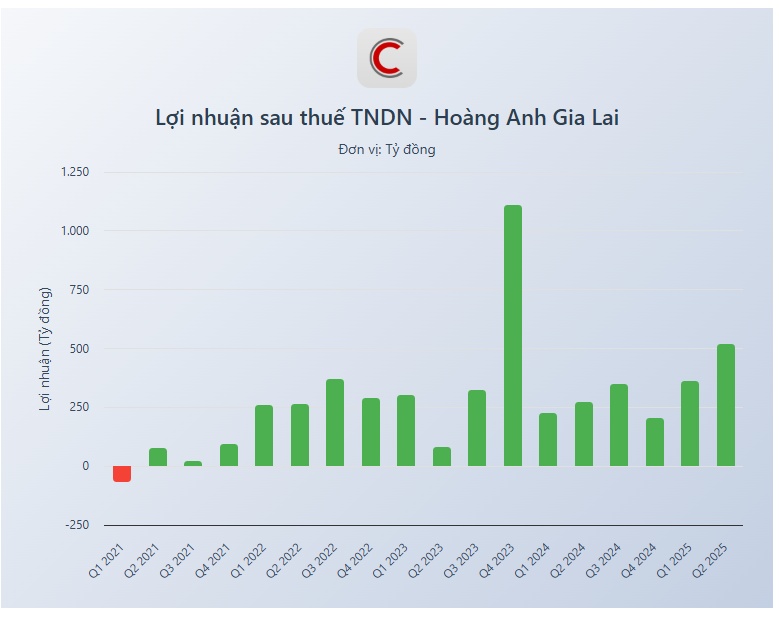

According to Hoang Anh Gia Lai’s Q2/2025 financial report, the company achieved VND 2,329 billion in revenue, a more than 50% increase compared to the same period last year. As a result, gross profit and net profit from business activities nearly doubled year-over-year. Net profit stood at VND 483 billion, up 86%.

For the first six months of 2025, Hoang Anh Gia Lai recorded VND 3,709 billion in revenue and VND 824 billion in net profit, representing increases of 34% and 73%, respectively, compared to the same period in 2024.

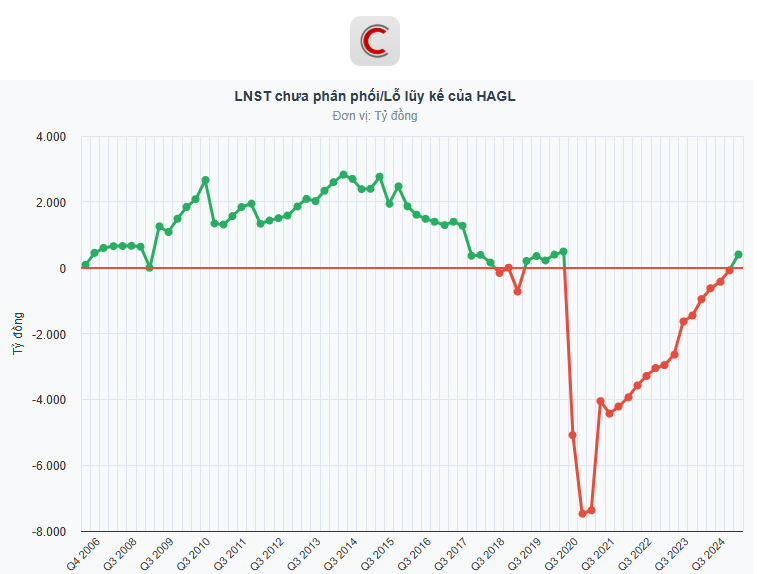

With these results, Hoang Anh Gia Lai reported undistributed post-tax profits of VND 400 billion as of June 30, 2025. This marks the first time since Q4/2020 that the company has emerged from cumulative losses.

The Thrilling Saga of “Bầu” Đức and Hoàng Anh Gia Lai: Unveiling the Latest Sensational Updates

“Vietnamese business tycoon, known as ‘Bầu Đức’, and his son have finalized a substantial stock transaction involving HAG shares, valued at approximately 400 billion VND. This significant deal underscores the dynamic nature of Vietnam’s evolving business landscape, where influential families continue to shape the country’s economic trajectory.”

A Tale of Contrasting Fortunes: The Intriguing Story of “Bầu” Đức and His Son

“Amidst a flurry of trading activity, Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai Joint Stock Company, registered to sell 25 million HAG shares. In a fascinating turn of events, his son, Doan Hoang Nam, stepped in and registered to purchase 27 million shares through either matched orders or negotiated deals. This intriguing development has sparked interest among investors and market observers alike.”

Has Duc Sold 25 Million HAG Shares to His Son?

“Doan Nguyen Duc, commonly known as ‘Bầu Đức’, has set his sights on offloading 25 million shares, while his son, Doan Hoang Nam, has registered to purchase 27 million HAG shares. This intriguing move has sparked interest among investors, who are now keenly observing the father-son duo’s strategies and their potential impact on the market.”