The VN30 basket witnessed a vibrant session as all 30 stocks surged. The robust comeback of large-cap stocks not only bolstered market confidence but also created a spillover effect across various sectors. The simultaneous rally in banking, real estate, retail, steel, and securities sectors generated a positive synergy.

Given their large market capitalization, high liquidity, and significant market influence, the rebound and strong upward momentum of banking stocks served as a crucial catalyst for the VN-Index. SHB and MSB soared to the maximum daily limit allowed.

VN30 stocks across the board witnessed price increases.

On the HoSE, all banking stocks climbed, with EIB, SSB, TCB, ACB, CTG, and TPB surging by over 4%. Trading volume in this sector exploded, with VPB, SHB, TCB, and MBB each recording transaction values exceeding a thousand billion VND.

The securities sector also made a powerful statement, with SSI attracting a torrent of cash, causing the stock to soar to the daily limit of 39,200 VND, setting a new historical peak. Its liquidity reached nearly 3,600 billion VND, the highest on the exchange, doubling that of the trailing stocks, including VPB and SHB. By the session’s end, SSI still had over 8.4 million shares on the buy side at the ceiling price, while the sell side was barren. VND, VIX, and ORS followed suit, hitting the ceiling and further fueling the sector’s exuberance.

Notably, Vingroup’s two heavyweights, VHM and VIC, contributed over ten points to the VN-Index, with VHM surging to the maximum daily limit and exerting considerable upward pressure. Additionally, the real estate sector shone brightly, with DIG, PDR, and NVL surging in the broader market recovery.

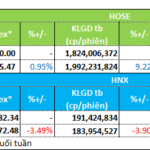

At the closing bell, the VN-Index climbed 53.6 points (3.32%) to 1,667.63, while the HNX-Index and UPCoM-Index rose 9.21 points (3.45%) to 275.79 and 0.26 points (0.24%) to 108.84, respectively.

Liquidity eased slightly, with the trading value on HoSE surpassing 38,381 billion VND. Foreign investors traded relatively balanced volumes on both sides, returning to a net buying status of over 687 billion VND as they heavily purchased MSB, VIX, and MWG. All three stocks finished the session at their respective ceilings.

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.

The Powerhouse That Swept Up $1.2 Billion in Vietnamese Stocks as VN-Index Soared Over 42 Points

The VCB witnessed an overwhelming net buy with 2.41 trillion VND, followed by HPG at 159 billion VND.

Market Beat: Indecision Creeps In, Market Polarizes

The investor sentiment remains cautious, resulting in lackluster trading volumes and a tug-of-war between the major indices around the reference levels. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index exhibited a similar back-and-forth pattern, managing to maintain a slight gain and trading at around 273 points.