The prestigious international credit rating agency S&P Global Ratings (S&P) has upgraded Export-Import Commercial Joint Stock Bank (Eximbank) to ‘BB-‘ with a stable outlook.

According to Ivan Tan, Director of Analytics and Credit Ratings (Singapore), the upgrade follows S&P’s adjustment of Vietnam’s Bank Industry Country Risk Assessment (BICRA) to the ‘8’ group, indicating a stronger banking system.

“We have raised Eximbank’s stand-alone credit profile (SACP) to ‘BB-‘ from ‘B+’. Eximbank will benefit from Vietnam’s consistent GDP growth trajectory, positively impacting the bank’s financial profile,” said Ivan Tan.

S&P analysts attribute Eximbank’s strategy to focus on the retail customer segment (54% of total outstanding balance as of December 31, 2024) and small and medium-sized enterprises. The bank’s profits are largely derived from these high-yield customer segments.

S&P affirms the sustainability of Eximbank’s profit growth. The bank’s efforts in restructuring and maintaining stringent underwriting standards will enhance profitability while reducing credit cost provisions.

The stable outlook reflects S&P’s expectation that Eximbank will execute its restructuring plans and maintain capitalization levels over the next 12–24 months.

S&P also highlights the possibility of an upgrade if Eximbank consistently achieves a risk-adjusted capital (RAC) ratio of over 10%. This can be achieved through sustained and robust capital buildup, driven by profit retention and moderated credit growth. However, the bank may require several years to attain this level.

S&P upgrades Eximbank’s credit rating to BB-

|

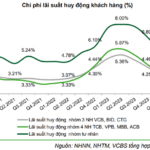

In its previous report, S&P noted an improvement in Eximbank’s return on assets (ROA), rising from 1.1% in 2023 to 1.5% in 2024 due to enhanced net interest margins and lower funding costs. S&P forecasts Eximbank’s ROA to stabilize between 1.25% and 1.35% in the next 12–24 months, as the government encourages banks to lower lending rates to support businesses and economic growth.

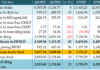

S&P also commends Eximbank’s effective management of asset quality, with a reduced non-performing loan (NPL) ratio of 2.5% as of 2024 year-end. The ratio of special mention loans and restructured loans also decreased significantly from 5% to 3.9%, reflecting the positive outcomes of the bank’s credit risk management and bad debt resolution measures. With a stable RAC ratio of 5.2-5.4% this year, Eximbank is well-positioned to support its targeted credit growth in the coming period, expected to reach 16-18%, surpassing the government’s industry-wide target of 12-15%.

Notably, S&P recognizes Eximbank’s flexibility in diversifying its funding sources, prioritizing low-cost funds. The successful restructuring efforts have laid a solid foundation for the bank to enhance its resilience to fluctuations and pursue sustainable long-term development.

Eximbank’s representative affirmed that the S&P upgrade to BB- testifies to the bank’s relentless efforts in fortifying its financial strength, risk management, and sustainable development. This recognition not only acknowledges Eximbank’s achievements but also reinforces the market’s, partners’, and customers’ confidence in the bank’s comprehensive restructuring and transformative journey, encompassing both operational model and strategic vision.

Eximbank remains committed to its strategy of safe, efficient, and sustainable development, aligning with the prosperity of its customers and contributing to the growth of the Vietnamese economy.

Currently, Eximbank is in a pivotal year, laying the groundwork for a significant leap forward in the 2026–2030 period. The bank is collaborating with international consulting partners and experts to undertake a comprehensive restructuring, formulate mid to long-term development strategies, enhance its customer-centric approach, accelerate digital transformation, and expand its target customer base beyond its current focus.

Recently, Eximbank announced its financial results for the first half of the year, with a pre-tax profit of VND 1,489 billion, reflecting a 0.97% increase compared to the same period last year. In the second quarter of 2025, Eximbank recorded a profit of VND 657 billion. The bank’s credit growth stood at a positive 9.8%, with total assets reaching VND 256,442 billion, marking a 6.95% increase from the beginning of the year.

Eximbank is in the process of relocating its head office to Hanoi, a strategic move that marks a turning point in the bank’s restructuring, brand re-positioning, and enhanced stature. This aligns with S&P’s observation about Eximbank’s limited market coverage and will enable the bank to expand its presence in the Northern and Central regions of Vietnam.

– 10:37 26/08/2025

“How Much Money Do You Need in Your Account to Become a Bank VIP? Vietcombank’s VVIP Status Requires a Balance of 50 Billion VND, While VietinBank’s Diamond Tier Asks for Deposits of at Least 5 Billion VND for Three Months.”

The rapid growth of the middle and upper classes has fueled a demand for premium banking services. However, the criteria for categorizing priority customers vary from bank to bank.

The State Bank Approves GELEX’s Acquisition of Eximbank Shares

If the transaction is successful, GELEX will increase its expected ownership to 10% of Eximbank’s charter capital, becoming a major shareholder of the bank.