According to HNX, NEM stock was delisted due to the company losing its public company status as per the SSC‘s announcement on August 19, 2025.

A year ago, on August 13, 2024, the SSC received a report from NEM regarding its status as a public company. The company did not meet the requirements for a public company as of July 22, 2024, as 128 non-major shareholders held 8.89% of the voting shares, failing to meet the criteria under Clause a, Point 1, Article 32 of the 2019 Securities Law.

Consequently, after a year of not meeting the conditions for a public company, the SSC requested NEM to submit documents for the cancellation of its public company status.

Interestingly, NEM was only recently approved as a public company by the SSC on June 6, 2023, and started trading on the UPCoM on January 5, 2024, with a starting price of VND 10,200 per share.

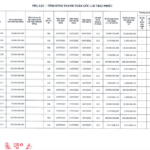

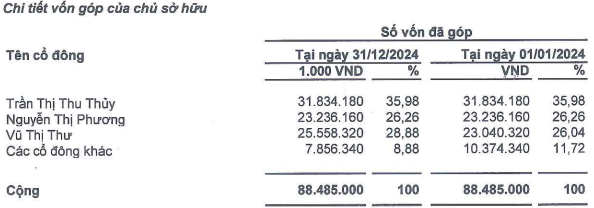

The 2024 audited financial statements reveal a concentrated ownership structure, with the top three shareholders, Tran Thi Thu Thuy (member of the Board of Directors and General Director) holding 35.98% of capital, Nguyen Thi Phuong (member of the Board of Directors) with 26.26%, and Vu Thi Thu (Chairwoman of the Board) owning 28.88%, totaling 91.12%. All other shareholders combined hold only 8.88%. As of January 1, 2024, other shareholders held 11.72% of the capital.

Source: 2024 Audited Financial Statements of NEM

|

Electric Equipment Joint Stock Company (NEM) was established in 2004 in Bac Ninh province as a limited liability company with initial chartered capital of 1.3 million USD. The company subsequently increased its capital to 1.8 million USD (VND 28.8 billion) in 2007 and then to nearly 4.1 million USD (nearly VND 88.5 billion) in 2016. In the same year, the company transformed into a joint-stock company.

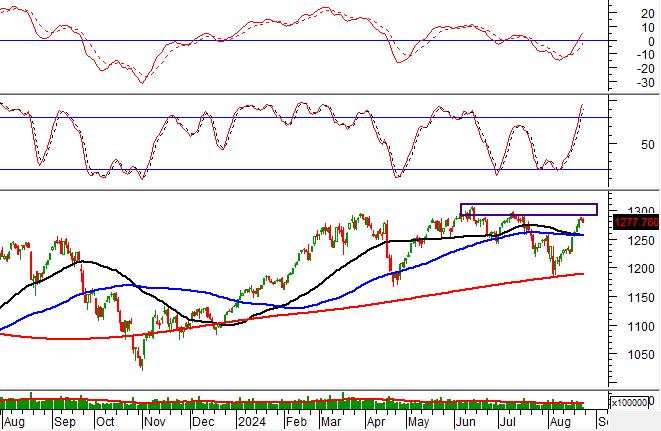

A significant turning point came when NEM received approval from the SSC to become a public company on June 6, 2023, and was later approved for trading on the UPCoM on December 28, 2023. On January 5, 2024, NEM shares started trading at a price of VND 10,200 per share.

In the initial period after listing, NEM witnessed a strong upward trend, with share prices peaking at VND 75,000 on January 31, 2024. However, the share price quickly declined thereafter.

In recent sessions, NEM‘s share price has continuously dropped, closing at VND 10,800 on August 27, 2025, not much higher than its initial listing price.

Currently, NEM specializes in the manufacturing and trading of electrical equipment. Its product portfolio includes medium-voltage switchgear (6-40.5kV); low-voltage distribution boards (0.4kV); capacitors (0.4-35kV); protection and control equipment (6-110kV); smart electricity meters; and fabrication of electrical cabinet bodies and cable trays.

NEM‘s business performance has been challenging, with revenues of less than VND 750 million in 2024, a decrease of 98% compared to 2023. While capital expenses were significantly reduced, they still amounted to nearly VND 7 billion, including provisions for inventory devaluation and depreciation of assets related to the production of meters. As a result, the company incurred a gross loss of nearly VND 6 billion.

Additionally, management expenses tripled compared to the previous year due to provisions for doubtful debts from partners. Ultimately, the company recorded a net loss of over VND 18 billion in 2024, compared to a minor loss of VND 94 million in 2023.

– 08:39 28/08/2025

The Former Top Provider of Concrete Batching Plants in Vietnam is About to Delist

The Board of Directors of CEG Corporation (UPCoM: CEG), a leading construction and industrial equipment company, has announced that January 10, 2025, will be the record date for shareholders to be eligible for the proposed cancellation of the company’s public company status.