Blue Bay Quy Nhon, a newly established company by CNT with a chartered capital of 830 billion VND, made its debut on October 9, 2024. Vice Chairman of CNT, Tran Cong Quy, acts as the legal representative, while Chairman Pham Quoc Khanh manages CNT’s capital contribution in the company.

In late November 2024, CNT approved the transfer of a commercial apartment project along Huynh Tan Phat Street, Dong Da Ward, Quy Nhon City, Binh Dinh Province, to Blue Bay Quy Nhon, ensuring financial support for the latter’s project execution.

CNT successfully bid for the land use rights of over 1,500 square meters of cleared land for the commercial apartment project along Huynh Tan Phat Street, with a book value of approximately 40 billion VND as of Q3 2024, equivalent to 25.5 million VND per square meter, nearly 2 billion VND higher than the starting price. The company commenced construction on November 2, 2024, and estimates a requirement of over 280 billion VND to build two basements and 18 floors, offering 181 apartments to the market.

|

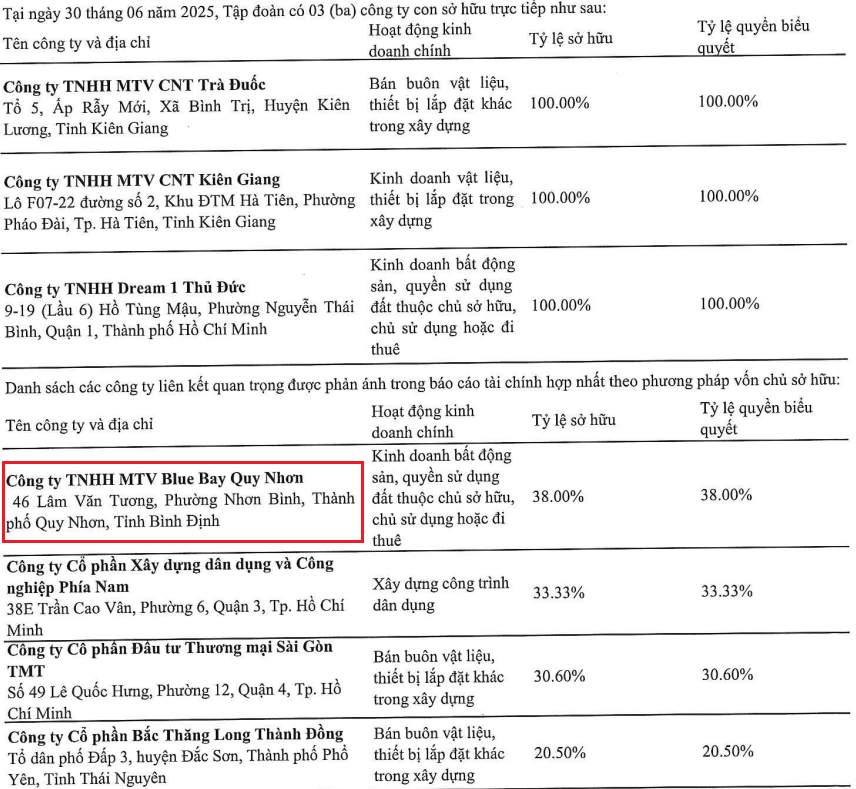

As of June 30, 2025, CNT holds three subsidiaries and four associated companies, including Blue Bay Quy Nhon.

Source: CNT

|

Regarding business operations, CNT recorded a decline in revenue and profit during the first half of 2025, with a revenue of over 18 billion VND and a net profit of nearly 3 billion VND, an 89% and 97% decrease, respectively, compared to the same period last year.

The company attributed this performance to the stagnant real estate market and challenges in debt recovery for product delivery and revenue recognition.

| CNT’s Financial Performance for the First Half-Year from 2018 to 2025 |

For the full year 2025, CNT targets nearly 64 billion VND in revenue and over 9 billion VND in after-tax profit. As of the second quarter, the company has achieved 29% and 32% of these goals, respectively.

By the end of the second quarter, CNT’s total assets exceeded 792 billion VND, a 6% decrease from the beginning of the year. Cash and cash equivalents witnessed a significant drop of 81%, amounting to over 59 billion VND. Inventories increased by 91% to over 214 billion VND, with the commercial apartment project in Quy Nhon, Binh Dinh, accounting for nearly 43 billion VND. Payable debts stood at nearly 103 billion VND, a 30% reduction, including financial borrowings of 16.5 billion VND, a 9% decrease, constituting 16% of total debt.

Thanh Tu

– 10:35, August 28, 2025

The Spirit of Vietnam: From Welfare Policies to Market Dynamism

“Developing social housing is not just an economic task, but also a crucial political and social responsibility, according to Nguyen Van Sinh, Deputy Minister of Construction. This initiative aims to stabilize the real estate market by addressing the housing needs of lower-income individuals and families.”

Agribank: A Leading Contributor to Vietnam’s National Budget for Sustainable Development

Let me know if you would like me to make any adjustments or provide additional content related to this topic.

As a leading force in the financial market, the Vietnam Bank for Agriculture and Rural Development (Agribank) has not only solidified its position as a top contributor to the national budget but has also played a pivotal role in fostering economic and social development, particularly in the “Three Agricultures” – agriculture, rural areas, and farmers.

Unlocking Affordable Housing Opportunities: Businesses Urge Amendments to the Land Law

The upcoming 2024 Land Law amendments aim to strike a delicate balance in land-related financial obligations and address the concerns arising from the steep rise in land prices over the past year. While businesses continue to grapple with the challenge of input costs for housing, the state is committed to curbing budget deficits and fostering a harmonious relationship between the state, businesses, and citizens.