On August 27, 2025, Vietnam’s domestic pepper market witnessed a strong upward momentum, with average prices reaching 148,700 VND/kg, an increase of 1,900 VND from the previous day. This is the highest price in recent weeks, indicating a clear recovery trend for this key export agricultural product.

In the Central Highlands and Southeast regions, pepper prices rose simultaneously by 1,600 – 2,000 VND/kg. Specifically, Gia Lai province is trading around 147,600 VND/kg, up by 1,600. The provinces of Ba Ria-Vung Tau and Binh Phuoc recorded prices of 148,000 VND/kg, a 2,000 VND increase. Meanwhile, Dak Lak and Dak Nong maintained the highest price group, reaching 150,000 VND/kg, after a daily increase of 2,000 VND. This is also the highest price in four months, since May 12, when pepper prices surpassed 151,000 VND/kg.

This recovery is attributed to multiple factors. On the one hand, pepper supplies from farmers are limited as the harvest season is nearing its end, while demand from processing and exporting enterprises is picking up again after a stagnant period. Additionally, rising pepper prices in India and Brazil have also contributed to the upward trend in the domestic market.

According to exporting enterprises, orders from Europe and the US have been gradually recovering in recent times after months of stagnation. International freight rates show signs of stabilization, helping Vietnamese pepper maintain its competitive advantage. Notably, many international customers are willing to accept higher prices due to concerns about supply shortages in the last months of the year.

With the current average price of nearly 149,000 VND/kg, many pepper-growing households have started to see better profits compared to the period when prices were below 130,000 VND/kg at the beginning of the year. However, experts caution farmers to be vigilant about the risk of sudden fluctuations, as pepper prices are heavily influenced by global market dynamics and domestic supply and demand factors.

In the short term, the upward price trend is expected to continue as stocks decrease and major export markets show signs of expansion. If international demand remains stable, it is entirely possible for domestic pepper prices to surpass the 150,000 VND/kg mark in the coming days.

The Domestic Consumption Price Surge

The domestic pepper price ranges from VND 143,500 to VND 146,000 per kg, a significant increase of VND 6,000 to VND 8,000 per kg since the beginning of August.

The Great Fuel Flip: Gasoline Discounts and Rising Oil Prices

After three consecutive hikes, fuel prices witnessed a mixed trend during the January 23rd revision. Specifically, gasoline prices saw a marginal decline, with E5RON92 recording a drop of 158 VND per liter and RON95-III falling by 78 VND per liter. Conversely, diesel prices surged, with various types of oil registering significant increases ranging from 404 VND per liter to 571 VND per kg/liter compared to the current base price.

The Soaring Property Prices: Navigating the Challenges

Recently, real estate prices in Hanoi have skyrocketed, particularly in the apartment sector. This trend has not only made the dream of homeownership more elusive for residents but also presented significant challenges for the banking system, where a large portion of collateral assets are real estate-based.

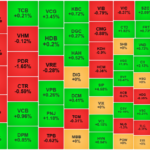

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.