In the first half of 2025, JC&C recorded a slight improvement in revenue, reaching over $10.8 billion, a 1% increase compared to the same period last year. However, their net income took a step back, with only $1.07 billion, a 14% decline. The net profit stood at $371 million, a 23% decrease year-on-year.

According to JC&C, these results came after accounting for non-recurring items totaling $158 million, mainly comprising unrealized losses from the revaluation of long-term investments.

Despite this, their underlying profit (profit excluding abnormal fees) increased by 6%, reaching $529 million. This improvement was due to a favorable forex gain of $33 million, compared to a loss of $28 million in the previous year, on foreign currency loans.

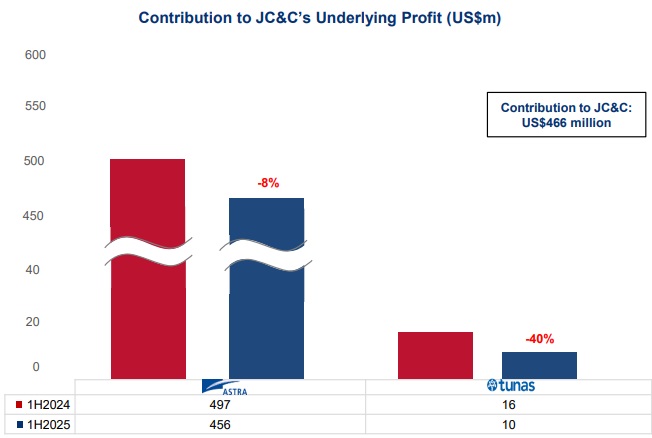

A closer look at their business performance reveals that their key market, Indonesia, contributed $466 million in profit, a 9% decrease. Astra, their golden goose in which the multinational group holds a 50.1% stake, brought in $456 million, an 8% decline. While Astra saw positive results from its financial services, infrastructure, and agriculture businesses, their automotive segment and income from United Tractors, Indonesia’s leading heavy machinery distributor, took a hit.

Source: JC&C

|

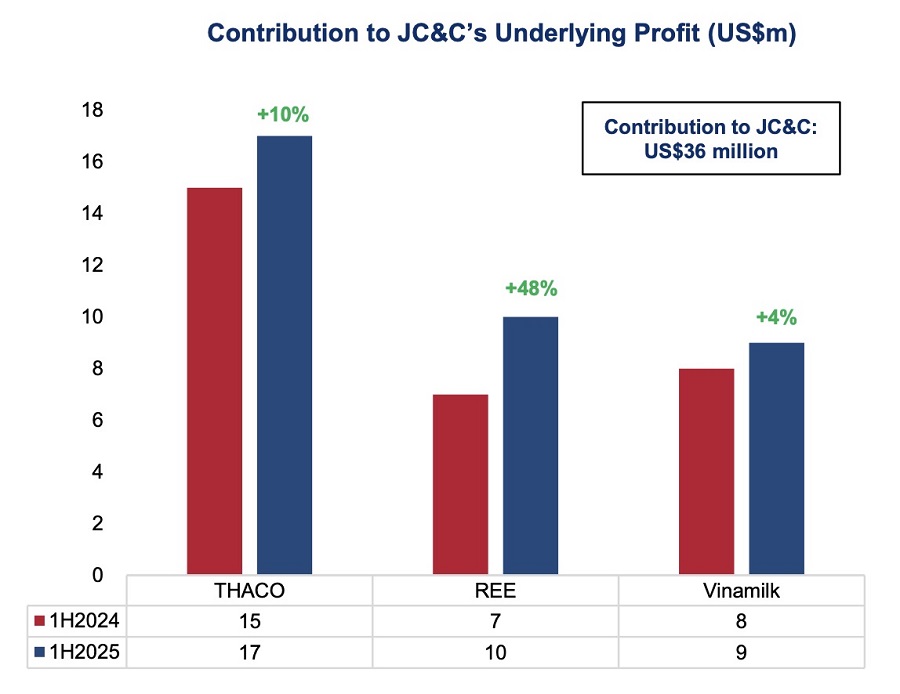

On a brighter note, their Vietnam market shone with a contribution of $36 million, a 17% increase. Investments in Refrigeration Electrical Engineering (REE, 41.6% stake), Vinamilk (VNM, 10.6% stake), and Thaco (THA) all grew, by 48%, 4%, and 10% respectively. Thaco, in particular, benefited from a 12% increase in automotive sales and improved gross profit margins. VNM‘s dividend income and REE‘s hydropower business, along with JC&C’s increased stake, drove their strong performance.

Source: JC&C

|

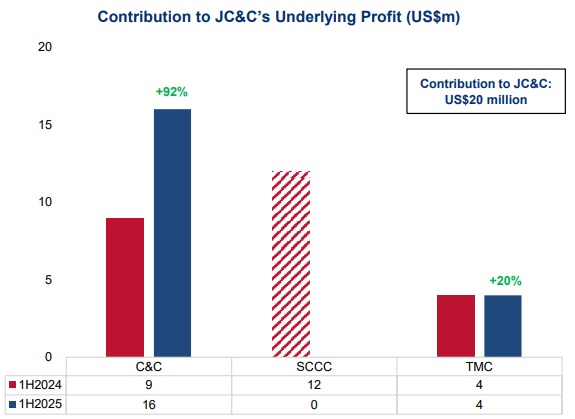

In other regions, JC&C’s investments contributed $20 million, a 16% decrease, mainly due to the absence of income from Siam City Cement, following their divestment in the latter half of 2024. Excluding Siam, profits increased by 71%, largely driven by Cycle & Carriage, which saw a 92% surge.

Source: JC&C

|

Financially, JC&C’s consolidated net cash position (excluding net debt from Astra’s financial services subsidiaries) as of June 2025 was $26 million, a significant improvement from the net debt of $235 million at the end of 2024. This change was primarily due to strong operating cash flow.

Net debt at Astra’s financial services subsidiaries increased from $3.7 billion to $3.9 billion. JC&C’s standalone net debt remained relatively unchanged at $810 million.

JCC is the investment arm of the Jardine Matheson Group in Southeast Asia, with Jardines holding a 76% stake. The name Jardine is not new to Vietnamese investors, as they have been present in the country for over 20 years and have made notable investments, such as their $1 billion purchase of a 10% stake in VNM in 2017 and their interest in REE in 2022.

– 15:53 28/08/2025

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.