“Techcombank Plans Additional Share Issuance”

Techcombank is planning to issue approximately 21.4 million new shares under its Employee Stock Ownership Plan (ESOP), with nearly 6.6 million shares allocated to foreign employees and over 14.8 million shares for Vietnamese employees. This issuance represents a ratio of 0.30275% of the total circulating shares.

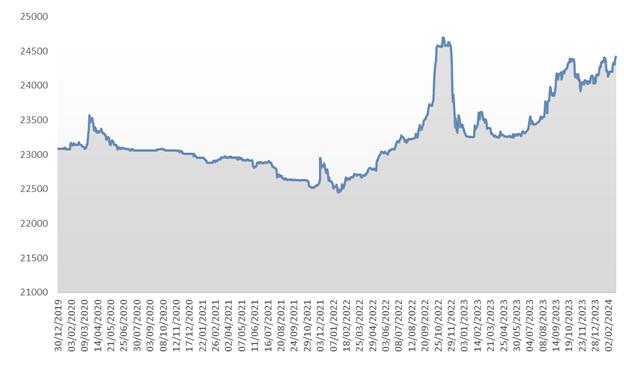

The issuance price is set at VND 10,000 per share, while TCB shares are currently trading at VND 30,850 per share (as of May 20, 2025) – a threefold increase over the planned issuance price.

| TCB Share Price Performance Year-to-Date |

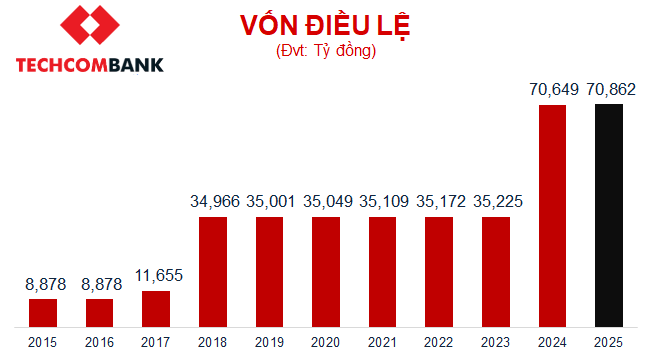

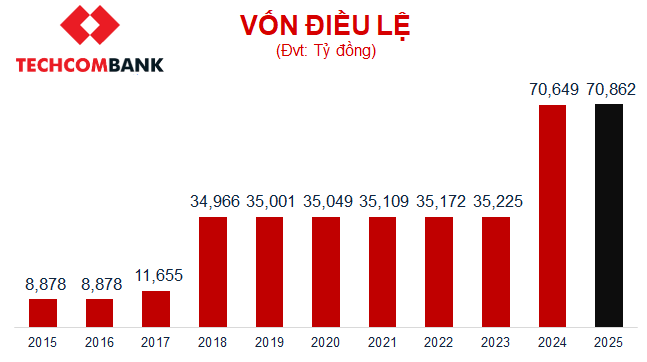

The new ESOP shares will be subject to a one-year lock-up period from the end of the issuance. The total issuance value at par is nearly VND 214 billion, resulting in an increase in charter capital from VND 70,649 billion to VND 70,862 billion.

Source: VietstockFinance

|

The proceeds from the ESOP issuance will be utilized to supplement the bank’s operating capital. According to the bank, the increase in charter capital will enhance their capacity to maintain high capital adequacy ratios and support the growth of long-term capital to meet credit demands.

The issuance is planned for the third or fourth quarter of 2025, following the receipt of a complete set of reporting documents by the State Securities Commission of Vietnam.

– 11:18, May 20, 2025

The Big Bank Deals of 2025: A Roundup

The banking industry is set for a flurry of activity in the remaining months of 2025, with a host of significant deals on the horizon. These include initial public offerings (IPOs), stock listings, and mergers and acquisitions. It promises to be an exciting period for the sector, with opportunities for growth and transformation.

“The Philosophy of Putting Customers First: Techcombank’s Unique Approach to ‘Auto-Wealth’”

“Techcombank’s ‘Auto Wealth’ is making its mark, not just with Techcombank’s own customers but with the entire financial industry.

“Techcombank: Aspiring to be the Leading Comprehensive Financial Group in the Region.”

“Techcombank is undergoing a remarkable transformation, positioning itself to become a leading financial services group. With a comprehensive range of financial products and services on offer, the bank aims to create an integrated ecosystem where customers can access all their financial needs from a single platform. This ambitious endeavor underscores Techcombank’s commitment to delivering unparalleled convenience and an enhanced customer experience.”