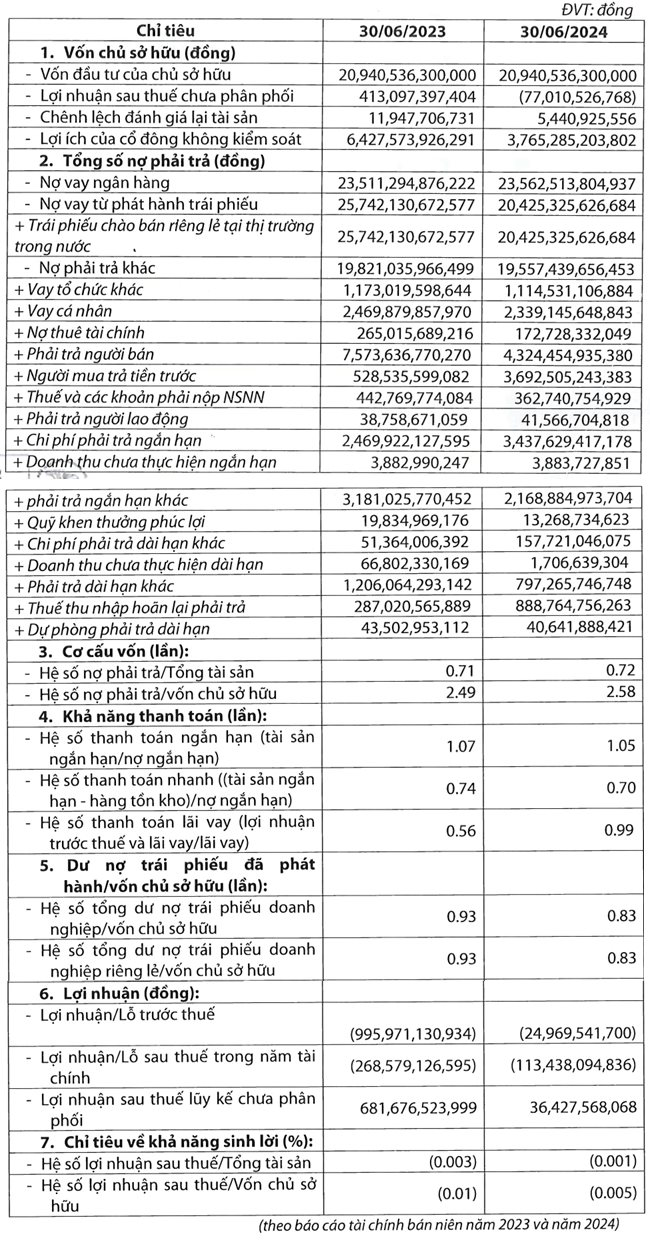

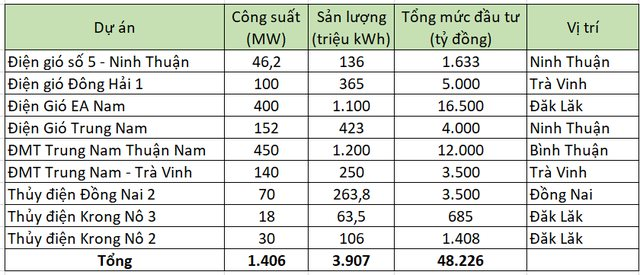

Trung Nam Group, a prominent Vietnamese construction company, has released its financial report for the first half of the year, revealing a pre-tax loss of nearly 25 billion VND. This marks a significant improvement from the previous year’s loss of nearly 996 billion VND during the same period. The company’s tax expenses also showed a notable reduction, with a post-tax loss of over 113 billion VND compared to approximately 269 billion VND in the first half of 2023.

As of Q2 2024, Trung Nam Group’s retained earnings after tax stood at over 36 billion VND. The group’s debt obligations have also witnessed a positive shift. As of June 30, 2024, the debt from bond issuance decreased to over 20.4 trillion VND, reflecting a reduction of more than 5.3 trillion VND compared to the previous quarter. Additionally, the company’s bank loan debt amounted to nearly 23.6 trillion VND, with other liabilities totaling almost 19.6 trillion VND.

Trung Nam Group’s financial report reveals improvements in their tax expenses and debt obligations.

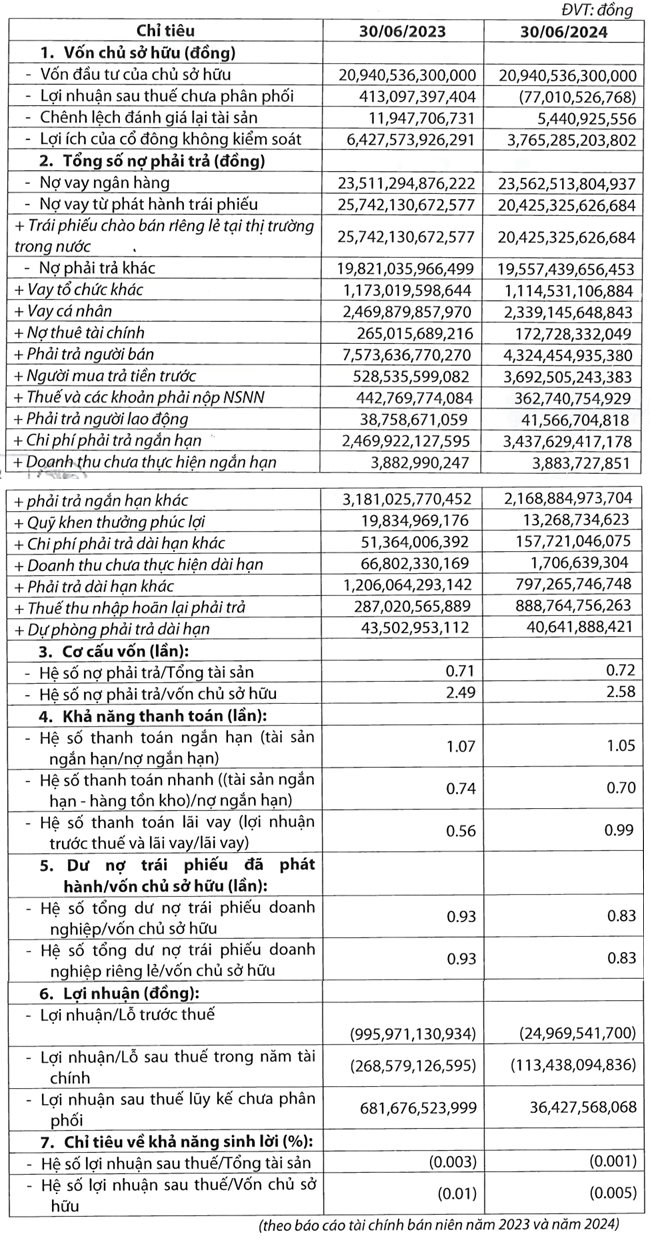

Established in 2004, Trung Nam Group has evolved from its roots in construction to become a diversified conglomerate with a strong presence in five key sectors: energy, infrastructure and construction, real estate, and industrial information electronics. The group’s flagship venture lies in renewable energy, with a portfolio of 9 power projects totaling a designed capacity of 1,406 MW and an impressive production volume of nearly 4 billion kWh. These projects have entailed investments surpassing 48.2 trillion VND, showcasing the group’s commitment to the energy sector.

Trung Nam Group’s diverse business portfolio spans across key sectors, including renewable energy.

In July 2024, Trung Nam Renewable Energy JSC, a subsidiary of Trung Nam Group, concluded a bond-related transaction involving the transfer of 19.9 million shares of Trung Nam Solar Power JSC. The recipients of this transfer included Asia Renewable Energy Investment and Development Co., Ltd. (acquiring 18 million shares) and Mr. Nguyen Thanh Binh (acquiring 1.9 million shares).

Among the recipients of the share transfer in Trung Nam Solar Power JSC is Asia Renewable Energy Investment and Development Co., Ltd., a subsidiary of Asia Industrial Technical Corporation (ACIT). Furthermore, Mr. Nguyen Dang Khoa, who is set to receive 100,000 shares of Trung Nam Solar Power JSC, also holds a position as the Deputy General Director of ACIT, underscoring his affiliation with the company.

ACIT has held a 49% stake in the Trung Nam Solar Power Plant since 2021, while the solar power company boasts a charter capital of 1,000 billion VND. With the additional acquisition of 18 million shares (equivalent to 18% capital) by ACIT’s subsidiary, it is possible that ACIT may gain control of Trung Nam Solar Power JSC, potentially shifting the balance of power away from the Trung Nam Group.

The Ministry of Industry and Trade Meets with Westinghouse Nuclear Technology Group

Unveiling prospects for long-term collaboration in the nuclear energy sector, with a keen focus on propelling nuclear power projects in Vietnam in the upcoming phase, stood as the pivotal agenda on the first day of the second round of negotiations for the Bilateral Reciprocal Trade Agreement between Vietnam and the United States.

“Russian Oil Giant Zarubezhneft Eyes Unprecedented 1,000 MW Offshore Wind Project in Vietnam”

With over four decades of expertise, Zarubezhneft is the strategic partner of choice for the Vietnam Oil and Gas Group (PVN). Together, they embark on a journey to explore and harness the oil and gas potential in both Vietnam’s continental shelf and Russia, marking a significant chapter in the energy sector of these nations.

The Sun-Powered Revolution: Unveiling the CoCo Solar Platform for Easy Access to Solar Power Installation and Financing.

On May 9, 2025, CoCo Solar, the pioneering platform for solar roof installation and financing, proudly debuted with a stellar lineup of strategic partners in attendance. The event marked a significant step forward in Vietnam’s renewable energy landscape, with the presence of leading financial and solar industry giants: VietinBank, BIDV, TPBank, MSB, VPBank, Sacombank, and renowned solar brands such as Sungrow, JA Solar, Trina Solar, Jinko Solar, Huawei, Deye, Solis, and Astronergy.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.