Specifically, KDH plans to privately issue more than 110 million shares to 20 professional securities investors at a price of 27,250 VND/share (a 12% discount compared to the average closing price from January 5 to February 22, 2024). If the issuance is successful, the company will receive 3 trillion VND, while its charter capital will be increased to over 9,094 billion VND.

The purpose of the sale by KDH is to use the proceeds to repay loans at banks as well as contribute more capital to Khang Phuc Investment and Trading Co., Ltd. – the subsidiary with the largest charter capital of KDH.

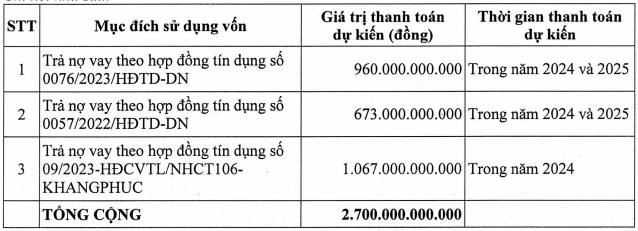

To be specific, KDH plans to use 300 billion VND to repay its loan at OCB Bank, and the remaining 2,700 billion VND to invest in Khang Phuc.

|

Allocation plan of 2,700 billion VND investment in Khang Phuc by KDH

Source: KDH

|

On February 22, the Board of Directors of KDH approved the commitment to guarantee a loan of 4,270 billion VND for Khang Phuc at Vietinbank – Hanoi branch.

As for the buyers, the list of 20 professional securities investors participating in KDH’s offering includes 14 organizations and 6 individuals. Half of the 14 participating organizations are funds under Dragon Capital, other notable organizations include: 2 major shareholders, Tien Loc Investment Company Limited and Vietnam Investment Limited; 2 securities companies, Rong Viet and Vietcap.

|

List of 20 investors participating in the purchase of 110 million shares of KDH

Source: KDH

|

Shares from the issuance will be restricted from transfer for 1 year from the completion date of the offering. The specific implementation time will be decided after approval by the State Securities Commission.

Hà Lễ