Illustrative image

According to preliminary statistics from the Customs Department, footwear exports from Vietnam in July brought in nearly $2.2 billion, up 3.2% from June. In the first seven months of the year, this item brought in more than $14 billion, up 9% over the same period last year.

Footwear is one of Vietnam’s strategic export items, bringing in tens of billions of dollars annually. In the global footwear supply chain, Vietnam ranks third in production with 1.4 billion pairs/year, after China and India; and second in exports with 1.3 billion pairs/year, only after China.

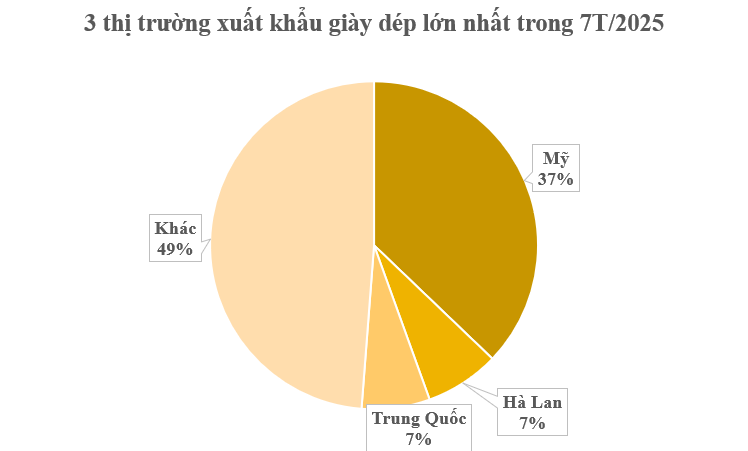

Vietnamese footwear has been exported to more than 150 markets, with the main export markets including the US, the European Union (EU), China, Japan, and the EU.

In terms of market, in the first seven months of the year, the US was the largest customer of Vietnamese footwear, with a turnover of $5.2 billion, up 11% over the same period last year. The Netherlands ranked second with over $1.03 billion, up 13% from 7/2024. China was the third largest export market with over $947 million, however, it decreased by 14% over the same period last year.

For the largest export market, footwear exports to the US have been subject to a 10% tax rate in recent years. Many American footwear brands have a presence in Vietnam. For example, Vietnam is currently the main production center for Nike, an American footwear company. Nike produces about 600 million pairs of shoes annually, of which 50% are made in Vietnam, and 50% of the raw materials for its global supply chain also come from Vietnam.

The strength of Vietnam’s leather and footwear industry lies in its ability to take advantage of preferential tariffs from 16 free trade agreements with many large markets, as well as its abundant labor force, with average labor costs ranging from $181 to $200 per month.

Last year, despite facing pressures such as price reductions, demands for sustainable production, increasing input costs, and labor shortages, the leather and footwear industry still achieved revenue of $26 billion, a growth of about 10% compared to 2023.

In 2025, the footwear industry aims for a 10% export growth compared to 2024, equivalent to a turnover of about $29 billion. According to the “Strategy for the Development of Vietnam’s Textile and Footwear Industries by 2030, with a Vision to 2035”, Vietnam strives to achieve footwear export turnover of $38-39 billion by 2030.

The New Regulations on Financial Mechanisms for Social Insurance, Unemployment Insurance, and Health Insurance

The government has issued Decree No. 233/2025/ND-CP, which outlines the financial mechanisms for social insurance, unemployment insurance, and health insurance. This decree also provides insights into the organizational and operational costs associated with these insurance programs.