The stock market opened on August 27 with a positive momentum, carrying forward the upward trend from the previous session. However, the market witnessed some profit-taking at higher levels, leading to a relatively mixed performance. The VN-Index managed to close in the green, gaining 5.15 points (+0.31%) to end at 1,672.78. However, foreign investors’ net selling pressure weighed on the market, with a notable outflow of VND 4.19 trillion across all markets.

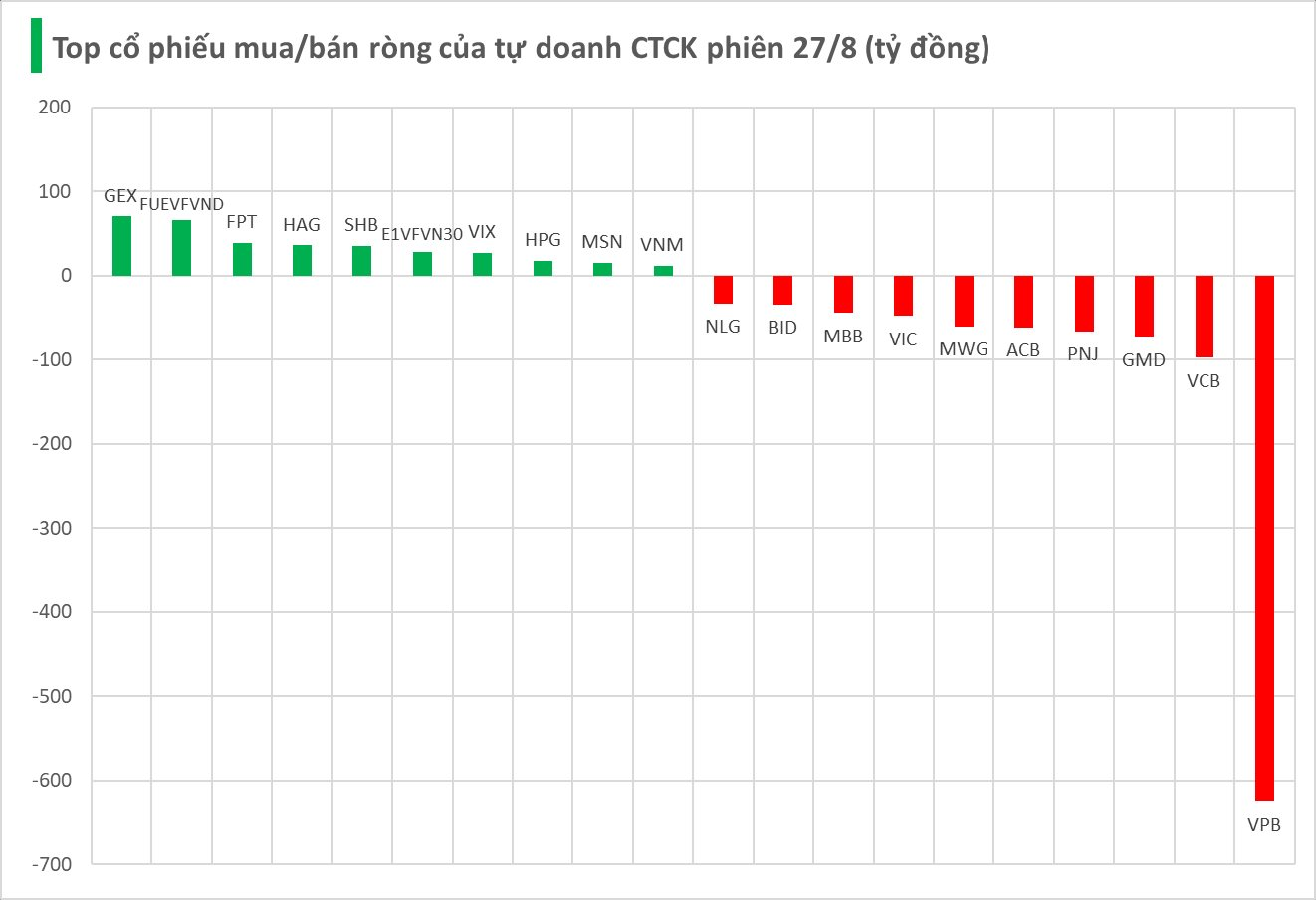

Securities companies’ proprietary trading continued to net sell VND 1,186 billion on the HoSE.

In particular, securities companies offloaded VPB significantly, with a net sell value of VND 626 billion. This was followed by VCB (VND 98 billion), GMD (VND 73 billion), PNJ (VND 66 billion), and ACB (VND 62 billion). Several other stocks also witnessed notable net selling pressure, including MWG (VND 60 billion), VIC (VND 48 billion), MBB (VND 44 billion), BID (VND 34 billion), and NLG (VND 33 billion).

On the buying side, GEX stood out with a net buy value of VND 71 billion. FUEVFVND was the second most bought stock by securities companies’ proprietary trading, with VND 66 billion, followed by FPT (VND 39 billion), HAG (VND 36 billion), SHB (VND 35 billion), E1VFVN30 (VND 29 billion), VIX (VND 27 billion), HPG (VND 19 billion), MSN (VND 15 billion), and VNM (VND 12 billion).

Reviewing the VN-Index 2025 Forecast: VCBS Stands Out With Its Realistic Scenario

VCBS, or Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Corporation, stands out as the sole entity, since late 2024, to forecast the VN-Index reaching 1,555 points in a base scenario and 1,663 points in an optimistic one. This prediction has proven remarkably accurate, closely mirroring the index’s actual performance.

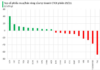

The Stock Code Surges Against All Odds: A Dramatic Rise Amidst a Falling Market

The stock market has been on a downward spiral, but amidst the gloom, a few stocks have emerged as bright spots, surging against the tide and even hitting the upper circuit.