Gemadept Joint Stock Company (Stock symbol: GMD, HoSE exchange) has just announced the Board of Directors’ resolution on issuing shares under the Employee Stock Purchase Plan (ESPP) for outstanding employees in 2024.

Accordingly, Gemadept plans to offer more than 6.3 million shares to outstanding employees in 2024, equivalent to 1.5% of the total outstanding shares of the company.

The shares will be subject to a lock-up period of two years from the end of the offering, with 50% of the shares being released in the third year and the remaining 50% in the fourth year.

Illustrative image

The purpose of the issuance is to ensure the highest benefits and values for all stakeholders, retain and attract high-quality human resources, enhance engagement, and provide strong incentives and motivation for employees to contribute positively towards the excellent completion of the 5-year plan for 2021-2025 (with the company’s pre-tax profit in 2025 tripling compared to 2020); ensuring the sustainable growth and development of the company.

With an issue price of VND 10,000 per share (pricing principle according to the resolution of the 2021 Annual General Meeting of Shareholders on June 30, 2021), Gemadept expects to raise over VND 63 billion, which will be added to the company’s working capital.

The issuance is expected to take place in the third and fourth quarters of 2025, before the implementation of the company’s plan to repurchase its own shares according to the resolution of the 2025 Annual General Meeting of Shareholders.

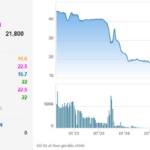

In terms of business results, according to the consolidated financial statements for the second quarter of 2025, Gemadept recorded net revenue of nearly VND 1,497 billion, up 26.7% over the same period last year. After deducting taxes and expenses, the company reported a net profit of over VND 581.5 billion, an increase of 39.1%.

For the first six months of 2025, Gemadept achieved net revenue of over VND 2,773.9 billion, up 28.6% compared to the first six months of 2024; profit after tax was over VND 1,109.2 billion, a slight increase of VND 8.1 billion.

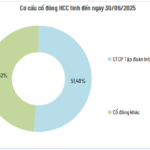

As of June 30, 2025, the company’s total assets increased by 6.6% compared to the beginning of the year, reaching over VND 19,184 billion. Of this, cash and cash equivalents were nearly VND 3,753.8 billion, accounting for 19.6% of total assets, and long-term financial investments were nearly VND 4,358 billion, accounting for 22.7% of total assets.

On the liability side of the balance sheet, total liabilities stood at nearly VND 5,425.1 billion, up 28.4% from the beginning of the year. Of this, loans and finance leases amounted to over VND 2,180.3 billion, accounting for 40.2% of total liabilities.

The Company’s Move: A Tale of Market Manipulation by its Former Leadership

“Lam Dong Pharmaceutical Joint Stock Company is set to offer almost 14 million shares to three investors, including the Dynamic Vision Investment Fund, HD Fund Management Joint Stock Company, and APC Holdings Joint Stock Company, to raise VND 150 billion. This company was once led by Mr. Do Thanh Nhan, who was arrested for ‘Manipulating the securities market’.”

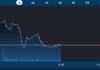

“BWE Exits Subsidiary with a Whopping VND 166.4 Billion Gain”

Recently, BWE finalized the acquisition of a 52% stake in Construction and Electrical Installation Biwase. The deal was valued at VND 166.4 billion.