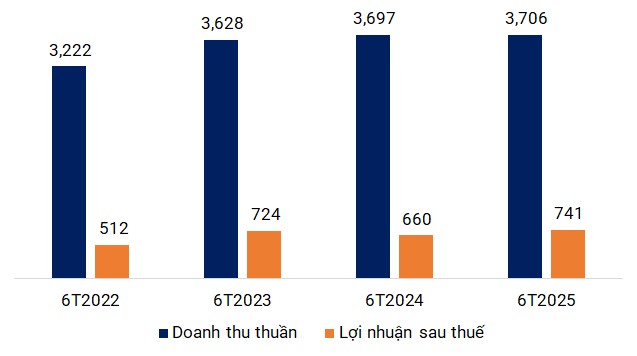

Sawaco’s consolidated interim financial statements show a slight improvement in revenue, reaching 3.7 trillion VND. The water business remains the primary contributor, with a near-static performance of 3.6 trillion VND. However, customer service revenue (relocation, main pipes, compensation, etc.) surged to 74 billion VND, up from 53 billion VND in the previous period. Additionally, the sale of supplies and goods skyrocketed to 9 billion VND, almost quadrupling.

A reduction in cost of goods sold led to an enhanced gross profit of 2.48 trillion VND. Within the expense structure, financial expenses decreased by more than half to 47 billion VND due to lower interest rates. Selling expenses remained stable at around 1.04 trillion VND. Conversely, management expenses increased by 10%, totaling 516 billion VND.

As a result, pre-tax profit reached 900 billion VND, a 14% increase year-over-year. After-tax profit exceeded 740 billion VND, reflecting a 12% growth.

|

Sawaco’s revenue and profit have remained stable in recent years

Source: Author’s compilation

|

As of the end of June 2025, Sawaco’s total assets were approximately 14.7 trillion VND, unchanged from the beginning of the year. Short-term assets increased to 4.8 trillion VND due to a rise in cash and cash equivalents from 843 billion to 1.2 trillion VND, along with a surge in short-term receivables to 648 billion VND. In contrast, fixed-term savings deposits decreased by 384 billion VND, settling at over 1.9 trillion VND.

On the liabilities side, total liabilities decreased to 5.15 trillion VND, mainly due to a reduction in short-term debt from 2.7 trillion to 2.3 trillion VND. The company’s long-term liabilities slightly increased to 2.9 trillion VND, primarily comprising loans. Shareholders’ equity reached 9.5 trillion VND, an increase of nearly 600 billion VND from the beginning of the year.

During the six-month period, Sawaco’s salary fund exceeded 566 billion VND, a nearly 10% increase year-over-year, with a stable headcount of around 4,100 employees. On average, each employee earned approximately 23 million VND per month, up from 20.8 million in the previous year.

As a 100% state-owned enterprise, Sawaco operates as a parent-subsidiary structure, managing and developing the water supply system and producing and distributing clean water for domestic and industrial use. The company also offers a range of related services. It is the parent company of several listed water sector companies, including CLW, NBW, BTW, GDW, TDW, and PJS.

The provision of clean water accounts for over 90% of Sawaco’s revenue and is solely focused on Ho Chi Minh City.

– 13:32 29/08/2025

The JC&C Tycoons “Stumble” Through the First Half of 2025: A Tale of Two Halves.

In the first half of 2025, Jardine Cycle & Carriage (JC&C) reported a net profit of $371 billion, a 23% decrease compared to the same period last year. Despite this, the underlying profit increased by 6%, attributed to strong performances from its three invested businesses in Vietnam and favorable foreign exchange gains.

A Real Estate Company is About to “Return” Dividends to its Shareholders

September 8th is the last day for shareholders to register for D11’s 2021 dividend payout, offering a generous 12% stock dividend.

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.