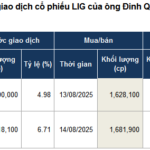

Major shareholder Nguyen Thi Tuyet Nhung has sold her entire stake of nearly 4.8 million shares, or 12.44% of HSL, between August 25 and 28. Following this transaction, Ms. Nhung no longer holds any shares in HSL.

|

During Ms. Nhung’s divestment, HSL recorded nearly 6.7 million shares traded via put-through transactions at an average price of VND 13,639 per share. Based on this price, Ms. Nhung could have earned at least VND 65 billion.

HSL shares surged to the daily limit of VND 14,750 per share on August 29, with more than 1.4 million shares matched, and a buying queue of nearly 1.2 million shares at the ceiling price. This marked the second consecutive session of upward limit-up moves.

Notably, since the end of July 2025, HSL shares have skyrocketed from VND 6,000 per share to nearly VND 15,000 per share, representing a staggering 146% increase in just over a month, and a remarkable 275% surge within three months, reaching their highest level since the company’s listing in 2018.

| HSL shares soar over 222% in one year |

Leadership Changes

Ms. Nguyen Thi Tuyet Nhung previously served as Chairman of the Board of HSL for the 2021-2026 term. She stepped down as Chairman in January 2023 but remained on the Board as a non-executive member. On August 15, 2025, an extraordinary general meeting of shareholders approved the dismissal of Ms. Nhung and two other members.

The three newly elected members are Mr. Pham Van Luan (General Director and Authorized Representative), Mr. Ho Cong Danh, and Mr. Kunwar Pramond Singh (an Indian national). None of them currently hold any shares in HSL.

Business Expansion and Restructuring Plans

At the recent extraordinary general meeting, HSL shareholders approved the addition of real estate business activities, including buying and selling houses, land use rights, and consulting, brokerage, and auction services. The company also plans to relocate its head office from its current location in Hanoi.

With the leadership changes, the exit of the largest shareholder, and the expansion into real estate, HSL is likely to undergo a restructuring phase or a change in ownership.

Declining Business Performance

HSL is known for its operations in the agricultural produce and animal feed manufacturing and trading sectors. In the first half of 2025, the company’s revenue reached nearly VND 36 billion, a 67% decrease compared to the same period last year. Net profit stood at over VND 883 million, an 82% decline, and the lowest in the semi-annual cycle. This was mainly due to financial provisions made at the company’s subsidiary.

In terms of revenue breakdown, goods sales accounted for more than 88%, electricity contributed nearly 11%, while the real estate leasing segment brought in only VND 368 million, or 0.01%.

| HSL’s Semi-Annual Financial Results over the Years |

– 15:00 29/08/2025

“HDCapital Slashes Ownership in Petrosetco to Below 14%”

HDCapital has recently offloaded 754,800 PET shares, reducing their ownership stake in Petrosetco from 14.27% to 13.56%.

“Lucrative Week for Investors: A Company Dishes Out a Whopping 60% Cash Dividend”

Introducing the top 17 dividend-paying companies: experience an extraordinary range of cash dividends, from a substantial 60% to a modest 1%.