On August 28, the Lam Dong Provincial People’s Council of the 10th term, for the 2021-2026 tenure, held its 3rd meeting (a specialized session) in a hybrid format, connecting three main centers in Da Lat, Phan Thiet, and Gia Nghia to 111 communal-level endpoints and Phu Quy special district.

Mr. Tran Hong Thai, Deputy Secretary of the Provincial Party Committee and Chairman of the Lam Dong Provincial People’s Council, stated: “The province’s socio-economic situation in the first eight months remains positive, with stable agriculture, controlled plant and animal diseases, sustained industrial development, and an export turnover of 2.1 billion USD.”

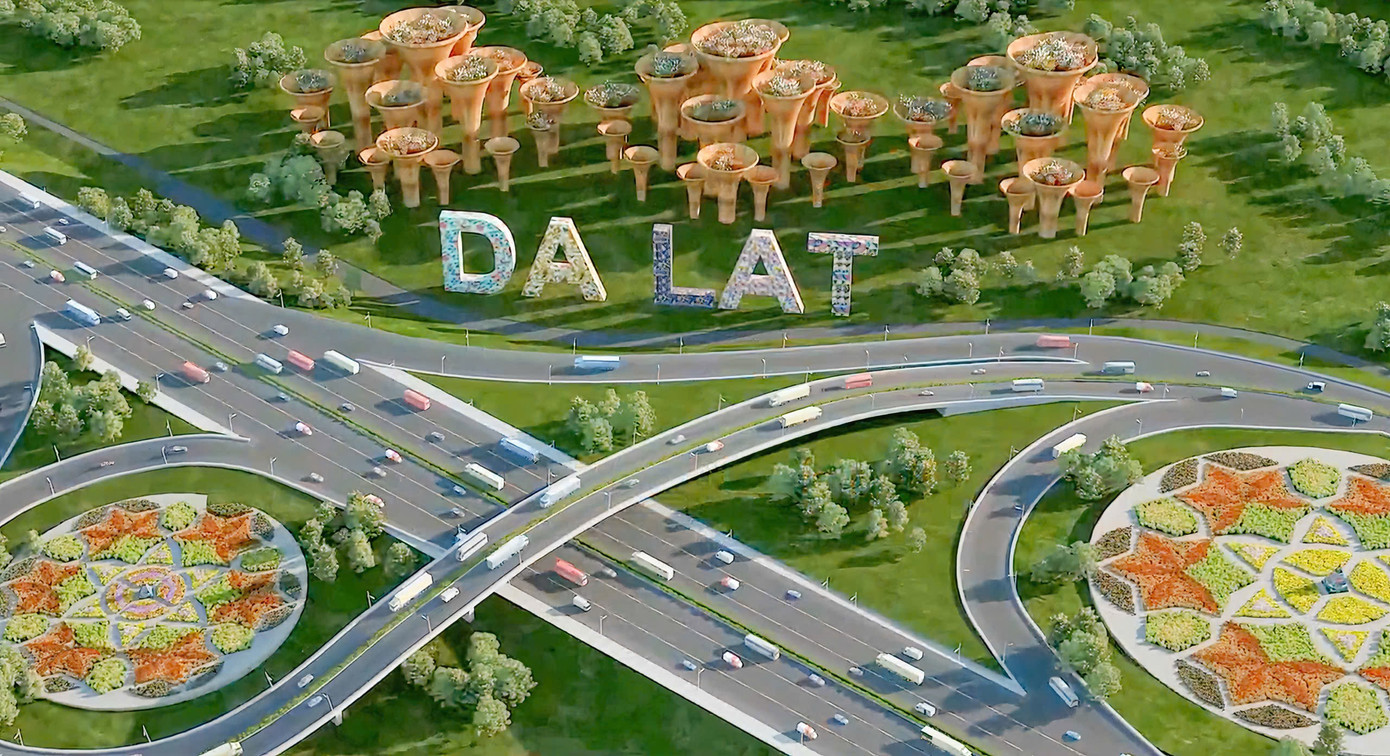

A bird’s-eye view of the Bao Loc – Lien Khuong Expressway.

However, the disbursement of public investment capital in the province remains low, reaching only 33.7% of the plan. Many large-scale projects are hampered by site clearance issues, including the Bao Loc – Lien Khuong Expressway, which has been inaugurated but not physically constructed yet. Additionally, natural disasters, traffic accidents, and the livelihoods of people in remote areas continue to pose challenges. During this session, the People’s Council passed 14 resolutions with a 100% approval rate.

Addressing these challenges, the Chairman of the Lam Dong Provincial People’s Council requested that the People’s Committee and relevant sectors immediately implement the resolutions, facilitate the removal of obstacles for non-budgetary projects, and expedite the reorganization process of project management units to promptly access the public investment plan during the administrative unit rearrangement period.

He also emphasized the need for investment promotion and proper handling of assets during the apparatus reorganization, in accordance with regulations, to prevent waste and loss. At the same time, he stressed the importance of ensuring full entitlements and benefits for officials, public employees, and civil servants during the apparatus streamlining process.

The Bao Loc – Lien Khuong Expressway, with a length of over 73km, passes through Bao Lam, Di Linh, and Duc Trong districts and the former Bao Loc city (Lam Dong province). The project, with a total investment of nearly VND 18,000 billion under the Public-Private Partnership format, was inaugurated on June 29, 2025.

The New Face of Ho Chi Minh City: Unveiling the Transformative Impact of Key Infrastructure Projects

Get ready, Ho Chi Minh City, for a transportation revolution! From now until the end of 2025, the city will witness the simultaneous rollout of multiple key traffic projects. It’s all hands on deck as we work to enhance connectivity and ease the flow of this bustling metropolis. Stay tuned as we transform the way you move!

Over 3,000 Former Thai Binh Officials Receive Monthly Support of 3 Million VND Each as They Relocate to Hung Yen

The Hung Yen Provincial People’s Committee has approved a resolution to provide financial support to over 3,000 civil servants from the former Thai Binh province as they transition to working in the new Hung Yen administrative center. Each civil servant will receive a substantial monthly allowance of 3 million VND for a period of 12 months to facilitate their relocation and ensure a smooth transition to their new workplace.

“Northern Mountainous Provinces Aim for Ambitious Growth: Targeting a Surge Beyond 8%”

On August 24, Deputy Prime Minister Bui Thanh Son met with the leaders of five provinces: Tuyen Quang, Thai Nguyen, Lang Son, Cao Bang, and Phu Tho. The discussion focused on devising strategies to boost production, expedite public investment disbursement, and refine a two-tier government model.