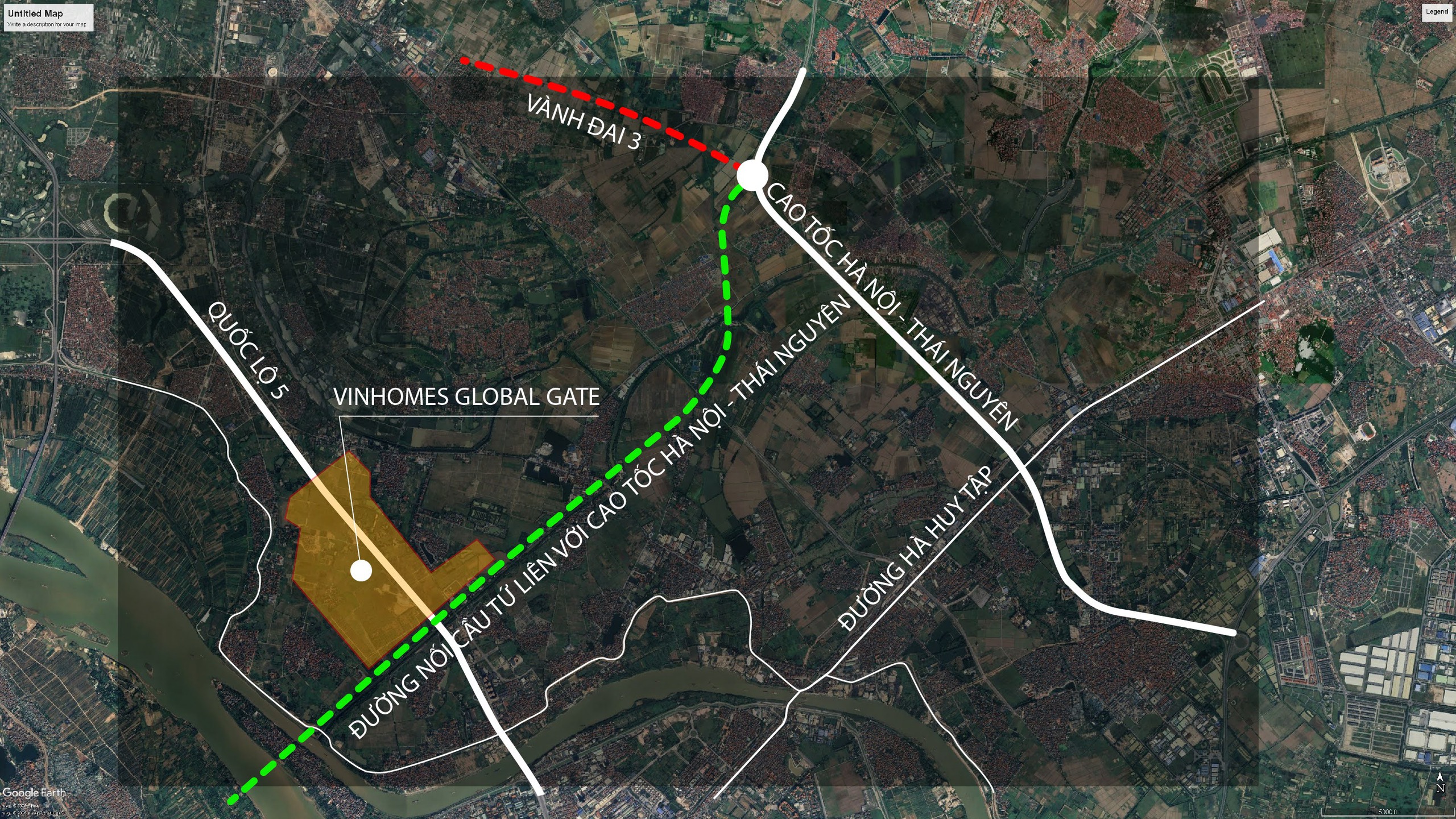

In April, Hanoi approved the investment policy for the construction of a road connecting the Tu Lien Bridge approach road to Truong Sa Street and the Hanoi-Thai Nguyen Expressway. The project has a total investment of nearly VND 5,100 billion.

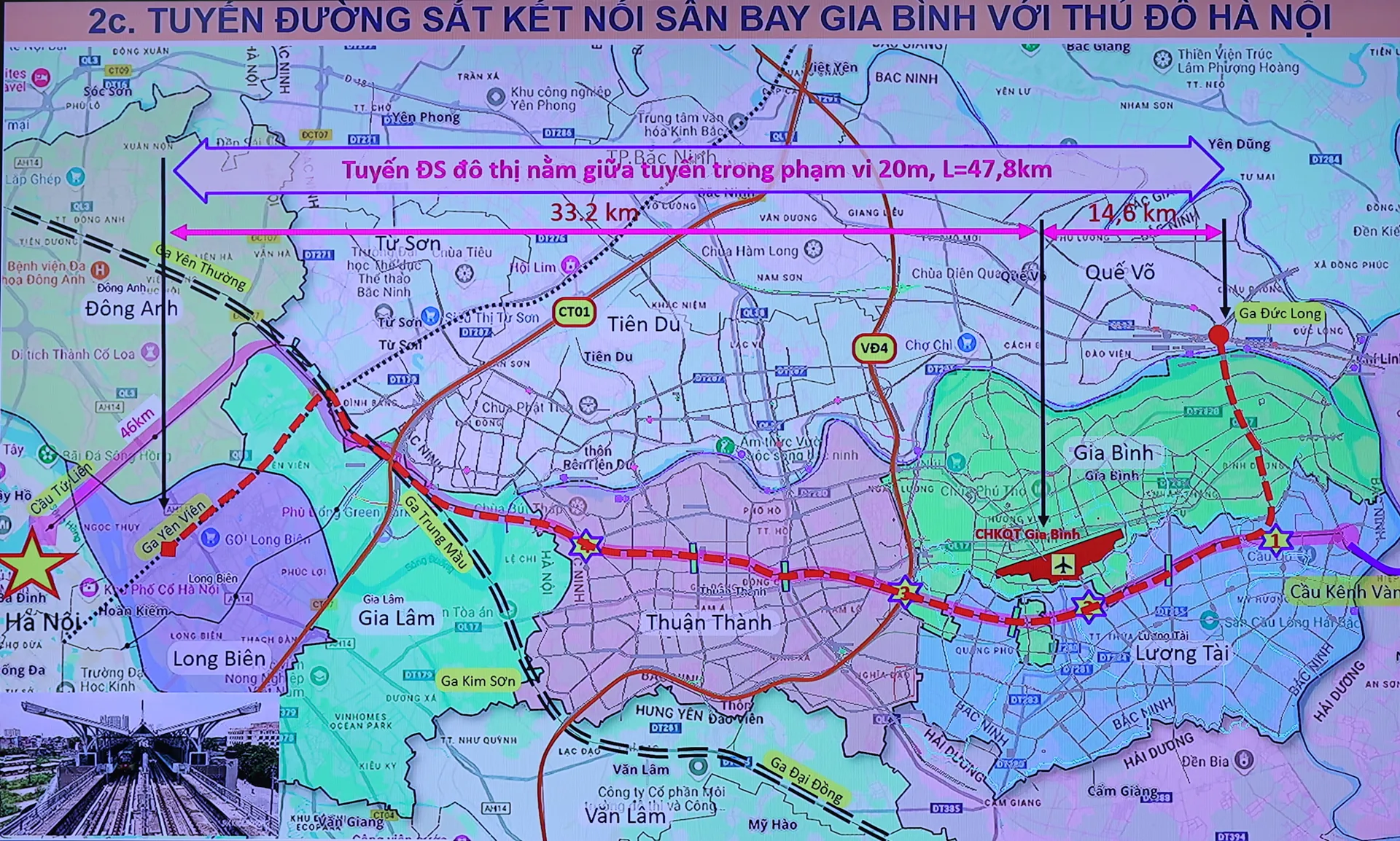

This project plays a crucial role as its endpoint marks the starting point of the road connecting Gia Binh Airport (the largest airport in the North) to the capital city of Hanoi. This “super road” spans over 35 km, with a width of 120 m and a total investment of more than VND 71,000 billion.

Upon completion, the Vinhomes Global Gate (Vinhomes Co Loa) mega-urban area will greatly benefit from its proximity to the project. In the future, residents will be able to easily connect to the center of Hanoi via the Tu Lien Bridge and also have a direct route to Gia Binh Airport through these expansive roads.

The road connecting the Tu Lien Bridge and the Hanoi-Thai Nguyen Expressway starts at the intersection with Truong Sa Street, right next to the National Convention Center.

From there, the road will run along the Ngu Huyen Khe River.

Most of this connecting road will pass through agricultural land, facilitating site clearance and project implementation.

Only a short section of the road connecting the Tu Lien Bridge to the Hanoi-Thai Nguyen Expressway passes through residential areas, close to Duc Tu Street.

It will then connect to the Hanoi-Thai Nguyen Expressway, which will serve as the starting point for the road to Gia Binh Airport. The existing cross-section of this road is 35 m wide and will be expanded to 120 m.

The road connecting the Tu Lien Bridge and the Hanoi-Thai Nguyen Expressway is nearly 5.7 km long and 60 m wide, equivalent to the width of the Tu Lien Bridge approach road.

It is expected that construction on this road will commence by the end of this year and be completed by April 30, 2027, coinciding with the completion of the Tu Lien Bridge and its approach roads. The photo depicts the construction site of the Tu Lien Bridge.

Unveiling a New Era in Hanoi’s Real Estate: Northeast Evolution

The real estate landscape of Hanoi’s northeastern region is undergoing a remarkable transformation, emerging as the new focal point in this new era. This metamorphosis is propelled by the region’s infrastructural advancements, which are poised to redefine the area’s future. As the country celebrates its 80-year journey, this region mirrors the nation’s historical progress, offering a vibrant and promising outlook.

The Current State of the Tu Lien Bridge Project: A $850 Million Endeavor, Two Months On.

“After over two months of construction on the Tu Lien Bridge project in Hanoi, contractors and construction units are ramping up their efforts. They are mobilizing resources and machinery to initiate critical components such as beams and pile drilling. With a sense of urgency, they aim to meet the project deadlines and ensure a seamless construction process.”

The Newest Development: Ministry of Public Security’s First Airport Project Worth Nearly 900 Billion in Vietnam’s Smallest Yet Top-Rich Province

The Ministry of Public Security is committed to meticulously preparing for the groundbreaking ceremony of the first airport project worth nearly VND 900 billion. This significant infrastructure development endeavor underscores the Ministry’s dedication to ensuring a meticulous and well-organized commencement.