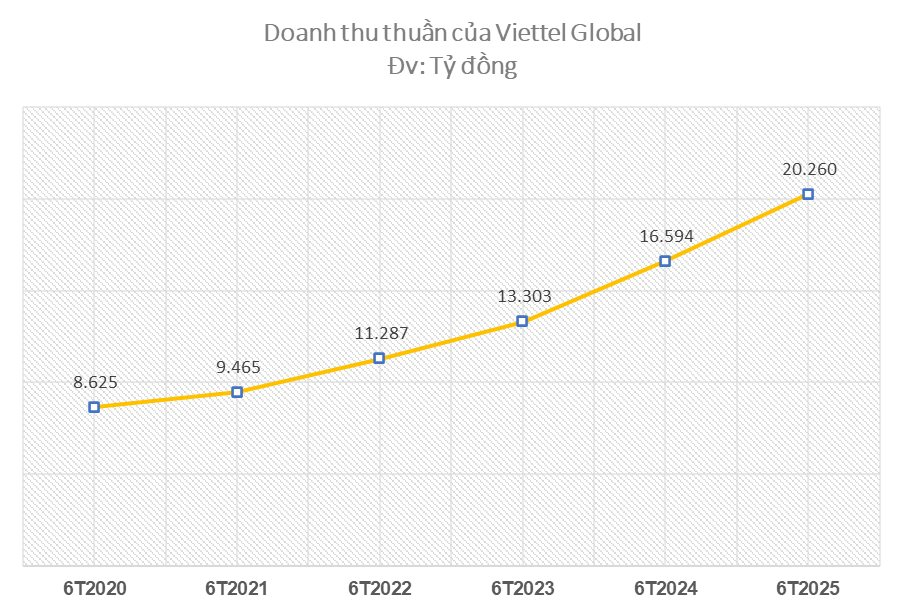

For the first half of 2025, consolidated post-tax profit reached VND 3,267 billion, a 14% increase compared to the same period last year. Viettel Global’s consolidated net revenue surpassed VND 20,260 billion, a 22% rise from 2024, nearly five times higher than the global telecommunications growth rate (4.7% as per GSMA). Notably, all of Viettel Global’s markets witnessed robust revenue growth, with standout performances from Lumitel in Burundi (+42%), Halotel in Tanzania (+30%), and Natcom in Haiti (+28%).

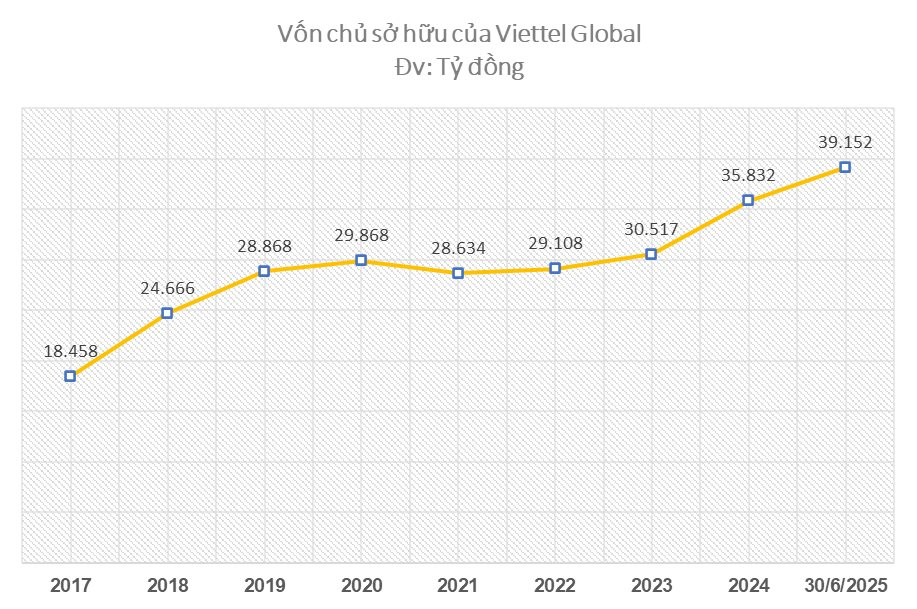

In terms of financial structure, Viettel Global’s equity has reached VND 39,152 billion, an increase of over VND 3,300 billion compared to the beginning of the year.

Alongside traditional telecommunications, Viettel Global’s market companies have consistently demonstrated their leadership in technology within their respective investment markets, starting with 3G, swiftly advancing to 4G, and now pioneering 5G services.

August 2025 marked a significant milestone as Telemor, the Viettel brand in Timor-Leste, officially launched its 5G services. Speaking at the event, Prime Minister Kay Rala Xanana Gusmão affirmed, “Telemor’s innovations have been making the lives of Timor-Leste’s people more convenient and connected. After 13 years of presence, Telemor is now opening a new future for Timor-Leste with 5G technology.”

The project in Timor-Leste has proven the success of Viettel’s international investment strategy, with a remarkable 215% return on investment. Currently, Viettel Global has officially rolled out 5G services in three markets: Laos, Peru, and Timor-Leste.

In addition to strong financial performance, Viettel Global and its market companies have excelled on the international stage, winning 23 prestigious awards in the first half of 2025 alone. These accolades recognize their achievements in business strategy, digital transformation, and corporate social responsibility initiatives.

The Billion-Dollar Bank: A Financial Powerhouse Emerges

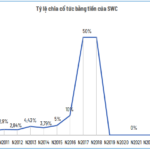

“With its recent stock issuance to shareholders, this bank has successfully raised its charter capital to over VND 26,630 billion. This significant milestone positions the bank as the 14th listed bank in the stock market with a charter capital of over $1 billion.”

Agribank: A Leading Contributor to Vietnam’s National Budget for Sustainable Development

Let me know if you would like me to make any adjustments or provide additional content related to this topic.

As a leading force in the financial market, the Vietnam Bank for Agriculture and Rural Development (Agribank) has not only solidified its position as a top contributor to the national budget but has also played a pivotal role in fostering economic and social development, particularly in the “Three Agricultures” – agriculture, rural areas, and farmers.

What is the Outstanding Bond Debt of the Aqua City Project Investor?

With a successful redemption of VND 502 billion in bonds (code TPACH2025004) on July 1st, the developer of Aqua City still has VND 1,600 billion in outstanding bond debt.