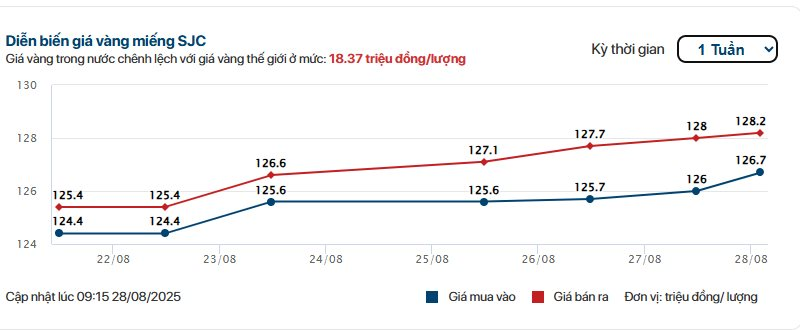

The domestic gold bar and gold jewelry prices witnessed a consecutive surge over the past week, with SJC gold jewelry and bars both increasing by approximately VND 200,000 per tael compared to the previous session’s close.

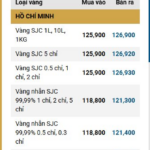

At the time of the survey, gold jewelry was quoted at: Bao Tin Minh Chau 120.2 – 123.2 million VND/tael (buy-sell); PNJ 119.9 – 122.6 million VND/tael; SJC 120.1 – 122.6 million VND/tael; DOJI 112.2 – 113 million VND/tael; and Mi Hong 121.2 – 122.7 million per tael.

Gold bar prices at major enterprises such as Bao Tin Minh Chau, PNJ, DOJI, and SJC commonly ranged from VND 126.7 to VND 128.2 million per tael, while Mi Hong quoted its prices at VND 127 – VND 128 million per tael.

Gold bar price movement over the past week. (Source: Cafef)

The domestic gold bar and gold jewelry prices have been on a constant upward trajectory for over a week. Recently, the government issued Decree No. 232/2025/ND-CP, amending and supplementing several articles of Decree No. 24/2012/ND-CP on gold business management.

Consequently, the new decree officially abolishes Clause 3, Article 4 of Decree 24, eliminating the state monopoly on gold bar production and the import and export of gold materials for gold bar production.

Experts evaluated that opening up this mechanism would contribute to increasing the supply, curbing the “buy gold at all costs” mentality, narrowing the price gap between the domestic and global markets, and cooling down the market.

However, the actual situation indicates that domestic gold prices show no signs of halting their upward trend as of now.

At the time of the survey, international gold prices stood at $3,384 per ounce, marking an $11 decrease compared to the previous session’s close.

According to experts from Kitco News, gold prices once again challenged the crucial resistance level of around $3,400 per ounce and might have further upside potential due to mounting inflationary pressures. This assessment comes as investors’ confidence in the US dollar continues to wane, as stated by a fund management company.

In their monthly market report, analysts at Schroders maintained their optimistic outlook on gold. This positive view was expressed as Schroders downgraded equities to a neutral rating, citing investors’ underestimation of risks in the market, “especially on the inflation and growth front.”

“We remain positive on gold as a portfolio diversifier amid shifting policies, fragile fiscal positions, and growing uncertainty about the long-term role of US government bonds and the US dollar. Gold still serves as a ‘portfolio insurance,'”

the report stated. “We continue to view the probability of a US economic recession in the medium term as low. However, with the market pricing in an almost perfect macroeconomic picture, stable growth, and controlled inflation, this environment is becoming increasingly vulnerable to ‘shocks’ in the coming months.”

Specifically addressing gold price movements, Jim Luke, Fund Manager for Metals at Schroders, highlighted the impressive accumulation around the $3,300 per ounce level.

He mentioned that gold faced several challenges in the second quarter. Initially, the US economy appeared to withstand the impact of higher tariffs and a shifting labor market due to immigration policy changes. However, market sentiment took a sharp turn after the disappointing employment data for July, along with significant downward adjustments for May and June figures.

The big question now, according to Mr. Luke, is how much “bad news” has been priced into gold, which has already rallied nearly 30% since the start of the year. Despite investment demand surging the fastest in the first half since 2020, he believes there is still significant room for growth in the second half.

“Quarterly investment demand is still within the post-2010 range. In the long-term argument, we believe there will be significant increases, surpassing previous historical peaks in total gold holdings during this cycle,” Mr. Luke stated.

He further emphasized that demand from the West, particularly North America and Europe, would gradually catch up with the record-high levels seen in Asia.

“The contrast between East and West is very clear. US and European ETF inflows have been relatively muted compared to previous cycles, while most of the global ETF growth this year came from China in April,” Mr. Luke said. “We are still far from a global gold-buying wave, which we believe will emerge sooner rather than later.”

The Golden Opportunity: Unveiling the Latest Proposition on Gold Bullion

“We propose the integration of QR code technology into the packaging and sealing of gold bars. This innovative approach will revolutionize the management and tracking of these valuable assets, offering unparalleled convenience and security. With a simple scan, authorized personnel will have instant access to crucial information, enhancing efficiency and transparency in the industry.”