Illustrative Image

According to statistics from the Vietnam Pepper and Spice Association (VPSA), in July 2025, Vietnam imported 3,176 tons of various peppers, with a turnover of 21.3 million USD. Of this, black pepper accounted for 2,887 tons and white pepper reached 289 tons. Compared to June, import volume and value decreased by 47.8% and 43.8%, respectively.

Despite the decline in July, in the first seven months of 2025, Vietnam imported a total of 31,472 tons of pepper, with a turnover of 195.4 million USD. Black pepper accounted for 26,424 tons, while white pepper reached 5,048 tons. Compared to the same period in 2024, import volume and value increased by 58.5% and a significant 143.4%, respectively.

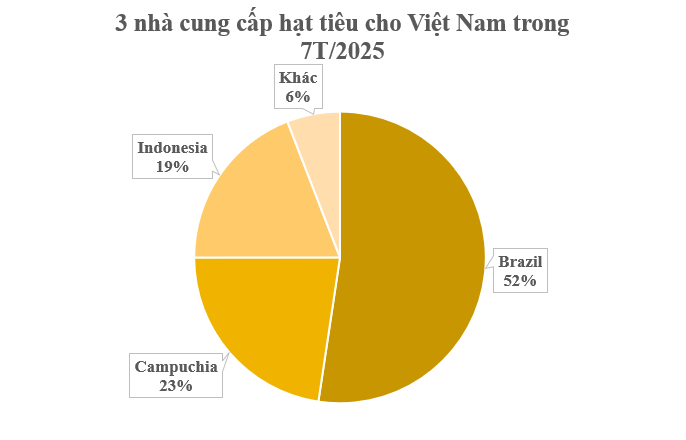

Brazil remained the largest supplier to Vietnam, providing 16,482 tons, a surge of 125.1% from the same period, accounting for 52.4% of total imports. Cambodia ranked second with 7,121 tons (up 9.8%), followed by Indonesia with 6,020 tons (up 43%).

Despite being one of the world’s largest pepper producers and exporters, Vietnam still imports tens of thousands of tons of pepper annually. This is because pepper prices in some countries, such as Brazil and Cambodia, are often lower than the domestic market due to larger supply and lower production costs. Vietnamese enterprises import cheaper pepper for processing and export, thereby increasing profit margins. This helps businesses reduce input cost pressure, especially in the context of volatile domestic prices due to seasonal fluctuations.

After reaching a record high of 290,000 tons in 2019, Vietnam’s pepper production has declined year after year. In 2023, production reached 190,000 tons, an increase of over 3.8% compared to 183,000 tons in 2022. Vietnam’s pepper output in 2024 is estimated at 170,000 tons, which could be the lowest level in the past decade since 2015. This reflects the reality that pepper is no longer a key crop for many farmers, especially as the economic value of other crops such as durian, coffee, and oil palm has increased significantly. In addition, climate change and extreme weather events have reduced yields and increased the cost of maintaining pepper production.

The area under pepper cultivation in Vietnam was over 131,800 ha in 2020, mainly in the Southeast and Central Highlands regions, accounting for more than 95% of the total area. However, by 2023, this area had decreased to about 115,000 ha due to unstable pepper prices and diseases.

Vietnam is now a major pepper processing center with many factories meeting international standards. Some FDI enterprises, such as Olam and Nedspice, own global supply chains and have set up factories in Vietnam to take advantage of low labor costs and favorable logistics infrastructure. These companies can import raw pepper from multiple countries, process it in Vietnam, and then export it globally.

Global pepper prices in 2025 are expected to remain high due to declining supply, while demand in major markets such as the US and Europe remains stable. The demand for pepper in the food and spice processing industries continues to be the main driver of the market.

Vietnamese Pepper Exports Reach the Billion-Dollar Mark

While global pepper prices plummeted, Vietnam’s “black gold” continued its upward trajectory. With favorable export prices, Vietnamese pepper has hit the remarkable milestone of reaching a billion dollars in value.