Closing session on August 27, SHB’s stock price stood at VND 17,650 per share, a further 1.4% increase after the previous session’s upper limit gain, ranking among the best-recovered stocks following the market-wide correction. Liquidity exceeded 100 million units, leading the market.

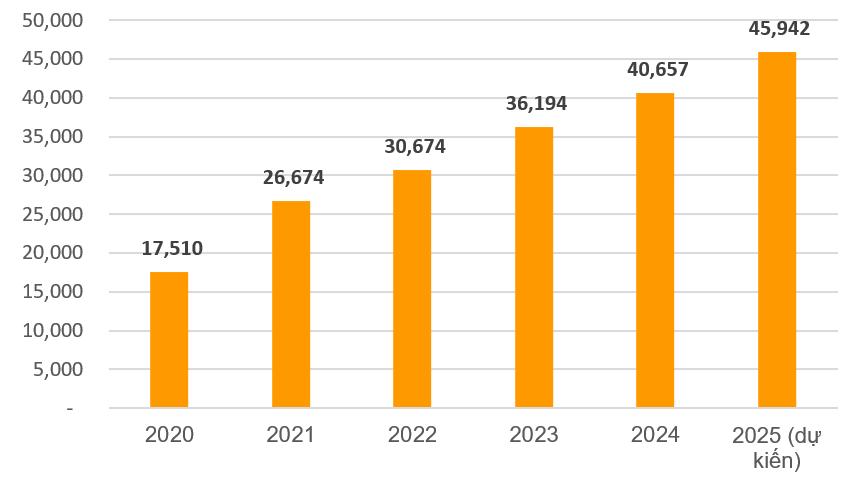

Recently, SHB has finalized the list of shareholders to receive a 13% stock dividend for the second time on August 19. Accordingly, the bank issued over 528.5 million shares, increasing its charter capital to VND 45,942 billion, maintaining its position in the Top 5 largest private joint-stock commercial banks in Vietnam. Earlier, SHB completed the first cash dividend payment of 5%, bringing the total dividend ratio for 2024 to 18%.

SHB’s Charter Capital Growth (in VND billion)

Firm Commitment to Sustainable Growth

In the first half of 2025, SHB recorded a pre-tax profit of VND 8,913 billion, up 30% year-on-year and equivalent to 61% of the 2025 plan. The cost-to-income ratio (CIR) was impressively maintained at 16.4% – the lowest in the industry. Operational efficiency continued to improve markedly. SHB’s labor productivity led the industry, with an average pre-tax profit of VND 1.3 billion per employee.

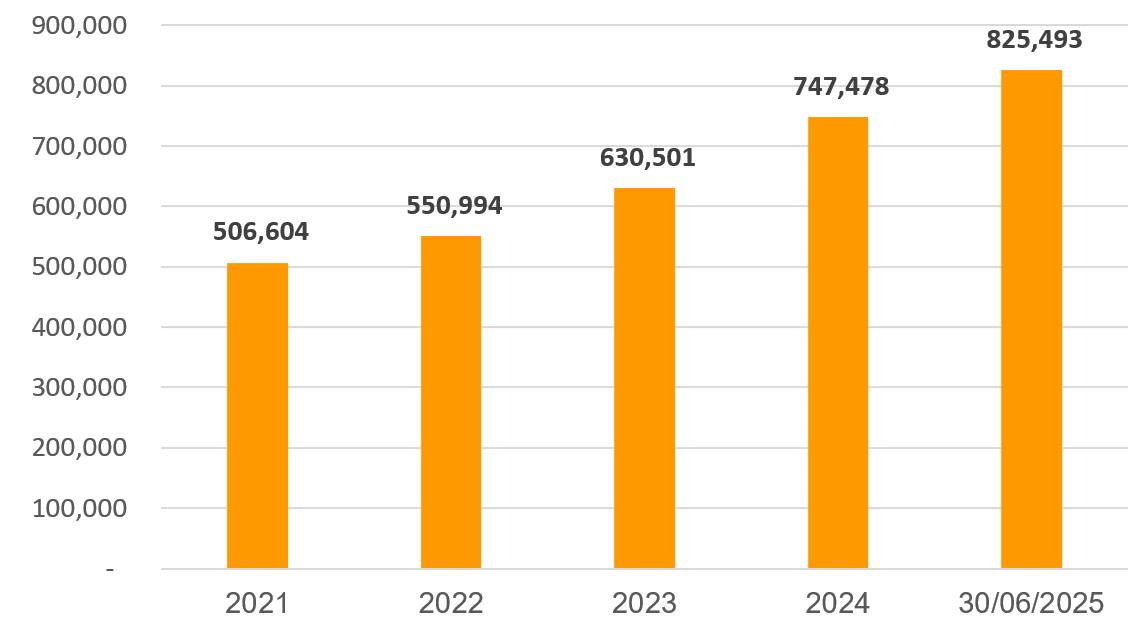

As of June 30, 2025, SHB’s total assets reached nearly VND 825 trillion, including customer lending exceeding VND 594.5 trillion, up 14.4% from the beginning of the year.

For 2025, the bank aims for a pre-tax profit of VND 14,500 billion, a 25% increase from 2024. The total asset target is projected at VND 832 trillion, with a milestone of VND 1 quadrillion targeted for 2026, marking a solid step forward in scale and position in the domestic and regional financial markets.

SHB’s Total Asset Growth (in VND billion)

Asset quality continued to improve significantly, with the bad debt ratio (NPL) according to Circular 31 well-controlled at a low level. Substandard debt decreased sharply, expanding the scope for asset quality enhancement.

Safety indicators remained well-maintained. The capital adequacy ratio (CAR) was consistently above 11%, well above the minimum requirement of 8%, ensuring a robust capital buffer for business operations.

SHB has developed credit risk measurement models and advanced IRB capital calculation methodologies in line with Basel II standards. The bank is on track to complete its risk management framework by 2027, fully meeting the requirements of Basel II – IRB, in alignment with the State Bank of Vietnam’s direction on enhancing risk management capabilities within the credit institution system.

The bank also applies liquidity risk management practices adhering to Basel III standards (LCR, NSFR) and implements financial asset-liability management tools (FTP, ALM) to tightly control cash flow, ensuring liquidity and proactive contingency planning for sustainable and efficient development.

Comprehensive Partnership, Ecosystem Development

During the 2024-2028 period, SHB is implementing a robust and comprehensive Transformation Strategy, aiming for substantial changes from within to become a modern and sustainably developing bank, aspiring to reach international financial markets. The bank is among the few selected by the World Bank, JICA, ADB, KFW, and other international financial institutions as a relending bank and a partner for key national projects. SHB also participates in ADB’s global trade finance program.

SHB remains steadfast in its strategy of expanding comprehensive cooperation with large state-owned and private economic groups, both domestic and international, ecosystem enterprises with supply chains and satellite companies, as well as small and medium-sized enterprises, while concurrently growing its individual customer base…

Recently, SHB has continuously forged comprehensive partnerships with prominent corporations such as Vietnam Steel Corporation, VNPT, Vietnam National Coal-Mineral Industries Group, Binh Son Refining and Petrochemical Company, EVN, and Tasco. Simultaneously, the bank has collaborated with reputable universities and hospitals nationwide, demonstrating its robust financial capabilities, brand reputation, and capacity to offer comprehensive financial solutions. This also underscores SHB’s position as a trusted partner in supporting the growth of prominent organizations across vital sectors of the economy.

Moreover, the bank continues to accelerate its digital transformation journey, aspiring to become a “Bank of the Future” model, incorporating cutting-edge technologies. This model deeply integrates artificial intelligence (AI), big data, and machine learning into the bank’s entire operational processes, products, and services. This strategic investment not only enhances SHB’s competitiveness and customer service capabilities but also expands its technological infrastructure and fosters innovative financial products, delivering personalized experiences to each customer.

Anchored by four pillars – reform of mechanisms, policies, regulations, and processes; people-centricity; customer and market centrality; and IT modernization and digital transformation, SHB remains steadfast in its six core cultural values of “Heart, Trust, Faith, Knowledge, Wisdom, and Vision.” The bank contributes to the socio-economic development of Vietnam, joining the nation’s journey towards a new era of prosperity and strength.

“SHB Commits to Sustainable Growth, Forging Comprehensive Partnerships for an Enhanced Strategic Ecosystem.”

SHB, or the Saigon – Hanoi Commercial Joint Stock Bank, is committed to a comprehensive and sustainable development strategy. We forge strong partnerships with leading state-owned and private economic groups, both domestic and international, as well as businesses with robust ecosystems, supply chains, and satellite companies. Our focus also extends to small and medium-sized enterprises, and we are dedicated to expanding our reach to individual customers.

The Ultimate Dividend Stock for the Week of August 25-29: PV GAS Shines Bright with a Massive $200 Million Payout Ahead of the Long Weekend

“This week, leading up to the National Day holiday on September 2nd, a total of 17 companies will be finalizing their cash dividend distributions. The highest rate among these businesses stands at an impressive 45%, equating to VND 4,500 per share owned. A substantial return for shareholders as we head into the holiday period.”

Mrs. Tran Kieu Thuong Purchases 1 Million NAB Shares

With a recent acquisition of 1 million NAB shares, Ms. Tran Kieu Thuong now holds a substantial stake in the company. Her total ownership stands at 1.045 million shares, representing 0.061% of NAB’s capital. This significant investment showcases Ms. Thuong’s confidence in the company’s potential and underscores her active role as a key stakeholder.