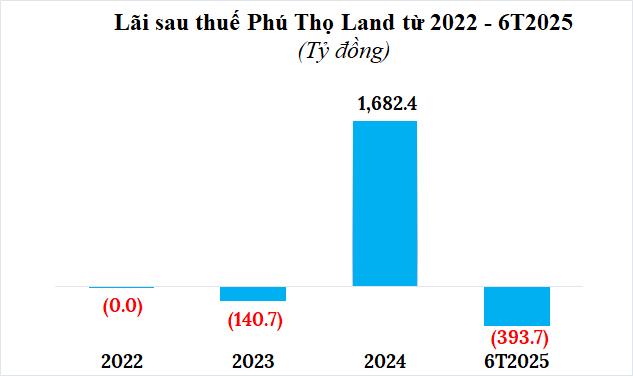

This isn’t the first time Phu Tho Land has incurred losses. In 2022-2023, the company also posted a loss of nearly VND 141 billion.

Source: Consolidated by the writer

|

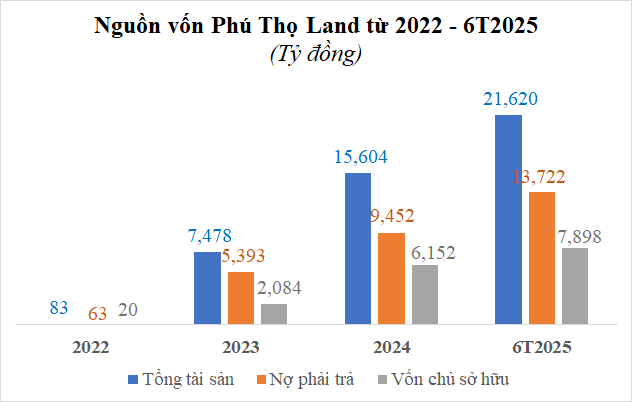

Notably, as of the end of June 2025, Phu Tho Land’s owner’s equity surged to over VND 7,898 billion, 3.7 times higher than in the first half of 2024. This includes a charter capital of VND 6,750 billion, triple the previous amount, and undistributed post-tax profits of over VND 1,148 billion.

Total liabilities decreased by 3% to over VND 13,722 billion, mainly comprising bank loans of over VND 7,380 billion, bond debt decreasing by more than half to over VND 904 billion, and other payables of over VND 5,438 billion.

Source: Consolidated by the writer

|

In the first half of the year, the company also paid over VND 47 billion in interest on the PTJCB2425001 bond issue, which was launched on December 24, 2024, with a value of VND 950 billion, a one-year term, and a fixed interest rate of 10% per annum.

This is the second bond issue of Phu Tho Land to be announced on the Hanoi Stock Exchange (HNX). Previously, on August 25, 2024, the company fully redeemed the PTJCB2324001 bond issue valued at VND 1,900 billion, issued on August 25, 2023, with an interest rate of 10.5% per annum.

Established in November 2019, Phu Tho Land operates in the real estate business with a charter capital of VND 20 billion. Its founding shareholders included CTCP BV Land, contributing 70% of the capital, CTCP Construction Balimas with 1%, and CTCP BV Asset with 29%. BV Land (UPCoM: BVL) and BV Asset are members of CTCP Bach Viet Group (BV Group). Mr. Luu Vu Truong Dam served as the company’s Director and legal representative until February 2022, when he was replaced by Mr. Hoang Ngoc Minh.

Following several capital increases, the company’s charter capital now stands at VND 6,750 billion, with Mr. Vo Phuoc Thanh as the Director and legal representative.

Phu Tho Land Raises Capital to VND 1,700 Billion and Issues VND 1,900 Billion in Bonds

Phu Tho Land Repays Bonds and Issues New Ones

– 08:18 30/08/2025

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

“Taseco Land Seeks Shareholder Approval for Plans to Offer Over 48 Million Private Placement Shares”

Taseco Land seeks shareholder approval to offer 48.15 million private placement shares at VND 31,000 per share, aiming to boost its charter capital to VND 3,600 billion.

The Khang Điền House Liquidates Over 848 Billion VND in Principal and Interest on Bonds

With a strong track record of financial prudence, Nha Khang Dien has once again demonstrated its commitment to meeting its financial obligations. The company recently made a substantial payment of over VND 848 billion, covering both principal and interest on its bond series KDHH2225001. This timely full repayment underscores the company’s dedication to maintaining a solid financial standing and bodes well for its future endeavors.