Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities JSC

|

Ms. Lien stated that Vietnam’s potential upgrade from a frontier market to an emerging market is a positive signal, offering an opportunity to attract significant capital from international investment funds such as BlackRock and Vanguard.

“This requires Vietnamese enterprises to enhance their capabilities to not only ‘ride the wave’ but also become the preferred choice for investment capital,” she emphasized.

To seize this opportunity, Ms. Lien suggested that companies should invest diligently in Investor Relations (IR) to build trust and attract sustainable capital. Instead of considering IR merely as mandatory information disclosure, enterprises should view it as a bridge connecting the company and investors.

“Information should be transparent and easily accessible to both individual and institutional investors, with a full English version available to reach international funds – investors who typically require globally standardized data,” she added.

Additionally, enterprises should regularly organize meetings with investors, analysts, or workshops to convey information effectively, helping the market understand their business strategies and growth prospects.

Vietnamese Enterprises Remain Hesitant to Invest in IR

However, reality shows that many Vietnamese enterprises are not yet ready for this new game. According to Ms. Lien’s observations, many Vietnamese companies are hesitant to invest in IR activities because they do not fully appreciate the potential and long-term value of IR and are concerned about the investment costs involved.

“Enterprises often view IR as a supporting task for mandatory information disclosure and are reluctant to expand their staff or organize in-depth activities,” she analyzed.

Moreover, the shortage of specialized human resources, especially those with experience working with international partners, is a significant barrier to the uniform development of IR. Of greater concern is the “impatient” mindset of many enterprises, expecting immediate results from IR efforts. This contradicts the very nature of IR, which is a long-term investment requiring patience and consistency.

“Enterprises with well-defined strategies and ‘patience’ in IR often receive long-term commitment from large investors,” she shared.

Ms. Lien proposed monthly tracking indicators to help enterprises monitor their progress: the number and quality of meetings with investors, the increase in the number and quality of new investors, response time to investor inquiries, stock liquidity changes, and positive stock price stability.

The expert emphasized that enterprises that invest systematically in IR often yield positive results by attracting stable foreign capital and improving stock valuations.

Key Considerations for Implementing IR

For enterprises that have decided to invest in IR, Ms. Lien noted that international institutional investors highly value transparency, not only in current results but also in the enterprise’s ability to manage risks during challenging periods.

Additionally, she observed that large investment funds are paying more attention to ESG issues, while most Vietnamese enterprises are not yet adequately prepared with international standard ESG reports. They also lack a reasonable communication strategy and skilled negotiation when dealing with foreign investors.

“This could lead to information asymmetry and difficulty in establishing the necessary long-term trust,” she asserted.

Another common mistake enterprises make is a lack of flexibility in communication and timely response to emerging situations. They may also fall into the trap of promoting flashy growth messages without providing specific evidentiary data, arousing investors’ doubts about the authenticity and sustainability of the enterprise’s story.

Looking ahead, as Vietnam prepares for its market upgrade, Ms. Lien believes that IR is no longer an option but a prerequisite for enterprises to take advantage of the incoming wave of international capital.

– 12:00 30/08/2025

“AI’s IR Evolution: Unlocking the Challenges Within”

In recent years, artificial intelligence (AI) has become a buzzword across industries – from marketing and operations to risk management and market research. Investor relations (IR), a specialized field requiring a blend of financial expertise and communication skills, is also embracing this transformative wave.

“From ‘Messenger’ to ‘Strategic Companion’”

Over the past decade, the role of Investor Relations (IR) in listed companies has undergone a significant evolution. Once considered merely a conduit for information, a logistical arm of public relations or corporate secretarial function, IR has now become integral to strategic planning, not just for the company but also in meeting the expectations and evaluations of institutional investors.

Crafting Trust in the Capital Markets

In today’s dynamic financial landscape, characterized by increasing demands for transparency, the quality of corporate disclosures plays an instrumental role. It significantly impacts investment decisions, shapes market confidence, and determines enterprises’ access to capital. However, despite notable improvements, the reality is that the quality of disclosures by listed companies still leaves much to be desired.

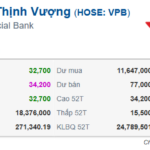

Is VPBank Ready for an IPO?

On August 18th, the Board of Directors of VPBank Securities Joint Stock Company (VPBankS) passed a resolution to seek shareholder approval via written consent. According to multiple sources, the securities firm is preparing to submit an IPO proposal as soon as the fourth quarter of 2025.