Corn Imports: A Vital Part of Vietnam’s Agricultural Sector

According to Vietnam Customs, the country’s corn imports from January to July 2025 totaled over 5.4 million tons, valued at more than $1.41 billion. This represents a 4.7% decrease in volume and a 1.2% drop in value compared to the same period in 2024.

July 2025 saw a significant surge in corn imports, with over 1.03 million tons worth $260 million, reflecting a remarkable 118% volume and a 113% value increase year-on-year.

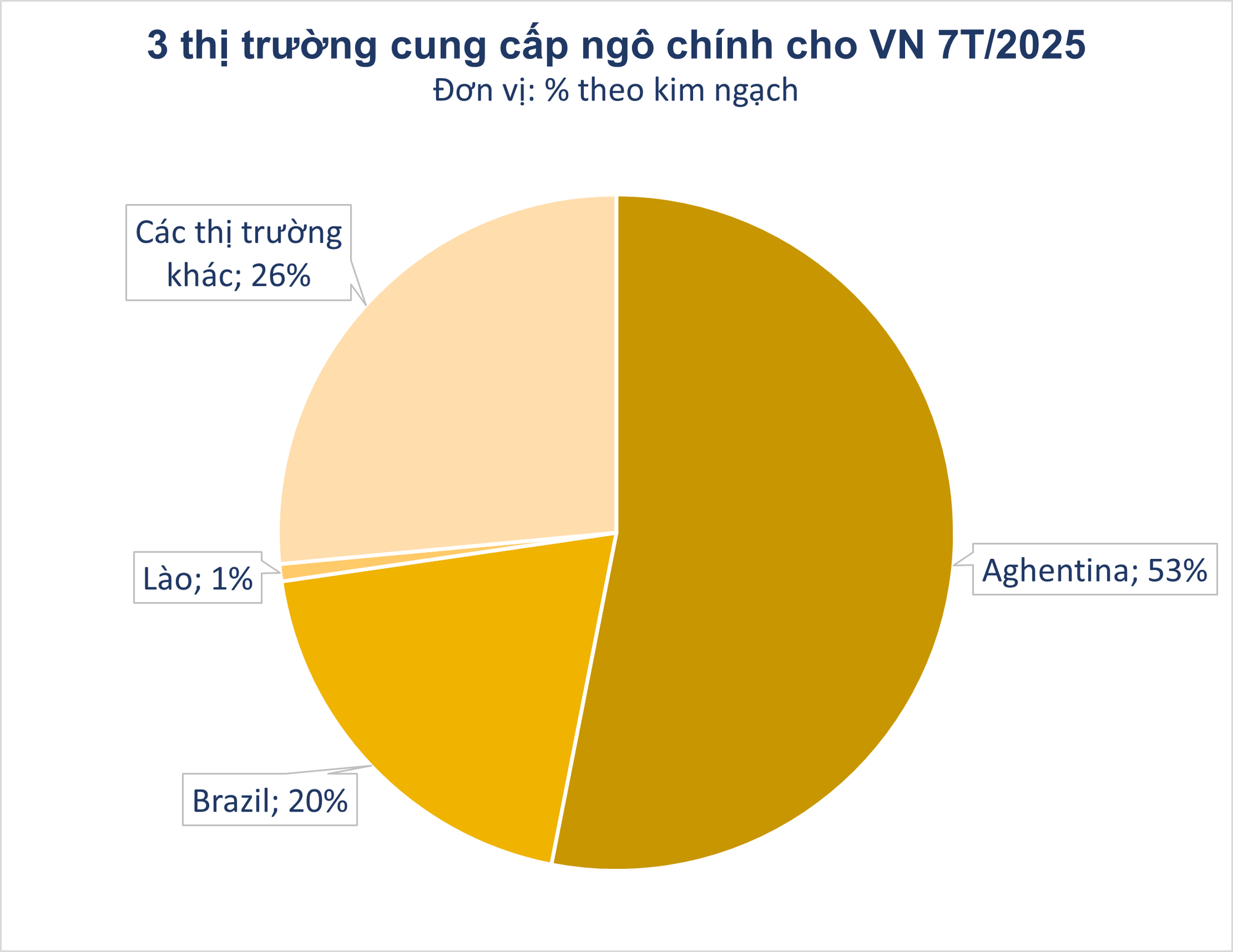

Argentina remained Vietnam’s top corn supplier during the first seven months of 2025, accounting for more than half of the country’s total corn imports. Vietnam imported 2.91 million tons of corn from Argentina, valued at $750 million, a decrease of 8.6% in volume and 3% in value compared to the previous year.

Brazil, the second-largest market, supplied over 1.1 million tons, equivalent to $277 million. Notably, Laos was among the top three corn providers, with imports totaling over 49,500 tons and valued at $11 million. Laos offered the most competitive prices, with an average import price of $225.5 per ton, a 9.8% reduction.

While Vietnam is one of the top 30 corn-producing countries globally, it also ranks among the largest corn importers, following China, Europe, Mexico, Japan, South Korea, and Egypt.

Proposed Reduction in Import Tax on Corn to Stabilize Prices

As per the Ministry of Finance, since October 2020, prices of key raw materials such as corn and wheat have been on a consistent upward trajectory, with increases averaging 30-35%. This price surge has had a ripple effect on animal feed prices, which witnessed a notable rise in the first quarter of 2021 compared to the previous quarter and are expected to continue this upward trend.

Vietnam’s animal feed industry has been growing steadily at an average rate of 13-15% annually. However, the Ministry of Finance highlights that in the production of industrial animal feed, raw material costs typically account for 80-85% of the production cost but rely heavily on imports.

While domestic agriculture can supply 4 million tons of bran and 4 million tons of cassava for animal feed annually, the demand stands at 27 million tons. This leaves a significant gap, with 70-80% of the required raw materials needing to be imported, particularly corn, wheat, and soybeans.

Upon reviewing the raw materials used in animal feed production, the Ministry of Finance identified corn and wheat as the two commodities with the highest proportion in feed composition and currently subject to import taxes above 0%. Corn, for instance, has an MFN import tax rate of 5%.

Consequently, the Ministry of Finance proposes reducing the MFN import tax rate for corn (HS code 1005.90.90) from 5% to 3%. This measure aims to stabilize prices, reduce input costs for animal feed production, and positively impact other industries like confectionery and food production.