Tasco Joint Stock Company (HUT on HNX) has just announced the resolution of its Board of Directors regarding the approval of the results of the additional public offering of shares to existing shareholders in 2024 and the increase in charter capital.

According to the resolution, from July 7, 2025, to August 20, 2025, Tasco successfully offered nearly 175.8 million shares to 9,168 shareholders, with over 2.7 million shares remaining unsubscribed.

The allocation ratio was 5:1, meaning that for every 5 shares owned, shareholders were entitled to purchase 1 new share.

Illustrative image

With an offering price of VND 10,000 per share, the total amount of capital raised by Tasco was over VND 1,757.7 billion.

As per the previous issuance plan, the proceeds will be used to supplement investment capital and contribute to the production and business activities of its subsidiaries, including Tasco Insurance LLC, VETC JSC, and Tasco Auto JSC.

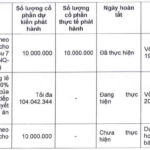

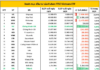

Following this offering, Tasco’s total number of shares increased from over 892.5 million to nearly 1.1 billion, equivalent to a charter capital increase from over VND 8,925 billion to nearly VND 10,683 billion.

The effective date of the capital change will be the date on which the State Securities Commission (SSC) issues a notice of receipt of the report on the results of the public offering of shares by the company.

On August 15, 2025, National Securities Joint Stock Company successfully purchased 3.5 million HUT shares by exercising 17.5 million share purchase rights.

It is worth noting that Mr. Bui Quang Bach, a member of Tasco’s Board of Directors, also holds a position as a member of the Board of Directors of National Securities Company.

In terms of business results, for the second quarter of 2025, Tasco reported net revenue of nearly VND 8,237.6 billion, up 26% compared to the same period last year. After deducting taxes and expenses, the company recorded a net profit of over VND 75.6 billion, an increase of 28.1%.

For the first six months of 2025, Tasco’s net revenue reached nearly VND 15,213.6 billion, up 29.8% compared to the same period in 2024, with after-tax profit reaching VND 112.6 billion, an increase of 23.6%.

As of June 30, 2025, total liabilities stood at nearly VND 31,603.2 billion, an increase of 9% from the beginning of the year. Short-term receivables accounted for VND 7,406 billion, or 23.4% of total assets, while fixed assets amounted to VND 6,697 billion, or 21.2% of total assets.

On the other side of the balance sheet, total equity was nearly VND 20,057.5 billion, an increase of 15% compared to the beginning of the year. Borrowings and finance leases stood at VND 12,412.7 billion, representing 61.9% of total liabilities.

“SSI Plans to Offer 415 Million Shares to Shareholders”

At the upcoming extraordinary general meeting, SSI Securities Corporation will propose a plan to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.

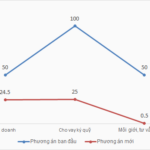

“SBBS Shifts Capital Usage: Focusing on Proprietary Trading and Margin Lending”

The Board of Directors of SBB Securities Joint Stock Company (SBBS) has approved a resolution to alter the capital usage plan from the previous year’s September issuance.