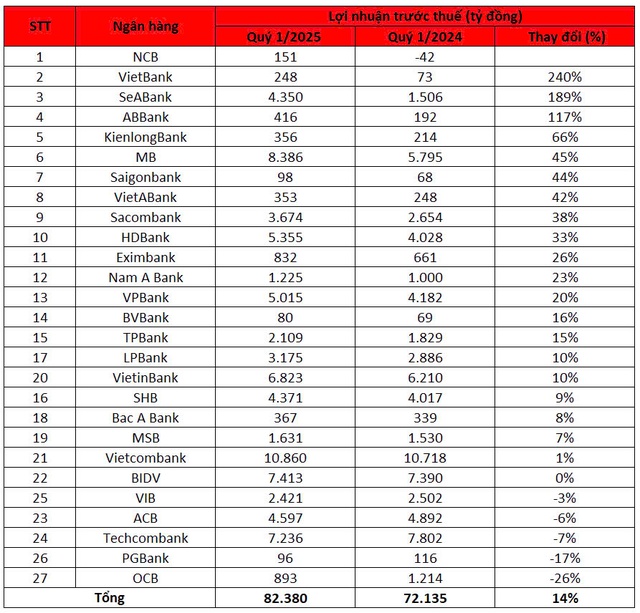

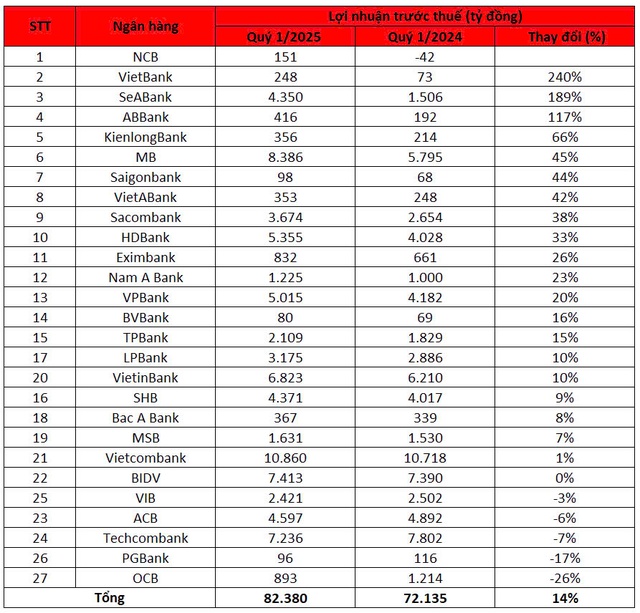

The first quarter of 2025 saw impressive profit growth for banks listed on the stock exchange, with their combined pre-tax profits reaching VND 82,380 billion, marking a nearly 14% increase compared to the same period in 2024. Notably, only five banks experienced a decline in profits, while five others managed single-digit growth. The remaining banks posted impressive double-digit increases, with some even reporting profits several times higher than the previous year’s first quarter.

Small Banks Surge Ahead: VietBank, SeABank, and ABBank Achieve Triple-Digit Growth

In the first quarter, National Commercial Joint Stock Bank (NCB) recorded pre-tax profits of over VND 151 billion, a significant improvement compared to the first quarter of 2024. This impressive performance was driven by a nine-quarter high net interest income of nearly VND 505 billion. Additionally, the bank turned a profit in various other business activities, including services, foreign exchange and gold trading, and investment securities trading.

For 2025, NCB has set a pre-tax profit target of VND 59 billion as per its restructuring plan. The bank has made a strong start towards achieving this goal in the first three months of the year.

VietBank, the Vietnam Thuong Tin Commercial Joint Stock Bank, witnessed a remarkable surge in its first-quarter pre-tax profits, which soared to over VND 248 billion. This impressive figure represents a 3.4-fold increase compared to the first quarter of 2024 and was primarily driven by a significant rise in net interest income. However, it only accounts for 14% of the annual plan approved at the 2025 Annual General Meeting of Shareholders.

At the 2025 Annual General Meeting, in response to a shareholder’s question regarding the feasibility of a 55% profit growth target amidst economic uncertainties, Ms. Tran Tuan Anh, CEO of VietBank, assured that while the target is ambitious, it is based on a robust macroeconomic outlook and thorough internal preparations. She emphasized their determination to achieve this goal by focusing on credit growth and optimizing their return on assets.

SeABank, the South East Asia Commercial Joint Stock Bank, achieved remarkable financial results in the first quarter of 2025, with its pre-tax profits soaring to VND 4,350 billion, reflecting a staggering 189% increase compared to the same period last year. This outstanding performance is further highlighted by their total operating income (TOI) of VND 5,820 billion, representing an increase of over 115%. Notably, non-interest income played a pivotal role in this success, reaching VND 3,369 billion and contributing to a more balanced revenue mix. It is worth mentioning that during the first quarter of 2025, SeABank successfully concluded the transfer of PTF Finance Company to AEON Financial Service.

Another bank that achieved impressive profit growth in the first quarter was An Binh Commercial Joint Stock Bank (ABBank). ABBank’s pre-tax profits surged from VND 192 billion in the first quarter of 2024 to VND 416 billion in the same period in 2025, primarily attributed to positive results in their foreign exchange business and successful cost-cutting measures.

Mr. Pham Duy Hieu, CEO of ABBank, commented on their positive start to the year and reaffirmed their commitment to maintaining a stable and sustainable development trajectory. He further shared their strategy of streamlining operations and reducing operating expenses to achieve their 2025 pre-tax profit target of VND 1,800 billion, which represents a 131% increase compared to 2024.

Other small banks that demonstrated notable profit growth in the first quarter of 2025 include Kienlongbank (+66%), Saigonbank (+44%), and VietABank (+42%). These positive results can be largely attributed to their focus on credit activities and effective asset management strategies.

MB, Sacombank, HDBank, and VPBank Lead the Pack among Large Banks

Among the larger banks, Military Commercial Joint Stock Bank (MB) stood out with an impressive 45% growth in pre-tax profits in the first quarter of 2025, reaching VND 8,386 billion. This outstanding performance propelled MB to the second position in the ranking of the most profitable banks in the system, surpassing industry giants VietinBank (VND 6,582 billion) and BIDV (VND 7,413 billion). MB’s remarkable results were fueled by strong performances in both credit-related income and non-interest income streams.

Sacombank, the Saigon Thuong Tin Commercial Joint Stock Bank, also delivered impressive financial results in the first quarter, with a 38% year-on-year increase in profits, totaling VND 3,674 billion. This growth was primarily driven by positive performances across their key income sources, coupled with a significant reduction in credit risk provisions.

Having faced significant asset quality challenges following its merger with Southern Bank, Sacombank is now in the final stages of its restructuring process under the supervision of the State Bank of Vietnam. The bank is poised to enter a new phase of robust recovery and growth in the coming years.

HDBank, the Ho Chi Minh City Development Joint Stock Commercial Bank, recorded a notable 33% increase in pre-tax profits, rising from VND 4,028 billion in the first quarter of 2024 to VND 5,555 billion in the same period in 2025. With this impressive performance, HDBank climbed to the sixth position in the industry’s profit rankings, surpassing both ACB and VPBank to become the second most profitable private bank in the system, second only to Techcombank.

The first quarter also marked the official launch of HDBank’s transformation into a modern, multi-functional, and sustainable financial banking group, in line with its 2025-2030 development strategy.

For 2025, HDBank has set ambitious targets, including a pre-tax profit goal of VND 21,179 billion, representing a 27% increase compared to 2024. The bank also aims to grow its total assets by 28% to VND 890,442 billion, while targeting a 32% increase in credit balance to VND 579,851 billion and a 28% rise in capital mobilization to VND 792,812 billion. HDBank remains committed to maintaining a stable and safe system, with a bad debt ratio of below 2%.

Commenting on these ambitious plans, Mr. Kim Kim Byoungho, Chairman of HDBank’s Board of Directors, acknowledged the challenges but expressed confidence in their ability to turn them into opportunities. He attributed their success over the past decade to their ability to embrace challenges and emphasized their readiness to forge ahead with determination.

VPBank, the Vietnam Prosperity Joint Stock Commercial Bank, concluded the first quarter of 2025 with consolidated pre-tax profits of VND 5,015 billion, representing a solid 20% increase compared to the previous year. This impressive performance positions VPBank as one of the few large banks to achieve such high growth rates.

The bank’s management anticipates completing 40-45% of its annual profit plan in the first half of the year, equivalent to VND 6,000-7,000 billion. According to CEO Nguyen Duc Vinh, VPBank is poised for a strong financial performance in the second half, driven by expected increases in credit and consumer spending.

With a pre-tax profit target of VND 25,270 billion (nearly USD 1 billion) for 2025, representing a 26% increase compared to 2024, VPBank is well-positioned to continue its positive trajectory. The bank aims to not only achieve exceptional credit growth but also to expand its financial ecosystem aggressively.

Why Do People Still Choose to Deposit Money in Banks Even Though Other Investment Channels Are Active?

In just the first two months of the year, over 301 trillion VND in savings deposits from residents flowed into the banking system, despite rising gold prices and a booming stock market.

The Sun Sets on Solar: CEO and Chairman Step Down

The two key leaders of Vimarko Joint Stock Company (VMK on UPCoM) have consecutively tendered their resignations.