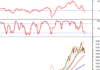

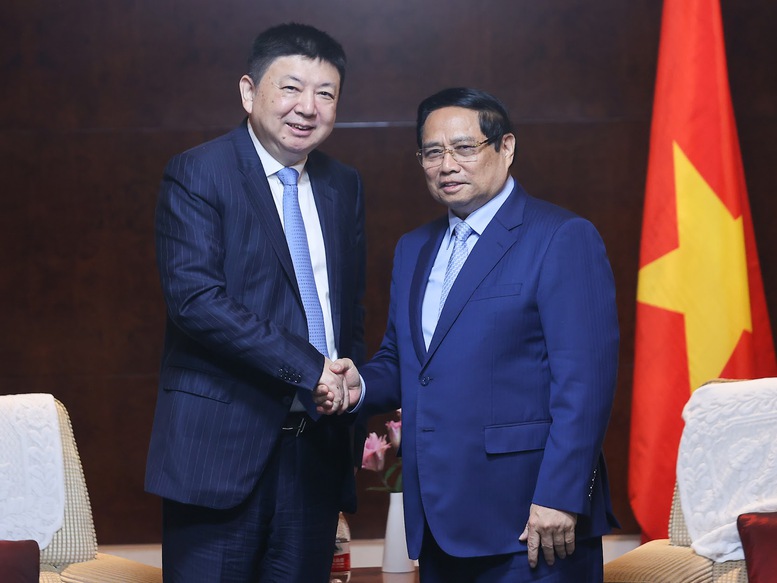

Prime Minister Pham Minh Chinh meets with Huadian R&D Group Chairman Peng Cuangbing. Photo: VGP/Nhat Bac

At the meeting, the Chairman of the Board of Directors of Huadian R&D Group (Huadian) Peng Cuangbing reported to the Prime Minister on the investment situation and the construction, operation, and social contribution of Huadian’s power plant projects in Vietnam. He also inquired about Vietnam’s renewable energy development strategy, planning, policies, and needs, based on which the company will formulate its business investment plan for the coming time. Huadian wishes to share its experience and technology with Vietnam to enhance the quality of construction and operation of renewable energy projects.

Huadian is currently one of the five largest power generation groups in China and has consecutively ranked among the top 500 enterprises globally (Fortune Global 500) for 13 years.

Huadian values the Vietnamese market, with a cumulative investment of over 2.8 billion USD, leading among Chinese enterprises in Vietnam. The Duyen Hai 2 Power Plant in Vinh Long province, with a capacity of 2×660 MW, is the group’s largest installed capacity and investment scale abroad. The group is implementing and planning to implement many clean energy projects in Vietnam.

The Chairman of Huadian shared their investment and business strategy in Vietnam, which is 1+1+1+N (one business entity in Vietnam + one research center in Vietnam + one manufacturing base in Vietnam + multiple cooperation projects). This strategy actively contributes to Vietnam’s green development and transformation.

Huadian aims to increase its investment in Vietnam in areas such as wind power, green hydrogen, and pumped hydro storage. They also seek to upgrade the power system, improve the technology of power plants, ensure safety, and enhance energy efficiency. Simultaneously, the group desires to strengthen cooperation with Vietnamese enterprises in the field of scientific and technological innovation to establish an R&D center.

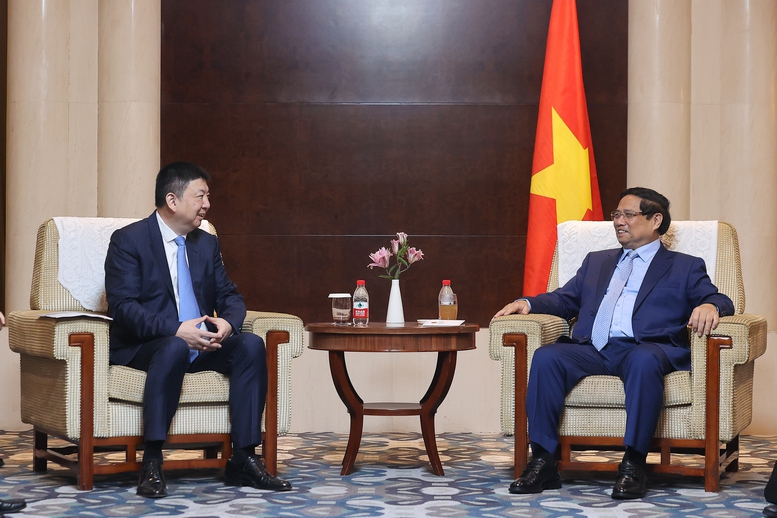

Prime Minister Pham Minh Chinh suggested that Huadian continue to expand effective investment in Vietnam, especially in clean energy, wind power, solar power, and hydrogen. Photo: VGP/Nhat Bac

Prime Minister Pham Minh Chinh appreciated Huadian’s long-term investment strategy in Vietnam, calling it a “right and accurate” choice for both the immediate and long term. He welcomed the establishment of the group’s research and development center and acknowledged their contributions to social welfare and human resource development in Vietnam.

The Prime Minister shared that Vietnam aims for growth rates of 8.3-8.5% in 2025 and double digits in the following years, leading to a substantial demand for clean energy.

Recognizing the importance of regularly reviewing the progress made after their meetings, Prime Minister Pham Minh Chinh expressed his gratitude and suggested that the group continue to expand effective investment in Vietnam, especially in clean energy, wind power, solar power, and hydrogen. This will contribute to the country’s green energy transition and sustainable development. He also emphasized the importance of technology transfer, experience sharing, human resource training, and cooperation with Vietnamese partners, particularly the Electricity Group.

Underlining the spirit of “harmonious interests and shared risks,” the Prime Minister instructed ministries, sectors, and localities to promptly address any obstacles in implementing the group’s projects in Vietnam, stating, “Once committed, it must be done, and once done, it must yield specific results.”

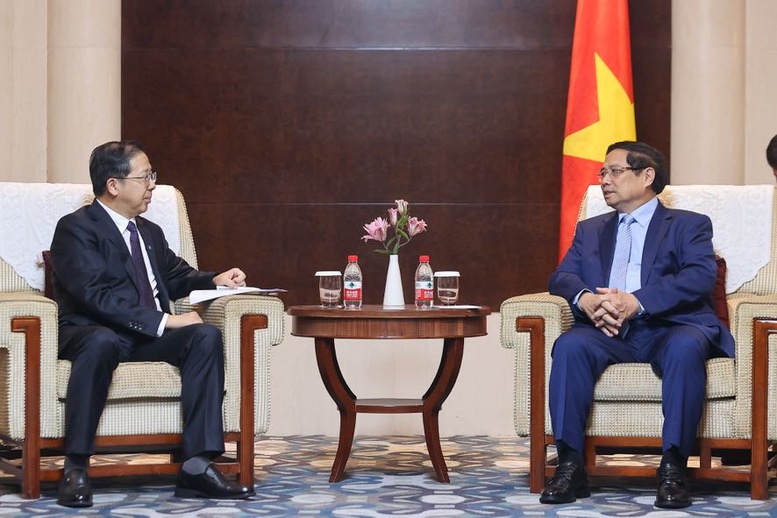

Prime Minister Pham Minh Chinh meets with Yadea Science and Technology Group Vice President Wang Jiacheng. Photo: VGP/Nhat Bac

On the same day, the Prime Minister received Mr. Wang Jiacheng, Vice President of Yadea Science and Technology Group.

Yadea is a leading global manufacturer of two-wheeled electric vehicles, maintaining its top position in global sales for eight consecutive years. The group has established ten large production and research centers in multiple countries, with its products distributed in over 100 countries and territories.

In 2019, Yadea invested in constructing a motorcycle manufacturing plant in Quang Chau Industrial Park, Bac Ninh province. In 2023, the group expanded its investment with a 100-million-USD electric vehicle manufacturing plant in Bac Ninh, covering an area of 230,000 square meters and designed to produce 2 million vehicles annually. Yadea’s projects create numerous local jobs, feature a high level of localization, and include the establishment of a green energy R&D center for Southeast Asia in Vietnam.

Yadea aspires to participate in projects that develop the two-wheeled electric vehicle industry and its auxiliary services, contributing to the formation of green urban transportation in Vietnam. They also aim to promote projects that facilitate Vietnam’s transition to green transportation.

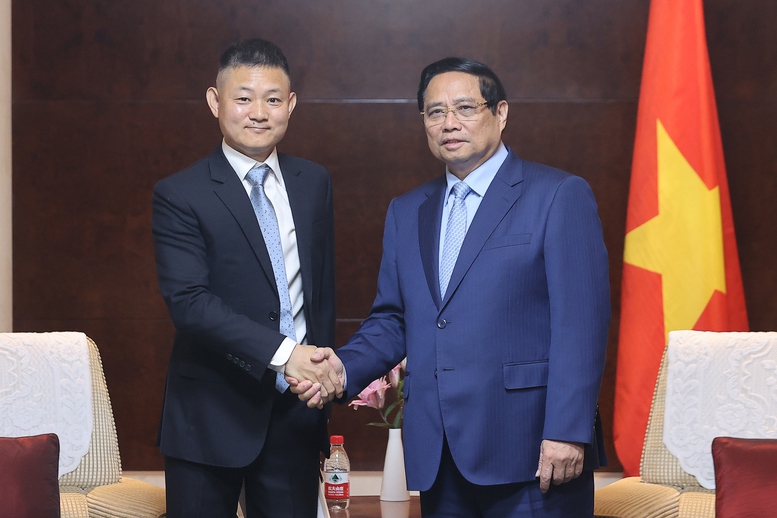

Prime Minister Pham Minh Chinh suggested that Yadea expand its investment in the electric vehicle sector in Vietnam, focusing on technology transfer, higher localization rates, and employing Vietnamese workers. Photo: VGP/Nhat Bac

The Prime Minister welcomed Yadea’s expansion of investment and the establishment of a research and development center in Vietnam. He shared Vietnam’s orientation towards restructuring the economy and transforming the growth model towards sustainability, digital economy, green economy, and circular economy.

Prime Minister Pham Minh Chinh proposed that Yadea broaden its investment in Vietnam’s electric vehicle sector, emphasizing technology transfer, higher localization rates, and the utilization of Vietnamese labor. He also encouraged the group to participate in Vietnam’s green transportation transition and collaborate on human resource development with the Vietnam Electricity Group, the National Power-Energy Corporation, and the Military-run Telecom Group.

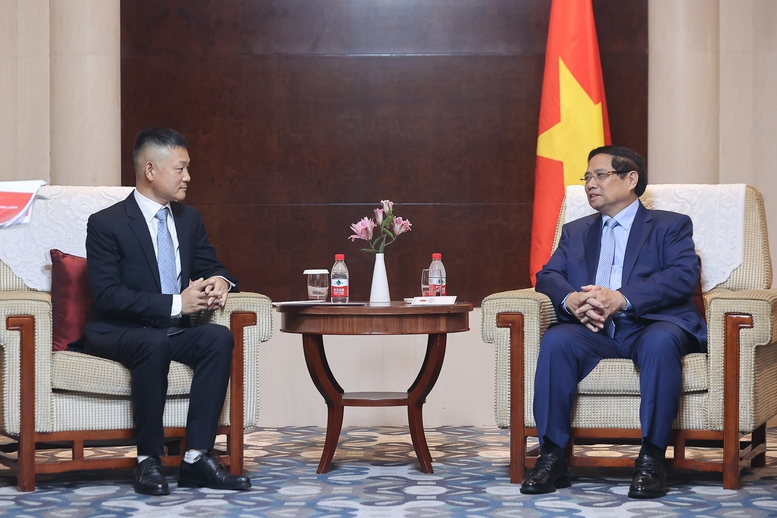

Prime Minister Pham Minh Chinh meets with China Flower Design Chairman Yang Wei Dong. Photo: VGP/Nhat Bac

Subsequently, Prime Minister Pham Minh Chinh received Mr. Yang Wei Dong, Chairman of the Board of Directors of China Flower Design.

Mr. Yang Wei Dong reported on the company’s production and business situation and capabilities, inquiring about Vietnam’s development strategy, planning policies, and needs in the field of infrastructure development, especially the spirit of Resolution No. 68 of the Politburo. Based on this, the company will formulate its business investment plan in Vietnam for the coming period.

China Flower Design is a leading comprehensive technical consulting service provider in China. In 2014, the company officially listed on the Shanghai Stock Exchange, becoming the first independently listed technical design company on the A-share market.

China Flower Design possesses comprehensive design capabilities for all transportation fields, including road, railway, water, and aviation. The company has expanded from design planning to full life-cycle services and ventured into new fields such as smart cities, environmental protection and renewable energy, low-altitude aviation economy, modern modular construction, commercial consumption and recovery, and rural development.

In August 2025, China Flower Design signed a Memorandum of Understanding with Vietnam’s Deo Ca Group, intending to cooperate comprehensively in multiple fields and jointly participate in projects undertaken by Deo Ca Group. The company also established a representative office in Vietnam and collaborated with Deo Ca Group to build a closer cooperation model, jointly enhancing training and human resource development.

Prime Minister Pham Minh Chinh suggested that China Flower Design provide consulting and support to complete the Lang Son-Cao Bang expressway project this year and advised on the efficient and sustainable development of the Hong (Red) River. Photo: VGP/Nhat Bac

Prime Minister Pham Minh Chinh welcomed the company’s strategic and long-term approach to enhancing cooperation with Vietnam, focusing on expanding the quantity and improving the quality of partnerships. He proposed that China Flower Design continue cooperating with and supporting Vietnamese partners, including large corporations, in technical design and consulting in various fields such as transportation, electricity, oil and gas, and digital infrastructure. This collaboration will contribute to building a professional ecosystem for the development of the technical design and consulting industry. Vietnam’s complex geography and geology pose challenges in constructing projects, making this cooperation even more valuable.

Emphasizing the importance of time, intellect, and decisiveness, the Prime Minister suggested that China Flower Design provide consulting and support to complete the Lang Son-Cao Bang expressway project within this year. He also advised on the efficient and sustainable development of the Hong (Red) River and encouraged cooperation in finance and the development of an international financial center in Vietnam.

Agreeing with Prime Minister Pham Minh Chinh’s orientations, the leader of China Flower Design affirmed that they would coordinate with Vietnamese partners and agencies to implement specific plans in the coming time.

“Petrovietnam’s $14.3 Billion Energy Hub Plan: Unveiling the Proposed Location for the Massive Project”

On August 27, the Vietnam Oil and Gas Group (Petrovietnam) met with the People’s Committee of Can Tho City to discuss the implementation of the “Research and Proposal for the PetroVietnam Energy Industrial Center Model” in the city. This initiative aims to explore the potential for green and sustainable energy development in Can Tho and the entire Mekong Delta region.

“HDBank Receives Commendation from the Prime Minister for Outstanding Contributions to the Program to Eradicate Temporary and Dilapidated Housing”

On August 26, 2025, at the National Online Conference to conclude the program “Whole Country Joins Hands to Eliminate Temporary and Dilapidated Houses in 2025” organized by the Government Office, HDBank was honored to receive a Certificate of Merit from the Prime Minister. This recognition highlights the bank’s outstanding contributions to social welfare and community development.