Danang’s Semiconductor Circuit Day 2025 – Photo: VGP/Luu Huong

This is the first time a locality has chosen a separate day for the semiconductor industry, demonstrating its determination and ambition to take the lead in the race to master core technology. Danang aims to become an international financial center and a bright spot in innovation, research, and core technology development in Vietnam and the region.

Speaking at the event, Chairman of the Danang People’s Committee, Luong Nguyen Minh Triet, said that the city had approved the Project for the Development of the Semiconductor and Artificial Intelligence Industries, with the orientation of making Danang one of the top three centers in the country in this field by 2030. The project aims to form a complete innovation ecosystem, focusing on training high-quality human resources, developing technology enterprises, and building a foundation for the sustainable development of the semiconductor industry.

Chairman of Danang People’s Committee, Luong Nguyen Minh Triet – Photo: VGP/Luu Huong

After more than a year of implementation, the semiconductor ecosystem in Danang has made significant progress. From the initial eight enterprises, the city has now attracted 25 enterprises operating in the fields of design, testing, and packaging. This is the result of a well-thought-out strategy on four fronts: clear policy orientation, infrastructure investment, well-trained human resources, and an attractive and transparent investment environment.

The training sector has also recorded positive progress. By 2024, eight universities and colleges in the area offered majors in semiconductors, with an initial scale of 600 students, expected to increase to 1,000 students in 2025. The city also organized six training courses for more than 255 lecturers and students to improve teaching and research capabilities.

Another important milestone is the launch of the Fab-Lab Project with a total investment of more than VND 1,800 billion. The project aims to achieve a capacity of 10 million products per year, serving domestic and foreign markets. The investor, VSAP LAB, is the first Vietnamese enterprise in the semiconductor industry, founded by a team of Vietnamese experts. They are people who have worked for large technology corporations worldwide, hoping to master core technology on Vietnamese soil.

Danang has great potential for developing the semiconductor industry – Photo: VGP/Luu Huong

Danang has all the conditions to “take the lead – move fast” in the semiconductor industry

As a pioneer in Vietnam’s semiconductor industry, Mr. Tran Dang Hoa, Chairman of FPT IS, Chairman of FPT Semiconductor, FPT Corporation, shared that in the context of the global supply chain shift, Vietnam is emerging as a new destination.

Vietnam’s advantage is its high-quality human resources and talent pool contributing to the country’s semiconductor industry: a team of overseas Vietnamese experts returning to contribute to the country; international enterprises bringing technology and training to Vietnam; and pioneering technology enterprises such as FPT. Danang now has all the conditions to “take the lead – move fast” in the semiconductor industry, with close cooperation between the government, schools, and businesses.

Mr. Tran Dang Hoa shared that in the semiconductor industry, FPT started over ten years ago and chose a different path by focusing on niche markets. In the power chip segment, since 2022, FPT has produced chips that meet Japan’s strict standards, with orders of over 70 million units from leading printer and camera manufacturers.

In addition, FPT focuses on developing testing services (OSAT). The corporation has collaborated with NIC to provide training courses for young people to access the latest technology, promote R&D, and innovate to create new chips for the market.

The New Vietnam: A Nation Transformed

According to Gerry Brownlee, Speaker of the New Zealand House of Representatives, Vietnam has undergone a remarkable transformation since the restoration of peace. The country is now on the brink of a significant leap in terms of per capita GDP growth, which will ultimately enhance the well-being of its citizens.

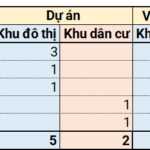

Investment Opportunity: August 2025 – Five Urban Developments with a Capital Investment of Nearly 30.2 Trillion VND

In August 2025, five provinces attracted investment with seven projects, totaling nearly VND 31.3 trillion. Notably, Quang Ngai province sought investment for three urban areas, with a total investment of approximately USD 1 billion.

“Premier Pushes for Swift Finalization of High-Speed Rail Standards”

On the morning of August 30, Prime Minister Pham Minh Chinh chaired a meeting of the Government’s Standing Committee to review the progress of the high-speed North-South railway project and the Lao Cai – Hanoi – Haiphong route.