Illustrative Image

A survey in key localities showed that pepper prices on September 1st in Dak Lak reached 152,000 VND/kg, unchanged from the previous day.

In Gia Lai, the pepper price was 151,000 VND/kg, also unchanged from the previous day.

In Lam Dong province (including the old Dak Nong province), the pepper price was 152,000 VND/kg, the same as the previous day.

In Ho Chi Minh City (including the old Ba Ria – Vung Tau province), the pepper price was 151,000 VND/kg, unchanged from the previous day.

In Dong Nai province (including the old Binh Phuoc province), the pepper price was 151,000 VND/kg, the same as the previous day.

Thus, on September 1st, 2025, pepper prices remained stable, hovering around 151,000 – 152,000 VND/kg.

In the global market, the price of Lampung black pepper from Indonesia is currently at 7,216 USD/ton, while the price of Muntok white pepper is recorded at 10,028 USD/ton.

In Malaysia, the price of ASTA black pepper remains at 9,600 USD/ton, while the price of Malaysian ASTA white pepper is 12,800 USD/ton.

In the Brazilian market, the purchasing price of ASTA 570 black pepper is 6,400 USD/ton.

In Vietnam, the price of black pepper with 500 g/l specification is currently at 6,240 USD/ton, while the price of 550 g/l black pepper is at 6,370 USD/ton. The price of white pepper is at 9,150 USD/ton.

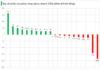

Last week, domestic pepper prices surged to 151,000 – 152,000 VND/kg, the highest in three months. In the Central Highlands and Southeast regions, especially in Gia Lai province, prices increased by 7,500 VND/kg, bringing Dak Nong and Dak Lak provinces to 152,000 VND/kg. The main reason for this increase was a short-term supply shortage and stable demand from businesses and the domestic market.

On the international market, Brazilian black pepper prices rose by 400 USD/ton, while Indonesian and Malaysian black pepper prices increased by 87 – 100 USD/ton. Vietnamese white pepper prices also went up by 200 USD/ton.

Notably, as of mid-August 2025, Vietnam’s pepper export turnover reached 1.06 billion USD. Experts predict that exports will continue to be favorable in the third and fourth quarters due to sustained high prices and stable demand from the US, EU, China, and Africa.

However, the pepper industry still faces challenges such as supply pressure, climate change, and technical barriers. Experts recommend that businesses focus on quality, transparent traceability, and deeper processing to strengthen their position in the market.

The New Vietnam: A Nation Transformed

According to Gerry Brownlee, Speaker of the New Zealand House of Representatives, Vietnam has undergone a remarkable transformation since the restoration of peace. The country is now on the brink of a significant leap in terms of per capita GDP growth, which will ultimately enhance the well-being of its citizens.

“A New Chapter: Nguyễn Thị Vinh’s Visionary Journey to Becoming a Major Stakeholder in Sách Thái Nguyên”

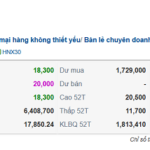

Three months after divesting her entire stake, Chairwoman Nguyen Thi Vinh registered to purchase 3.5 million STH shares, aiming to acquire an 18% stake in Sach Thai Nguyen.