Realtime Robotics (RtR): The Visionary Journey of Dr. Luong Viet Quoc

The compact and foldable UAV HERA, a testament to RtR’s innovation.

When Dr. Luong Viet Quoc founded RtR, he brought with him the experience and vision of a scientist, determined to face the challenges of skepticism head-on. The global UAV market was already dominated by major manufacturers from the US, Israel, and China, leaving little room for a startup from Vietnam.

Rather than competing on price, RtR, under Dr. Quoc’s leadership, chose to focus on R&D and breakthrough innovations. This led to the creation of the Drone Hera, a foldable UAV with a 15 kg payload capacity, a 56-minute flight time without cargo, and an impressive 11 km range, outperforming its competitors of similar size.

Success came through a lengthy process of experimentation and validation. The product has been patented in the US and Australia and has passed stringent tests to be adopted by the Los Alamos National Laboratory (US) and law enforcement agencies in the US and the Netherlands.

The endorsement from Boeing Vietnam’s General Director, Michael Vu Nguyen , highlighted the value of RtR’s journey: “RtRobotics’ products are now competitive in certain international segments, proving that Vietnamese UAVs are not just potential but have already found their place in the global market.”

CT Group: A Bold Venture Supported by the Government

The decision of CT Group, a real estate conglomerate, to venture into UAV manufacturing was a bold one, led by its Chairman, Tran Kim Chung . The challenge lay not only in mastering core technologies but also in building a manufacturing foundation and supply chain from scratch.

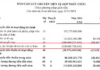

With a vision to transform into a technology group, CT Group has developed a portfolio of 16 product lines , investing in the Low Altitude Economy, and achieving an impressive 85% localization rate . Their initial success is evident through an export contract for 5,000 heavy-duty transport UAVs (with payloads ranging from 60 to 300 kg) to South Korea.

This strategic move caught the attention of high-level government officials. During a meeting on August 13, the Prime Minister commended CT Group’s initiative and directed ministries and sectors to consider providing the group with access to a VND 500,000 billion preferential credit package for science and technology.

This support is not just a financial boost but also a strong signal of the private sector’s role in the national technology strategy, affirming their capacity to participate in the global high-tech supply chain.

Viettel: Embracing the Mission of Technological Self-Reliance in Defense

The equation of technological self-reliance in defense is a strategic challenge, requiring long-term investment and determination. As the country’s leading industrial-technological corporation, Viettel has been entrusted with the mission of developing “Made in Vietnam” solutions to replace imports and ensure national security.

This journey demands building capabilities from scratch, from material research and aerodynamic design to software development and artificial intelligence integration.

The fruits of these efforts were evident at the International Defense Exhibition, where Viettel High Tech showcased their mastery of 100% indigenous technology. Their products not only varied in types but also incorporated complex technologies.

The VU-R70 UAV, featuring the iconic image of the Vietnamese mythical bird, Lac Bird. Photo: Ho Minh Duc

The VU-R70 reconnaissance UAV can operate continuously for 4.5 hours , while the VU-C2 suicide UAV is equipped with an electro-optical self-guiding head, integrated with AI to autonomously search, lock, and attack targets on command.

Viettel also introduced the VU-MALE long-range multi-purpose UAV model, indicating their vision towards more complex strategic solutions. This is not just the success of a single enterprise but a testament to Vietnam’s capability for technological self-reliance in defense.

From Individual Stories to a National Strategy

Beyond these prominent stories, the vibrancy of Vietnam’s UAV sector stems from a diverse ecosystem, where each enterprise tackles a unique challenge.

MiSmart , guided by the philosophy of “Drone Viet for Viet People,” has successfully introduced specialized drone solutions in agriculture, addressing practical issues of spraying and sowing for farmers.

In the logistics domain, XBStation charts a new course with their UAV delivery models capable of transporting packages weighing up to 6.5 kg, targeting urban and remote area markets.

In the high-tech segment, Phenikaa-X (a member of Phenikaa Group) and HTI Technology are mastering vertical takeoff and landing (VTOL) technology. Phenikaa-X’s VTOL-01 is specialized for challenging terrain like mountains, while HTI Technology’s Horus P02 operates silently and is equipped with thermal sensors, making it ideal for reconnaissance and rescue missions.

These “storm-surviving” stories are no longer solitary endeavors. They are now part of a well-crafted national strategy, reflecting a broader vision.

The establishment of the Aerospace, Satellite, and Unmanned Aerial Vehicle (UAV) Network of Vietnam on August 25 is a testament to this. The network’s mission is to transform Vietnam from a consumer market into a manufacturing and creative hub in the global UAV value chain.

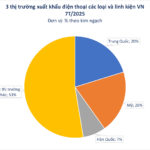

This opportunity is further emphasized by Mr. Tran Anh Tuan, Vice President of the UAV Vietnam Network, who points out that the restriction on UAV imports from China by the US and its allies has created a significant market gap.

Speaking at the event, Deputy Prime Minister Nguyen Chi Dung emphasized that these technology networks will serve as an ‘extended arm,’ working alongside the government to turn the country’s ‘difficult equations’ into ‘great opportunities’ for the future.

With strong policy support and a foundation of pioneering enterprises, the vision of making Vietnam a leading UAV hub in ASEAN within the next decade is no longer a distant dream. It is a strategic goal, built on solid capabilities and emerging opportunities.

The Electric Revolution: Unveiling Honda’s Upcoming E-Bike Models for Vietnam

These are the electric motorcycles that Honda could be bringing to the Vietnamese market in the near future. With their cutting-edge technology and sleek designs, these models are set to revolutionize the way we commute and perceive electric vehicles in Vietnam. Stay tuned as we uncover more about these exciting additions to the country’s automotive landscape.

“Vietnam’s ‘Goldmine’ Deal: US Spends Over $6 Billion; Making Vietnam the Second Largest Exporter with Tax Exemptions.”

As of late, economic powerhouses such as China and the United States have been vying for a particular resource from Vietnam, akin to a modern-day gold rush.