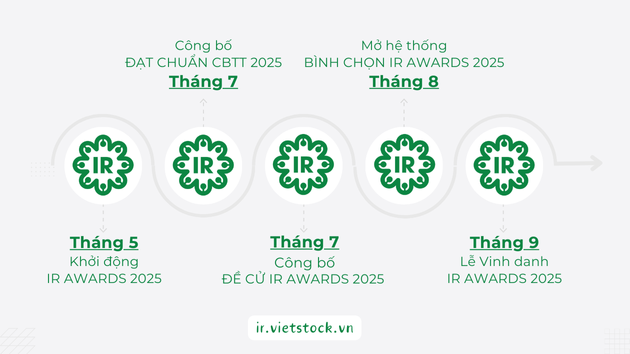

* [IR AWARDS] Important Disclosure Schedule for August 2025

* [IR AWARDS] July 2024 Disclosure Schedule to Remember

-

01/09: Effective Portfolio (MSCI)

-

03/09: PMI Announcement

-

05/09: Portfolio Disclosure (FTSE ETF)

-

06/09: Socio-Economic Report for August 2025

-

13/09: Portfolio Disclosure (VNM ETF)

-

18/09: VN30F2509 Maturity

FOMC Meeting Results (Fed) -

22/09: Effective Portfolio (FTSE ETF, VNM ETF)

-

–/09: Market Ranking Report (FTSE)

-

–/09: 15th IR Awards Ceremony

Timely and compliant disclosure of information on the stock market is the fundamental responsibility of public companies towards their shareholders and investors. This is also the first criterion in the annual IR Awards program, jointly organized by Vietstock and the Finance and Life e-Magazine, to honor listed companies with the best IR practices.

Notable penalties for disclosure violations in August 2025

In the past month, the State Securities Commission (SSC) has imposed penalties on public companies for disclosure violations, including UPCoM: TBH (Universal Department Store Joint Stock Company), HOSE: HAG (Hoang Anh Gia Lai Joint Stock Company), UPCoM: TST (Telecom Technical Services Joint Stock Company), HNX: SDA (Simco Song Da Joint Stock Company), HOSE: CKG (CIC Group Joint Stock Company), UPCoM: KAC (Khang An Real Estate Investment Joint Stock Company), and UPCoM: LTG (Loc Troi Group Joint Stock Company), for failing to disclose information as required by law.

The SSC also sanctioned CKG and KAC for incomplete disclosure of information as mandated by legislation.

Additionally, the SSC penalized HNX: HKT (QP Green Investment Joint Stock Company), SDA, KAC, and LTG for providing misleading information to the public, which is a serious breach of legal requirements.

|

IR AWARDS 2025 IR Awards is an annual program that recognizes listed companies with outstanding IR practices. Since 2011, it has been jointly organized by Vietstock, the VAFE Association, and the FiLi e-Magazine. IR Awards acknowledges and celebrates companies that meet the standards for information disclosure in the securities market. This is achieved through comprehensive surveys, and the publication of the Annual Information Disclosure Standards for listed companies. IR Awards recognizes and honors companies with the best IR practices for the year. This involves quantitative assessments, investor and professional financial institution polls, and the announcement of winners at the annual IR Awards Ceremony. |

– 08:04 09/03/2025

The Stock Market Surge: Expert Tips on Stocks to Boost Your Portfolio

Despite predictions to the contrary, the VN-Index has been on a remarkable upward trajectory, consistently reaching new highs. This has left investors pondering which stock sectors to invest in for the remainder of the year.

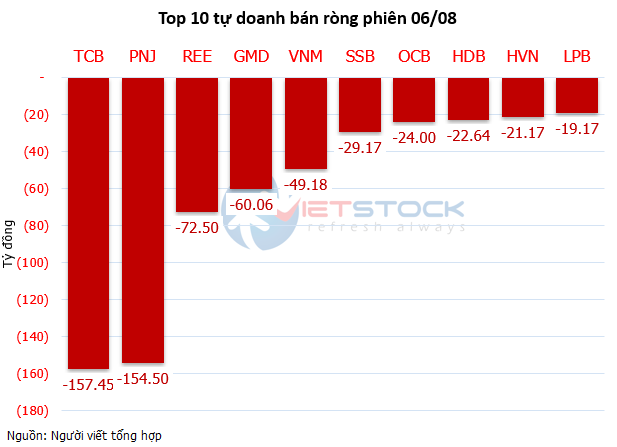

Market Beat: Green Returns in Afternoon Trade, VN-Index Climbs to 1,680 Points.

The market staged a remarkable comeback in the afternoon session, reversing the negative trend witnessed in the morning. The afternoon session saw a surge of buying interest, pushing the market into positive territory and closing the day in the green.