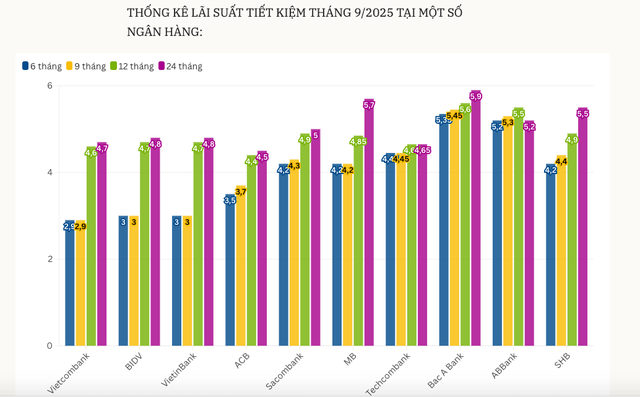

A quick reference to deposit interest rates at the counter (mobilized interest rates) listed on the websites of banks such as Agribank, Vietcombank, BIDV, VietinBank, VPBank, Techcombank, MB, ACB, Sacombank, HDBank, SHB, VIB, SeABank, BacABank, TPBank, NCB, KienlongBank, Saigonbank, and Vietbank, among others, on the first day of September 2025, reveals some adjustments in short-term interest rates. However, the overall trend remains stable.

Among the state-owned commercial banks, deposit interest rates at the counter in early September 2025 remain unchanged from the same period in August 2025.

Specifically, Vietcombank’s interest rate table still maintains the same rates for all terms, with a mobilized interest rate of 2.9%/year for 6 and 9-month terms; 12-month term listed at 4.6%/year; and 24-month term and above listed at 4.7%/year. The interest rate of 4.7%/year is also the highest interest rate currently offered by Vietcombank for terms of 12 months and above.

At BIDV, interest rates remain stable compared to the previous month, with savings deposit interest rates for 6 and 9-month terms listed at 3.0%/year; 12-month term maintained at 4.7%/year; and 24-month term listed at 4.8%/year.

VietinBank’s savings deposit interest rates for 6 and 9-month terms remain at 3.0%/year; the 12-month term is 4.7%/year; and the 24-month term is 4.8%/year.

In the joint-stock commercial bank group, the mobilized interest rate remains largely stable. The market recorded mobilized interest rates at many banks ranging from 3.0%-6.0%/year. The average interest rate listed at banks currently is as follows: 6-month term at 6.0%/year, 7-month term at 6.1%/year, 12-month term at 6.5%/year, 13-month term at 6.6%/year, 15-month term at 6.7%/year, and 18-month term at 6.8%/year.

This marks a clear adjustment in the capital market, as interest rates previously tended to stabilize for several months. The fact that the 6-month term has crossed the 6%/year threshold gives customers more options when saving, depending on their profit or safety needs.

August 2025 also saw some commercial banks focus on solutions to increase savings deposit mobilization by offering more incentives for online depositors or targeting specific customer groups.

For example, Viet A Bank applied an interest rate policy for the Dac Tai Savings product, with an interest rate of over 6%/year for terms of 6 months and above. Specifically, the 6-month term has an interest rate of 6.0%/year, the 7-month term is 6.1%/year, and longer terms such as 12, 13, 15, and 18 months consecutively reach 6.5%, 6.6%, 6.7%, and the highest at 6.8%/year.

Eximbank launched the “Combo Casa” online savings package for terms of 18-36 months with a maximum interest rate of 6%/year. MB and VietinBank implemented a policy of adding preferential interest rates to encourage customers to deposit during this period.

To attract large sources of capital from individual and institutional customers with strong financial capabilities, some banks also applied special interest rates. However, to enjoy these attractive interest rates, customers must meet strict conditions on minimum deposit amounts and terms.

For instance, ABBank offers an interest rate of up to 9.65%/year for a 13-month term. However, to qualify for this interest rate, customers must open new or renew time deposits of VND 1,500 billion or more.

PVcomBank also listed a special interest rate of 9%/year for 12-13 month terms when customers make deposits at the counter, provided they maintain a minimum balance of VND 2,000 billion. HDBank applied an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, provided customers maintain a minimum balance of VND 500 billion.

The latest forecast on interest rate trends by VCBS Research indicates that by the end of the year, mobilized interest rates are expected to face pressure from high credit growth, especially after the State Bank of Vietnam (SBV) announced an increase in the credit growth target for credit institutions to meet the capital needs of the economy.

In July, the SBV also requested credit institutions to implement synchronous solutions to stabilize and strive to reduce mobilized interest rates, contributing to the stability of the monetary market and creating room for lending interest rate reduction. Additionally, with the expectation of a 50-basis point cut in interest rates by the US Federal Reserve (Fed) in the second half of 2025, the VND-USD interest rate differential is expected to narrow, thereby enabling the SBV to maintain a low-interest rate environment.

Based on these factors, VCBS Research forecasts: “The 12-month mobilized interest rate of private joint-stock commercial banks is expected to have a slight downward adjustment of 2 basis points to 4.7% by the end of 2025.”

ABS Research also believes that in the context of the SBV’s continued stable monetary policy, encouraging commercial banks to reduce mobilized interest rates to support businesses and people to access capital, and the strong growth of credit in the system, mobilized interest rates are expected to remain stable or slightly decrease in the second half of 2025.

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

“Top Banks Guide: Linking Your Bank Account to Receive Social Security Benefits on VNeID”

“The recent collaborative effort by major banks to guide individuals through the process of receiving social security payments with ease, via their VNeID bank accounts, is a noteworthy development. This initiative ensures a streamlined and accessible approach to managing finances, with detailed instructions provided by these financial institutions.”

Unlocking the Power of Words: Crafting a Captivating Headline

“Vietcombank Achieves a Remarkable Double: Unlocking New Frontiers”

As of the August 27 trading session, Vietcombank’s market capitalization reached a new pinnacle, soaring to a staggering 577.377 trillion VND. This remarkable feat positions the bank at the forefront, surpassing the combined market capitalization of VPBank and Techcombank.